After Commerce graduation, every student remains confused about which industry to opt for to shape their career. A decade earlier, options were limited, but today it’s a broader horizon. Yet, finance and accounting remain one of the core industries .The most popular options are between CFA vs CMA.

While the CFA program is ideal for those interested in investment and portfolio management, the CMA certification suits those interested in the management and advisory side of accounting. To choose between CFA vs CMA, you have to identify what appeals to you and where your interest lies, and to chalk out your career goals. Let’s go on to see exactly what each course offers so you can make a better decision.

Let’s first take a look at both of these courses individually

Industry Trends & Market Insights

Both the CFA and CMA designations are highly respected in India’s booming finance industry.

- CFA professionals are in high demand in investment banking, portfolio management, equity research, and financial advisory. With the Indian financial market growing rapidly, especially in cities like Mumbai, Delhi, and Bangalore, opportunities for CFAs have doubled over the last few years.

- CMA (US) holders are increasingly sought after in multinational corporations (MNCs), Big 4 consulting firms, and global shared service centers. As businesses expand their finance and accounting operations in India, strategic roles for CMAs are opening up in cities like Hyderabad, Chennai, Pune, and Gurugram.

Both qualifications align perfectly with India’s growth story, driven by an expanding economy, increasing FDI, and a thriving corporate sector.

Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) course is one of the most reputable finance courses to pursue, especially for those who are looking to specialize in the investment industry, financial management, and portfolio management. In fact, because of the immense possibility of growth, a majority of finance professionals are opting for this course.

Eligibility

The eligibility criteria for the Chartered Financial Analyst (CFA) course are quite simple, if you are in the final year of graduation or within 23 months of graduating, you can start preparing for your CFA level 1 examination. However, in certain cases, you may be eligible for CFA without graduation provided you have a minimum of 4 years of relevant work experience.

Got Questions Regarding The CFA Eligibility

Click Here for a Free Counselling Session

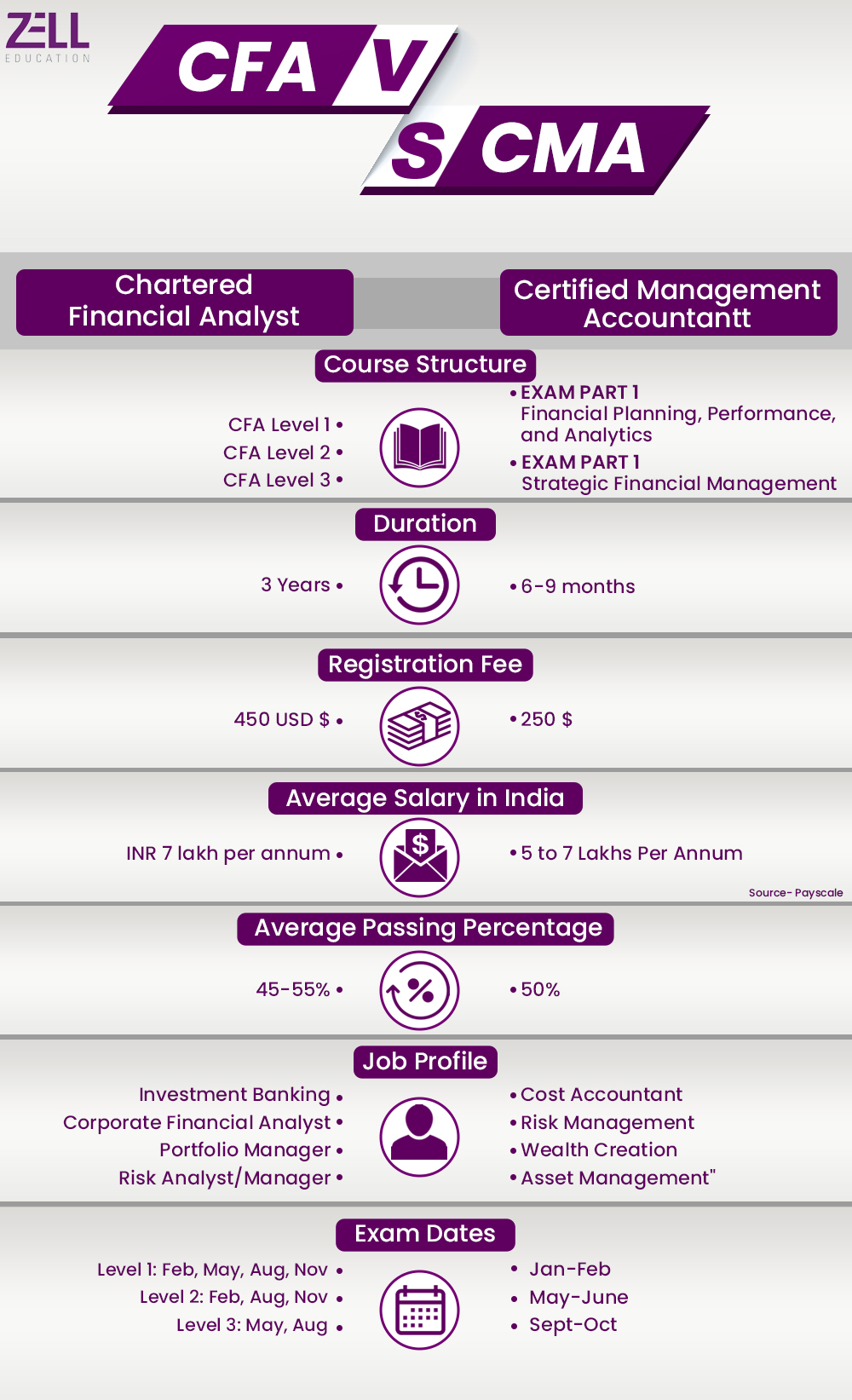

Course Structure

There are 3 levels of examination (CFA Level 1, CFA Level 2, and CFA Level 3) that you must clear to complete CFA. All three levels cover the same 10 subjects, however, the marking value for each subject in each level will differ. The subjects in all three levels will advance with each passing level. The subjects covered in CFA are –

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Statement and Analysis

- Corporate Issuers

- Equity Investment

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management & Wealth Planning

Recognition

CFA is a global certification. A CFA charter can land you in countries like the USA, India, Hong Kong, Canada, and the UK. Moreover, a big advantage of pursuing CFA is that even after completing just one or two levels of CFA, you can start working in the field of finance for a higher salary as compared to a regular graduate. If you combine this course with other qualifications such as CA, ACCA, or MBA, the number of lucrative career opportunities for you will only increase.

Exam Fees & Cost Analysis

Here’s a breakdown of the costs involved:

| Aspect | CFA (approx.) | CMA (approx.) |

| Enrollment Fee | ₹31,000 | ₹18,000 (IMA membership) |

| Exam Fees | ₹62,000 per level (3 levels) | ₹33,000 per part (2 parts) |

| Total Cost | ₹2,17,000 – ₹2,50,000 | ₹1,00,000 – ₹1,20,000 |

| Additional Costs | ₹50,000 – ₹75,000 (prep materials) | ₹30,000 – ₹50,000 (prep materials) |

Note: Fees vary slightly based on exchange rates and early bird discounts. CMA is generally more affordable and quicker to complete compared to CFA.

Certified Management Accounting (US CMA)

A Certified Management Accountant (US CMA) is a professional who is authorized to look over the strategic management and corporate financial accounting of a company. It is a globally recognized qualification and the certification is given by the Institute of Management Accountants (IMA), USA.

In the last few years, the demand for CMA-qualified professionals has increased tremendously, not only in India but also in various countries across the world. The subjects covered in the CMA course help professionals collect all the necessary accounting information in an organization and enable them to make recommendations to their employer. This further helps the organization to make sound financial decisions.

Eligibility

Students can start studying for CMA certification after completing their 12th grade. However, to be certified as a CMA, you will need a Bachelor’s degree, and 2 years of work experience and you need to apply for the IMA membership.

Course Structure

The CMA Exam is taken in two parts i.e. CMA Part 1 and CMA Part 2. Both of these parts are divided into 6 subjects each and are specified below:

CMA Part 1 – Financial Planning, Performance, and Analytics

– Financial Reporting

– Planning, Budgeting and Forecasting

– Performance Management

– Cost Management

– Internal Controls

– Technology and Analysis

CMA Part 2 – Strategic Financial Management

– Financial Statement Analysis

– Corporate Finance

– Decision Analysis

– Risk Management

– Investment Decisions

– Professional Ethics

Recognition

CMA (USA) certification is one of the highest management accounting qualifications in the world. This qualification is recognized in countries like China, India, the UK, and Canada, as well as the Middle East.

CFA vs CMA: Which is Harder?

Between the two, CFA is widely considered more difficult:

- CFA exams have a lower pass rate, around 40-45% at each level. The syllabus is vast, covering deep financial analysis, investment management, and ethics.

- CMA exams have a slightly higher pass rate of around 45-50%. The focus is on financial management, strategic planning, and analysis, which is narrower compared to CFA.

In short: CFA demands more hours of study (300+ hours per level) and a stronger grasp of complex financial models, while CMA requires mastering management accounting principles and business strategy.

Career Opportunities & Salary Insights

| Career Aspect | CFA | CMA |

| Entry-Level Salary | ₹6,00,000 – ₹8,00,000 per annum | ₹5,00,000 – ₹7,00,000 per annum |

| Mid-Level Salary | ₹12,00,000 – ₹20,00,000 per annum | ₹10,00,000 – ₹15,00,000 per annum |

| Senior-Level Salary | ₹25,00,000+ per annum | ₹20,00,000+ per annum |

| Popular Roles | Portfolio Manager, Equity Analyst, Investment Banker | Finance Manager, Management Accountant, Financial Controller |

CFA can lead you into the high-paying world of investment banking and asset management, while CMA opens doors in corporate finance, FP&A (Financial Planning and Analysis), and business strategy.

Difference: CFA vs CMA

| Criteria | CFA | CMA |

| Focus | Investment management, portfolio analysis, and financial analysis | Management accounting, corporate finance, and strategic decision-making |

| Exam Level | 3 Levels (CFA Level 1, 2, and 3) | 2 Parts (CMA Part 1 and Part 2) |

| Eligibility | Final year or within 23 months of graduating; 4 years of relevant experience in case the candidate is without a degree | 12th grade with 50% marks |

| Global Recognition | Globally recognized for investment banking and portfolio management | Globally recognized for management accounting |

| Course Duration | 3-4 years (Approx.) | 1-2 years (Approx.) |

| Cost | Higher due to multiple exam levels and registration fees | Comparatively lower |

| Career Opportunities | Portfolio Manager, Research Analyst, Financial Advisor | Management Accountant, Financial Analyst, Corporate Planner |

Now that you have some more information about both of these courses, let’s understand which course would be the right one for you based on your current qualification, your goals and your interests.

Also Checkout : US CMA vs CMA India: Which is Better Career Option ?

CFA vs CMA, Which One is Worth it for You?

The choice between the two qualifications, CFA vs CMA, can be quite difficult because both are associated with different career trajectories and benefits. Your preferred qualification will depend on your professional aspirations, interests, and what particular type of skills you intend to acquire.

Who Should Go for the CFA Designation?

It would be an ideal qualification for those interested in finance, particularly investment analysis, portfolio management, and financial research. If your aspirations are working in areas like investment banking, asset management, or hedge funds, CFA is highly regarded in these functions.

It suits people who have a deep interest in understanding the financial markets and who want to build solid analytical skills. The tough nature of the CFA exams makes it also suitable for people who are dedicated to continuously learning and updating themselves with new regulations.

Who Should Go for the CMA Certification?

The CMA certification is more suitable for the professional who wants to work in management accounting, corporate finance, and strategic decision-making. If you think about your future role in the industry related to budgeting, financial planning and analysis, or internal controls, then CMA would be the best alternative for you.

For instance, If you want to influence business strategy and work in leadership positions in the finance department. CMA certification places high emphasis on practical skills that can be used directly in business operations. This makes it an excellent option for those individuals who like the application of practical methods in the management of finances.

CFA vs CMA: Are There Any Similarities Between The Two?

Although CFA vs CMA both deal with different career directions, they also have something in common. They are both globally recognized and respected professional certifications that promise remarkable opportunities to enhance your career. Each designation expects a commitment toward ethical and professional conduct, which simply reflects the essence of integrity within finance.

Both of these programs require immense persistence and discipline while studying for the exams, which are tough and comprehensive. They also ensure networking through their respective professional bodies across various countries due to their global presence.

Preparation Strategies

Here’s how you can stay ahead:

- CFA

- Dedicate at least 300-350 hours per level.

- Build strong fundamentals in financial reporting, equity analysis, and quantitative methods early on.

- Practice mock exams extensively — CFA Institute provides official mocks that are crucial.

- CMA

- Target 150-170 hours per part.

- Focus on understanding concepts deeply rather than rote learning.

- Solve previous years’ papers and attempt multiple-choice questions (MCQs) daily.

Tip: Whether CFA or CMA, consistency and discipline will be your biggest allies.

Planning to pursue an Investment Banking career?

To Book Your Free Counseling Session

Conclusion

Choosing between the CFA vs CMA depends on your career aspirations and where you see yourself in the finance industry. If it is investment management, equity research, and/or portfolio management that you want to excel in, the CFA designation gives you this special knowledge and respect. On the other hand, if you are more interested in management accounting, corporate finance, and strategic decision-making, you have the CMA certification to help you accomplish that goal. Both certifications promise huge returns as career opportunities, but your decision should be guided by your professional interests and the specific skills you wish to develop.

FAQ’s CFA vs CMA

What is the difference between management accounting and financial reporting?

Management accounting helps internal users of the organization in making decisions and budgeting, while it also assists with strategic planning. Financial reporting involves the preparation of financial statements and reports used by external constituencies like investors and regulators, in an attempt to present a snapshot of the company’s position of financial health.

Which course can be completed faster? CFA vs CMA?

The CMA course is generally shorter in duration compared to the CFA course. Where the CMA has two parts and can be cleared in a year, each of the CFA’s three levels demands a minimum of six months of preparation. Hence, CFA in totality is going to take a lot longer.

Is CFA equivalent to a Master’s degree?

However, the CFA is not an academic degree but a professional certification, though it is highly regarded and treated by most employers as equal to a Master’s in Finance.

CMA vs CFA which is harder?

CFA is regarded as more difficult than CMA because its curriculum is broader and multi-level, touching on the more advanced aspects such as financial analysis, portfolio management, and ethics. The CMA would be more about management accounting and financial management, which is specialized but less extensive. Both require huge dedication, but often the depth and global recognition of CFA make it the more challenging one.