| CFA Full Form | Chartered Financial Analyst |

| Duration | 1.5 – 4 years |

| Eligibility | Bachelor’s degree or final year of graduation |

| Job Roles | Equity Analyst, Portfolio Manager, Risk Manager |

| Salary (India) | ₹6 – ₹20 LPA |

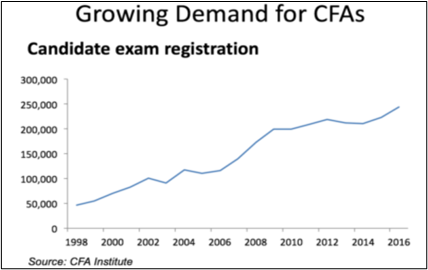

CFA, also known as Chartered Financial Analyst (Full Form), is one of the most sought-after professions in the field of finance. If your inclination lies toward investment management, you’re sure to master it efficiently by pursuing this course. However, let us inform you beforehand, that clearing the CFA course isn’t for the fainthearted.

In the three CFA levels that you appear for, it’s not just your learning and skill level that will be tested but also your patience and consistency. Once you clear the CFA course and become a Charter holder, you are sure to be welcomed into this field with several exciting opportunities and attractive salary packages.

If you’ve made up your mind or are still deciding whether to pursue the CFA or not, we’re about to simplify this course for you with exam pattern, syllabus, and CFA course fees structure.

What is CFA?

Chartered Financial Analyst (CFA) is a position designated by the CFA Institute. Companies employ CFAs in large numbers at various positions for their specialized knowledge in finance. They are hired for various roles such as Portfolio Management, Consulting, Risk Management, to name a few. The field offers vast opportunities in the world of finance and necessitates a steep learning curve.

Let us learn more about the advantages of pursuing a CFA certification:

| Course Name | Chartered Financial Analyst |

| Exam Mode | Online |

| Fees | 50,000 – 1,50,000 Rs |

| Duration of Course | 2 – 3 Years |

| Levels in CFA Course | 3 |

| Eligibility for CFA | Bachelor’s Degree |

CFA Course Details

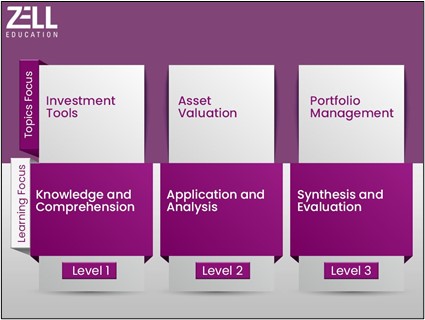

The CFA designation is awarded by the CFA Institute, the global association of investment professionals. The course comes in three levels, whereby each next level is more difficult than the previous one, covering topics such as investment management and financial analysis and the professionalism and ethics that should be present when performing these tasks. Generally, it takes 2 to 3 years, and exams are conducted every quarter. The 10 key topics of the CFA program include Equity Investments, Derivatives, Portfolio Management and more. The eligibility for this programme is any bachelor’s degree or equivalent relevant work experience.

CFA Course Highlights

- Levels: Three (Level I, II, and III)

- Duration: 1.5 to 4 years

- Mode: Computer-Based Testing (CBT)

- Eligibility: Final year undergraduates or graduates

- Global Recognition: 170+ countries

- Skills Covered: Investment analysis, portfolio management, financial reporting, ethics

How Much Do the CFA Exams Cost?

The total cost for the CFA program ranges from USD 2,500 to USD 4,000.

Key fees include:

- Enrollment Fee: USD 350 (one-time)

- Exam Registration Fee: USD 940 (early) to USD 1,250 (standard) per level

- Rescheduling Fee: USD 250 if you change your exam date

CFA Eligibility Criteria

First things first, let’s check your CFA level 1 eligibility for the examinations. And in case if you are not, what are the other routes available to lock in your CFA eligibility. Here’s what you’ll need

- A Bachelor’s degree from a renowned university

- An undergraduate degree before applying for CFA level 2

- A combination of 4000 hours of professional work experience and higher education

- Professional work experience need not be investment-related, they could also be paid article ships or internships

- Live in a participating country and have an international passport

- You need to fill up and submit a Professional Conduct Statement form

Please note: The CFA Institute may request proof of education (copy of diploma, mark sheet, any other relevant documents) and/or work experience (letter of employment, salary slips, any other relevant documents) to be submitted at any point of your learning duration.

CFA Admission Process

- Check Eligibility: Bachelor’s degree (or in final year) + valid international passport.

- Register Online: Through the CFA Institute’s official website.

- Schedule Exam: Choose your exam window and test center.

- Prepare for Exams: Use CFA-approved study materials or prep providers.

- Appear for Exams: Level I, II, and III in sequence.

- Get Charter: After passing all three exams and completing 4,000 hours of professional experience.

Things to Keep in Mind About CFA Examinations

CFA is a globally recognized qualification offered by the CFA Institute based out of the USA. Thus, its exam pattern is quite different from the examinations offered by the Indian board.

- CFA includes three levels of exams (Level 1, 2 & 3)

- Level 1 is conducted every June and December, and Levels 2 and 3 are conducted every June

- The syllabus covers the entire world of investment management – from Equity to Derivatives to Portfolio Management

- From 2021, the CFA exams were been conducted four times a year for Level 1, Level 2 and 3 exams will be held quarterly

CFA Exam Dates 2025-2026

The CFA exams are offered in specific exam windows:

- Level I: February, May, August, November

- Level II: May, August, November

- Level III: February, August

Other Important CFA Exam Dates

- Registration Opens: About 9-10 months before the exam window

- Early Registration Deadline: 6 months prior

- Standard Registration Deadline: 4 months prior

- Scheduling Deadline: 3 months prior

- Rescheduling Deadline: 2 months prior

CFA Course Syllabus

Lets check the CFA Course curriculum breakdown comprises the following 10 topics, further split into their corresponding sub-topics as mentioned below:

Popular Specializations

- Portfolio Management

- Investment Banking

- Wealth Management

- Equity Research

- Risk Management

CFA Course Level 1

CFA Course Syllabus Level 1 |

Weightage |

| Ethical and Professional Standards | 15-20% |

| Quantitative Methods | 8-12% |

| Economics | 8-12% |

| Financial Statement Analysis | 13-17% |

| Corporate Finance | 8-12% |

| Equity Investments | 10-12% |

| Fixed Income | 10-12% |

| Derivatives | 5-8% |

| Alternative Investments | 5-8% |

| Portfolio Management and Wealth Planning | 5-8% |

CFA Course Level 2

CFA Syllabus Level 2 |

Weightage |

| Fixed Income | 10-15% |

| Derivatives | 5-10% |

| Alternative Investments | 5-10% |

| Portfolio Management and Wealth Planning | 10-15% |

| Ethical and Professional Standards | 10-15% |

| Quantitative Methods | 5-10% |

| Economics | 5-10% |

| Financial Statement Analysis | 10-15% |

| Corporate Finance | 5-10% |

| Equity Investments | 10-15% |

CFA Course Level 3

CFA Syllabus Level 3 |

Weightage |

| Ethical and Professional Standards | 10-15% |

| Quantitative Methods | 0% |

| Economics | 5-10% |

| Financial Statement Analysis | 0% |

| Corporate Finance | 0% |

| Equity Investments | 10-15% |

| Derivatives | 5-10% |

| Alternative Investments | 5-10% |

| Fixed Income | 15-20% |

| Portfolio Management and Wealth Planning | 35-40% |

Got Questions Regarding The CFA Journey

Click here for a free counseling session

CFA Exam Dates 2025

The Chartered Financial Institute conducts CFA exams the CFA Level 1 exams four times a year in total. The months in which you can appear for these examinations are February, May, August and November. To find out the CFA exam dates for the year 2025 to 2026 for all the 3 levels check out the table below.

|

CFA Exam Dates |

February Period | May Period | August Period | November Period |

|

CFA Level 1 Exam Date |

19h – 25th February |

15th – 21nd May |

20th – 26th August |

13th – 19th November |

|

CFA Level 2 Exam Date |

Not Available. |

22nd – 26th May |

27th August – 31st August |

20th – 24th November |

| CFA Level 3 Exam Date | 15th – 18th February | Not Available. | 16th August – 19th September |

Not Available. |

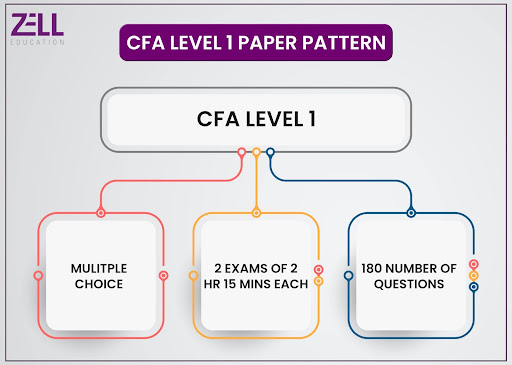

CFA Exam Pattern

Are the CFA Exams Multiple Choice?

- Level I: Entirely multiple-choice (MCQs)

- Level II: Vignette-supported MCQs

- Level III: Essay-type questions and vignette-supported MCQs

CFA Level 1 Exam

- CFA Level 1 consists of 2 exams of 3 hours each on the same day, with a 2-hour break covering all 10 topics

- Total of 240 MCQs (120 per exam) with subject wise bifurcations

- No Negative Marking

CFA Paper Pattern – Level 1

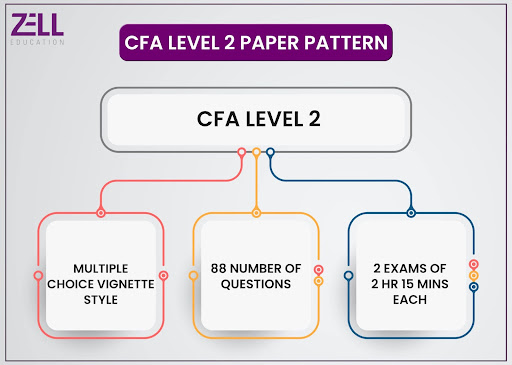

CFA Level 2

- CFA Level 2 of two 3-hour sessions consisting of 21 case-studies with 10 and 11 item-set questions in each respective session

- There will be 120 questions – 18 case studies x 6 questions, and 3 case studies x 4 questions

- The length of a case study is from 1 to 2 and a half pages. It can include tables and diagrams

CFA Paper Pattern – Level 2

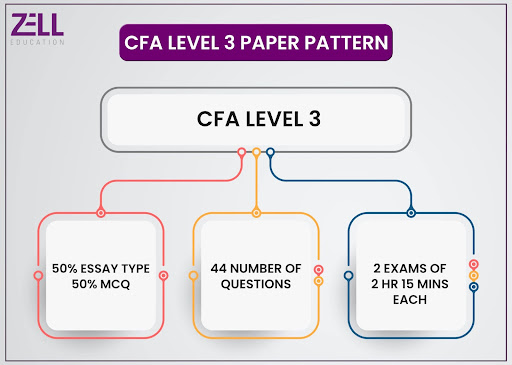

CFA Level 3

- CFA Level 3 consists of two 3-hour sessions. The first session can contain anywhere from 8-12 essay questions (with sub-parts) and the second session can contain 11 case studies where 8 case studies x 6 questions, and 3 case studies x 4 questions.

- An essay question has 2+ parts

- The length of a case study is from 1 to 2 and a half pages. It can include tables and diagrams

CFA Paper Pattern – Level 3

How Long Does It Take To Pass the CFA Exams?

On average, it takes 2.5 to 4 years to complete all three levels of the CFA program. The timeline depends on your study schedule, work commitments, and whether you pass each level on your first attempt.

Most candidates devote around 300 hours of study per level, as recommended by the CFA Institute. Those balancing full-time jobs may require longer preparation periods. Since exams are offered only a few times a year, failing even one level can delay your journey by 6–12 months.

Strategic planning, consistent study routines, and time management are crucial if you want to complete the program within three years

CFA Program Benefits

Earning the CFA charter can transform your finance career. Here are some major benefits:

- Global Credibility: The CFA designation is recognized by employers in more than 170 countries. It signals expertise, integrity, and dedication to the investment profession.

- Career Advancement: Charterholders often move faster into senior roles such as Portfolio Manager, Research Analyst, or Chief Investment Officer.

- Higher Salary Potential: Several surveys show that CFA charterholders earn up to 40% more than non-charterholders in the financial sector.

- Deep Financial Expertise: The CFA curriculum covers investment analysis, asset valuation, portfolio management, wealth planning, and ethics in depth — making you a well-rounded finance professional.

- Extensive Network: You become part of a global network of 190,000+ CFA charterholders, giving you access to exclusive job boards, events, and leadership opportunities.

Why Study CFA?

If you aspire to build a career in finance, particularly in investment management or asset management, the CFA designation can be a game-changer.

The program teaches you practical financial skills like analyzing companies, managing portfolios, and understanding global financial markets.

Beyond technical skills, it emphasizes ethical standards, which is critical for working with large investments and client portfolios.

Employers value CFA charterholders because the designation proves you have the ability, discipline, and knowledge needed for complex financial roles.

In short, the CFA credential is not just about education; it’s about career transformation and global opportunities.

CFA Job Profiles, Salary & Top Recruiters

CFA Job Profiles and Salary

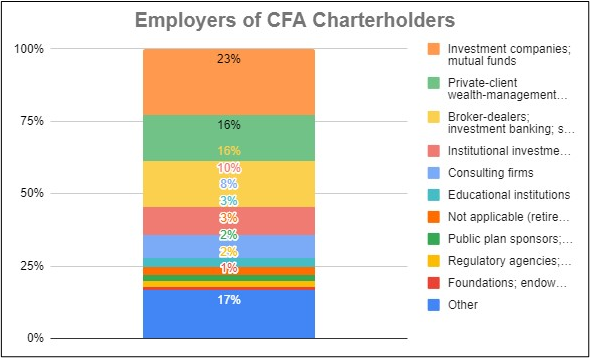

CFA charterholders work across diverse sectors including banking, asset management, consulting, and fintech. Some popular profiles are:

- Portfolio Manager: Designs and manages investment portfolios for clients. Salaries range between ₹15 LPA to ₹40 LPA, depending on experience.

- Equity Research Analyst: Analyzes stock performance and helps clients make investment decisions. Entry-level salaries start at ₹8–12 LPA, growing to ₹25 LPA with experience.

- Risk Manager: Identifies financial risks and recommends strategies to mitigate them. Salaries typically range from ₹10 LPA to ₹30 LPA.

- Investment Banker: Works on mergers, acquisitions, and capital raising. Salaries can start from ₹12 LPA and go upwards of ₹35 LPA for experienced bankers.

- Wealth Manager: Advises high-net-worth individuals on managing and growing their wealth. Salaries usually fall between ₹8–20 LPA.

Salaries can vary based on city, employer, experience, and whether you have additional qualifications like an MBA.

CFA Top Recruiters

Several top financial institutions and global corporations actively seek CFA charterholders. Leading recruiters include:

- JP Morgan Chase

- Goldman Sachs

- Morgan Stanley

- BlackRock

- UBS

- Credit Suisse

- ICICI Bank

- HSBC

- Kotak Mahindra Bank

- Standard Chartered Bank

These firms hire CFAs for roles in asset management, investment banking, equity research, risk management, and financial consulting.

The CFA charter adds significant weight to your resume, especially in competitive finance sectors.

Are CFA Charter Holders Paid More?

Yes, multiple surveys, including CFA Institute’s global compensation study, confirm that CFA charterholders earn significantly more than their non-charter counterparts.

On average, CFA charterholders enjoy a 20% to 40% salary premium, especially as they climb the career ladder into mid- and senior-level positions.

This premium reflects not only the technical skills but also the credibility, dedication, and trustworthiness associated with the CFA designation.

In investment banking, asset management, and portfolio management, a CFA charter can be the deciding factor for promotions and salary hikes.

Challenges of Achieving the CFA Charter

While the CFA credential is highly rewarding, earning it isn’t easy. Some key challenges include:

- High Time Commitment: Each level demands 300+ hours of preparation, and balancing studies with a full-time job can be exhausting.

- Low Pass Rates: Historically, pass rates are around 40% for Level I, with slightly higher rates for Level II and III.

- Financial Investment: Between registration, enrollment, and study material costs, you may spend around USD 3,000–4,000.

- Work Experience Requirement: You must demonstrate 4,000 hours of qualified work experience over at least 36 months to earn the charter.

- Intense Curriculum: Topics range from ethics to quantitative methods, and mastering them requires strong discipline and endurance.

Success in the CFA program demands consistent effort, strategic preparation, and resilience.

CFA Exam Dates 2025

CFA Level 1 Exam Dates 2025

| Month | Date |

| February | 19 Feb – 25 Feb 2025 |

| May | 15 May – 21 May 2025 |

| August | 20 Aug – 26 Aug 2025 |

CFA Level 2 Exam Dates 2025

| Month | Dates |

| February | 22 Feb – 26 Feb 2025 |

| August | 27 Aug – 31 Aug 2025 |

CFA Level 3 Exam Dates 2025

| Month | Dates |

| May | 15 May – 18 May 2025 |

| August | 16 Aug – 19 Aug 2025 |

Want to Become a Chartered Financial Analyst

Let us answer your questions related to CFA

Scope for CFA in India

Scope of CFA is one of the most recognized courses for finance in India, with jobs in profiles such as Portfolio Manager, Research Analyst, Risk Manager, Corporate Financial Analyst, and Investment Banking Analyst.

There’s a rising demand for the skills that these professionals possess. That’s why companies such as KPMG, PwC, Deloitte, EY, JP Morgan Chase, Bank of America Merrill Lynch, Deutsche Bank, Credit Suisse, Motilal Oswal, and Anand Rathi hire CFAs from Level 1 itself.

The pay packages are similar to that of CAs, ranging as a CFA salary in India from ₹4 to 8 lacs per annum. One common question we are asked is whether CFA Level 1 students get hired and paid? The answer is – yes, CFA Level 1 students do get hired and paid with packages ranging from ₹4 to 6 lpa depending on the company and profile. A fully qualified CFA Level 3 would be paid higher in the range of ₹7 to 10 lpa.

Best CFA Colleges in India

Although the CFA program is a self-study course, some Indian colleges and coaching centers offer excellent training to help students clear the exams.

Popular Private CFA Level 1, 2 & 3 Colleges in India

- IMS Proschool: Offers classroom and online CFA coaching across multiple Indian cities.

- Miles Education: Partners with NSE Academy and IMA USA to deliver specialized CFA training.

- EduPristine: Provides CFA exam preparation courses with online and offline study options.

- ICFAI Business School (IBS): Some campuses integrate CFA Level 1 into their MBA finance programs.

- Christ University, Bangalore: Offers programs aligned with CFA exam prep, especially at undergraduate levels.

Choosing a reputed CFA coaching center or college can make a big difference in exam success, especially if you need structured learning.

CFA Course Comparison

CFA vs FRM: Which course is better?

A question that most CFA students often ask when looking for a lucrative career in finance. While CFA equips with broader financial concepts, FRM is a niche course that specifically focuses on risk management. In terms of salary and global opportunities, both these courses are almost at par with each other. However, in terms of future scope and growth, the CFA course takes a step ahead from FRM due to its wide range of learning and opportunities.

CFA or MBA: Which course is better?

If you’re stuck between choosing an MBA in finance or CFA, you must weigh your options correctly before you make your final decision. While CFA can open up multiple global opportunities in the field of financial markets and investment, an MBA in Finance from one of the top universities can make you an ideal candidate for companies in India and abroad. However, you need to keep in mind that the university you choose for MBA needs to be one of the 10 universities known for an MBA in Finance, for your degree to truly make an impact on your career.

CFA vs US CMA: Which Course is better?

Chartered Financial Analyst (CFA) is an international qualification pursued by those that aim to work in the investment industry & portfolio management whereas Certified Management Accounting (CMA) is for those that are more inclined toward the accounting aspect of finance. Since CFA and CMA are specialization courses in different fields within commerce, you should analyse where your interests are before deciding between the two. Still confused read more about the difference between CFA and CMA.

CFA or CA: Which is Better?

Choosing between CFA and CA depends on your career goals. CFA is ideal if you want to pursue a career in investment banking, asset management, portfolio management, or global finance roles. It focuses on financial analysis, investment strategies, and ethics. CA is perfect if you’re aiming for audit, taxation, accounting, or corporate finance roles, especially within India. It builds expertise in laws, taxation, auditing, and financial reporting. If you’re passionate about the global investment world, CFA is better. If you want to specialize in accounting and audit practices, CA is the way to go.

CFA Course Fees

Wondering how much would it cost you to complete your CFA course? Here’s a breakdown of the CFA fees, from registration to coaching.

- Program Enrollment Fee: $450 (for first-time exam registrants only)

- Early Registration Fee: $700

- Standard Registration Fee: $1000

- Late Registration Fee: $1450

- Zell Coaching Fee: Starting from INR 17,700

CFA Course Scholarships

Taking a closer look at what each type of CFA scholarship, let’s see what each type offers.

1. Access Scholarship

The Access Scholarship CFA Program is designed for students who can not afford the CFA program fees. With this scholarship, the student will only have to pay 250 USD for the exam registration fee which is usually $1,000 USD. And also, the enrolment fee of $450 = INR 34,000 is completely waived off, & you only need to pay a balance $250 = INR 19,100

How to avail this CFA scholarship: To avail this scholarship you will be expected to submit and state all of your financials, for example: family income and the current assets of your family. Additionally, you need to write an essay which states why you as a candidate deserve this scholarship.

2. Women’s Scholarship

The Women’s Scholarship Program, as the name suggests, is specifically designed to encourage women to sign up for the CFA program. Under this scholarship program, you will only have to pay 350 USD= INR 26,752 as exam registration fees which is usually $700= 53,000. The enrolment fee of $350 = INR 26,812 is completely waived off as well.

How to avail this CFA scholarship: To be eligible for this CFA scholarship, you need to be a woman who isn’t eligible for any other CFA scholarship. You must not apply for the CFA program until you receive your scholarship award.

3. Student Scholarship

If you are currently a student and are enrolled with a University affiliated with the CFA Institute, then you may be eligible for the Student Scholarship Program. With this scholarship, your enrolment fee of $350 = INR 26,812 is waived and you are only required to pay $350 as registration fee instead of the $1,000 USD registration fee.

How to avail this CFA scholarship: Students currently attending an Affiliated University and have not yet registered for their next exam are eligible to apply for a CFA Program Student Scholarship. Students must also satisfy the enrolment criteria and requirements for the CFA program.

4. Professor Scholarship

If you are currently working as a professor at a college or a university and you teach subjects like finance, economics, business, or any of the topics from the CFA Program Candidate Body of Knowledge (CBOK). Under the Professor Scholarship Program, you are only required to pay 350 USD as your registration fees.

How to avail this CFA scholarship: To avail this scholarship you must be a full time professor, administration or department head at college or university. They should have the minimum number of credit hours for the scholarship eligibility.

5. Regulator Scholarship

A Regulator Scholarship is designed for those working in a company that is responsible for overlooking the standards of practice or business conduct of the investment management industry. This could include financial regulators, central banks, securities commissions, stock exchanges, SROs and/or government entities that have an agreement with the CFA Institute. With this scholarship, your registration fees are reduced to 350 USD.

How to avail this CFA scholarship: This scholarship is awarded to organizations and not directly to students. To apply for this scholarship, your organization must nominate you for it. For this, you must check with your HR or designated CFA representative.

The Chartered Financial Analyst is a globally recognized qualification in the field of finance and investment. If you have recently completed your graduation or are appearing for your final semester, you may be eligible to become a CFA. Interested? We highly recommend checking out our Chartered Financial Analyst (CFA) Course.

The Bottom Line

The CFA program is one of the most respected and rewarding credentials in the world of finance. It opens doors to high-paying, prestigious roles in investment firms, banks, and consulting companies worldwide.

However, the journey demands significant dedication, financial investment, and resilience.

If you are determined to build a global finance career and are ready for a rigorous intellectual challenge, earning the CFA charter could be one of the best decisions you ever make.

FAQs on What is CFA:

Is CFA worth pursuing?

CFA is one of the toughest accounting courses to crack, but it is also an in-demand profession with high earning potential. While your learning journey may be posed with interesting challenges, the final destination is surely going to be worthwhile. Why is the CFA program so hard? CFA requires time commitment, patience and hard work which can often get difficult for those who want to fast-track their career.

Which level of CFA is the toughest?

As per several CFA charter holders, Level 3 of the CFA exam is considered to be the toughest.

Is CFA better than CA?

It depends on what your career goal is. CFA is the best for jobs related to investments, while CA is more specifically accounting, auditing, and taxation. Both are highly respected but one is good for this field; one is for the other.

Is CFA very difficult?

Yes, it is because it is considered one of the hardest finance exams with each level passing percentages around 40%-50%. So it requires quite consistent study and dedication.