What is FRM ?

Financial Risk Management

- •FRM = Global Risk Expert

- •Eligibility – Grade 12 Cleared

- •Popularity – #1 course for risk professionals

- •Jobs available – 36,000+

- •Salary Range – Upto ₹10 Lac

FRM Course Syllabus

The FRM syllabus is divided into two parts covering 5 core topics. The first part focuses on understanding the foundations of risk management … read more

- •Foundations of Risk Management

- •Quantitative Analysis

- •Financial Markets and Products

- •Valuations and Risk Models

- •Foundations of Risk Management

- •Quantitative Analysis

- •Financial Markets and Products

- •Valuations and Risk Models

Our FRM Course Faculties

Zell – Best FRM Coaching in India

Why Zell?

- •FRM Qualified Trainers

- •AnalystPrep as Study Providers

- •100% Placement Assistance

- •1.5 Lac+ Students Impacted

- •Flexible Training Options

Benefits of AnalystPrep as FRM Study Providers

Most Recognized & Trusted

Highly Trusted exam prep provider for FRM

Complete Study Package

Access to Study Material, Question banks, Mock Exams and Formula Sheets.

Free of Cost

The cost of AnalystPrep on its own is $600. However, for Zell Students it is available at no extra cost.

Zell Alumni Work Here, You Could Too

Zell Alumni Work Here, You Could Too

Student Reviews for FRM Course

FRM Course Fees

| Weekend | |

| Part 1 + 2 | 80,000 |

OFFERINGS

Part 1 + 2

Weekend

FRM Course FAQs

How is FRM structured?

The FRM course has 10 total competencies in financial risk, which are broken down into 2 parts. The 1st part contains 4 competencies, which emphasizes on financial risk, and the 2nd part contains the next 6 competencies which tests application of tools acquired in part 1. Both the parts need to be cleared in order to complete the course. The FRM Exam process is sequential. Candidates must pass Exam Part I before their Exam Part II will be graded.

Is FRM a degree?

Recognition of FRM is equivalent to a master’s degree.

How many attempts for FRM are available in a year?

Part 1 is offered via computer-based testing (CBT) in May, August and November (2022). Part 2 is offered via CBT in May and November 2022.

Can part 2 be given before part 1?

Candidates that take Exam Part II prior to receiving a passing score on Exam Part I (e.g., candidates that take Exam Part II in the same month that they take Exam Part I) will not have their Exam Part II graded if they fail Exam Part I. Candidates must take and pass Part II within four years of passing Part I.

How much time does it take to study FRM?

Based on the aspirant’s focus and dedication, it takes a minimum of 1 year to finish both the exams of the FRM course.

How is the FRM exam graded?

The GARP (Global Association of Risk Professionals) does not reveal how the exams are graded or what the pass marks are, however, according to estimates and reports, a student would need to score around 53% of the MCQs correctly to pass the exams. The total exam score is not revealed. Additionally, quartile data is provided as a guide to show your topic mastery relative to your peers taking the same exam. This can be useful information if you failed your exam, so you can concentrate your efforts on improving weaker topics if you decide to retake.

What is the format of the FRM exam?

FRM Exam Part I is an equally weighted 100 question multiple-choice Exam, and the FRM Exam Part II is an equally weighted 80 question multiple-choice Exam. Both Exams are administered via computer-based testing (CBT).

What are my career opportunities after FRM?

Certified FRMs are most likely to be risk analysts, risk managers, credit risk analysts, market risk analysts, regulatory risk analysts, operational risk managers, or chief risk officers.

Can a non-commerce student pursue FRM?

Yes, there are no eligibility requirements for the FRM course. Anyone is free to pursue this course.

Is FRM globally recognized?

The FRM course is provided by the Global Association of Risk Professionals (GARP). GARP is headquartered in the US. The GARP FRM accreditation is globally recognized as the premier certification for financial risk professionals dealing in financial markets.

Does FRM provide any exemptions for cross-courses?

FRM provides no exemptions for any other courses and vice-versa.

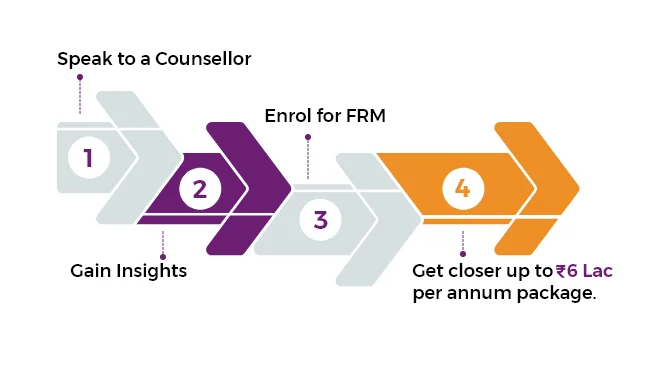

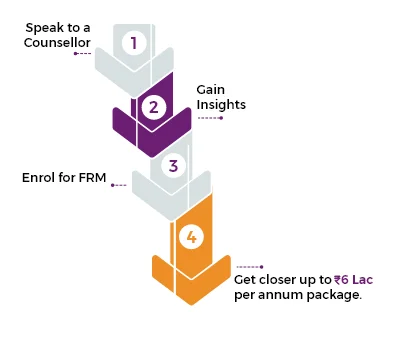

Speak to A FRM Course Expert