CFA Salary in India (2025):

| Average Annual Salary | ₹6 – 25 LPA depending on experience |

| Entry-Level (0–2 yrs) | ₹6 – 12 LPA |

| Mid-Level (3–7 yrs) | ₹10 – 25 LPA |

| Senior-Level (8+ yrs) | ₹18 – 50 LPA+ |

| Charterholders (avg.) | ₹28.6 LPA (CFA Institute Survey) |

| Starting Salary | ₹10–15 LPA for fresh CFAs |

| Job Roles & Ranges | Financial Analyst: ₹6–15 LPA Portfolio Manager: ₹18–40 LPA Investment Banker: ₹10–35 LPA |

Chartered Financial Analyst (CFA) is a course that qualifies candidates to work in the field of finance. It is a globally recognized course that allows candidates to work in India as well as in countries like the US, UK, UAE, Hong Kong, and Australia.

In the last few years, the demand for CFAs has risen drastically, and a lot of companies are hiring experts who can help with the management of investment portfolios. Moreover, international companies in India are more inclined to hire people with globally recognized qualifications than local qualifications.

Understanding the CFA Certification

Let us dig into the world of CFA through a clear and elaborate understanding of its concepts.

What is the CFA Program?

The Chartered Financial Analyst (CFA) program is a highly prestigious certification that is an extremely sought-after position across several multinational companies across the globe. It is regarded as one of the most prestigious credentials for finance professionals, demonstrating expertise in investment analysis, portfolio management, and ethical financial decision-making.

The CFA Journey in India

In India, the CFA qualification is extremely valued by several employers of multinational companies. The qualification of CFA is considered to be extremely prestigious, and CFA professionals are extremely in demand. The CFA program consists of three levels, each requiring rigorous preparation. On average, candidates take 2-4 years to complete all three levels. The exams test topics such as ethics, economics, corporate finance, portfolio management, and alternative investments.

Commitment to the CFA program is significant—candidates are advised to dedicate 300+ hours of study per level. Despite the effort, the payoff can be substantial. Entry-level CFA candidates in India can expect salaries ranging from ₹6-12 lakh per annum, while experienced shareholders can earn ₹20 lakh or more, depending on their roles and expertise.

CFA Salary Overview in India

The salary CFA professionals receive in India varies and depends on factors like experience, job role, industry, company size, and geographic location.

Here’s an overview:

Average Salary:

- National Average: The average annual salary for a CFA in India is approximately ₹6,82,300, which is about ₹36,960 per month. This figure is ₹2,94,800 (+76%), higher than the national average salary in India.

Salary by Job Role

Salaries for a CFA professional vary based on the scope and job role and also the size of the organization that the employee is working in.

| Job Role | Average Salary (INR per annum) |

| Financial Analyst | 6-12 lakhs |

| Investment Banker | 12-35 lakhs+ |

| Portfolio Manager | 15-40 lakhs+ |

| Risk Manager | 10-30 lakhs |

| Equity Research Analyst | 8-20 lakhs |

| Wealth Manager | 7-25 lakhs |

Bonuses, profit sharing, and incentives can significantly boost total compensation, particularly in investment banking and portfolio management.

Regional Variations in Salaries

CFA salaries can vary based on location due to differences in the cost of living, financial hubs, and industry presence.

- Mumbai: The financial capital offers the highest salaries, with investment banks and asset management firms offering lucrative packages. Salaries can be 15-30% higher than other cities.

- Delhi NCR: Competitive salaries, especially in consulting and corporate finance roles. Typically, 10-20% lower than Mumbai.

- Bangalore: Strong presence of fintech and private equity firms, offering salaries comparable to Delhi but with more opportunities in tech-driven finance roles.

- Other Cities (Chennai, Hyderabad, Pune, Kolkata): Salaries are generally 20-40% lower than Mumbai, though the cost of living is also lower.

Industry choice also plays a role. Finance professionals in investment banking and asset management earn higher salaries than those in corporate finance or risk management.

Scope of CFA

After completion of the CFA, you can work in a variety of job profiles in the field of finance. Some of the most commonly preferred jobs that CFA charter holders take up are Investment Banking and Stockbroking.

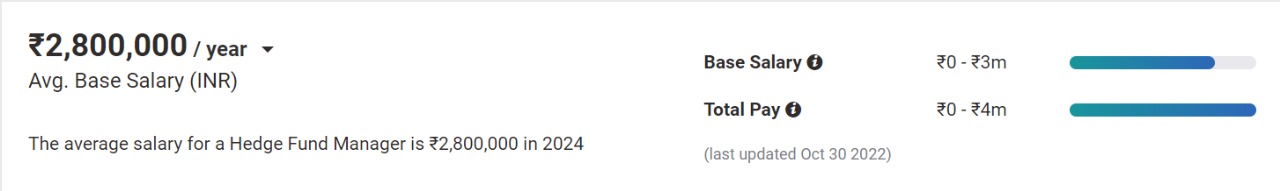

In general, the average starting salary of a CFA is INR 6 to 8 lpa. With enough experience in wealth management and portfolio management, you may also become a Hedge Fund Manager, which may help you earn a salary of INR 15 lpa.

There are numerous benefits of becoming a CFA. In addition to working in India, a CFA can also explore multiple opportunities in other countries such as the US, UK, Singapore, Hong Kong, and UAE. Indian companies like Motilal Oswal and ICICI Securities, as well as international companies like Goldman Sachs, Morgan Stanley, and the Big 4 (KPMG, Deloitte, EY, and PwC).

CFA Salary based on levels

|

Level of CFA Cleared |

Average Salary (in INR) |

| Level 1 |

4 – 5.4 lpa |

| Level 2 |

6 lpa |

| Level 3 |

10 + lpa |

CFA Salary in India based on Job Profile

Based on what job profile you work in, your average salary after completing CFA might be as follows.

| Job profile | Average Starting Salary (in INR) |

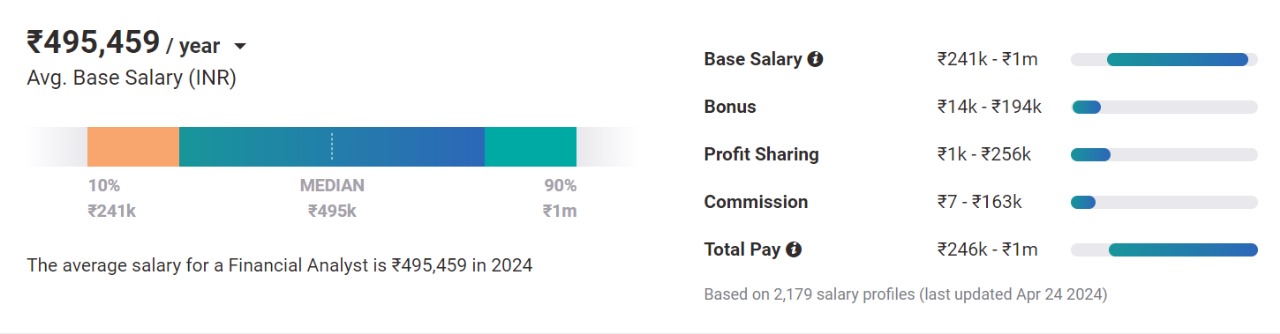

| Financial Analyst | 6,00,000 to 7,00,000 |

| Portfolio Manager | 6,50,000 to 7,50,000 |

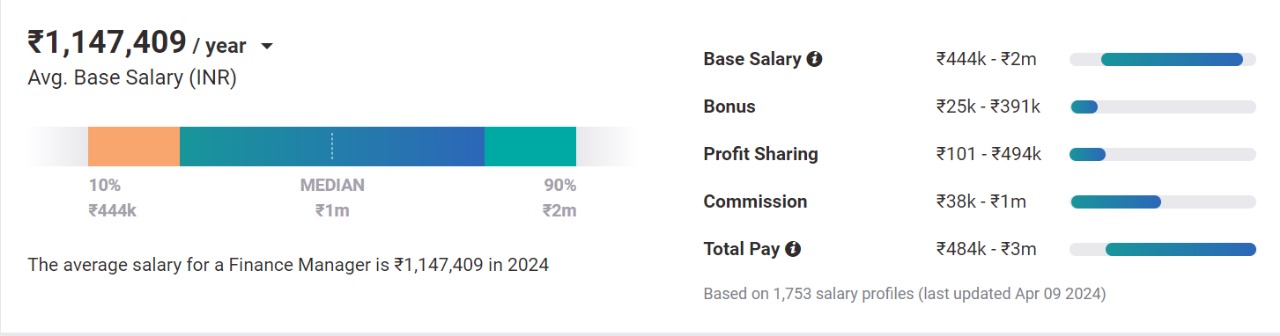

| Finance Manager | 9,00,000 to 10,00,000 |

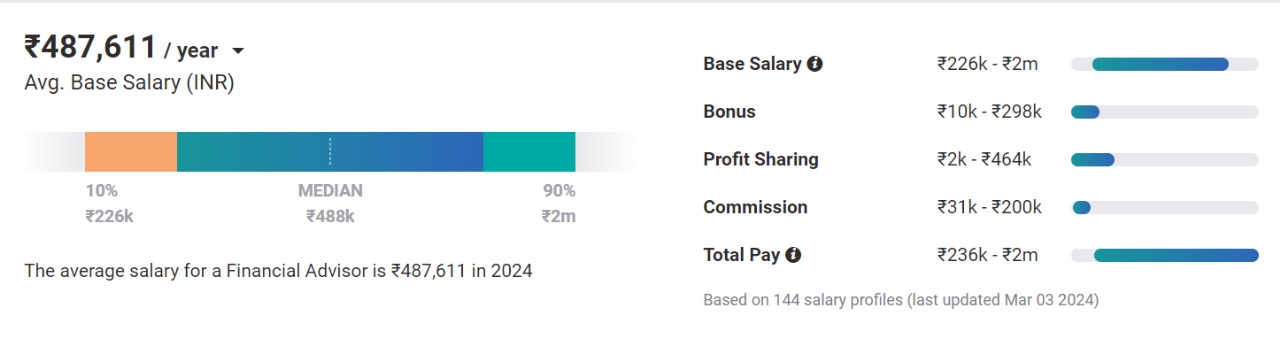

| Financial Advisor | 4,00,000 to 5,00,000 |

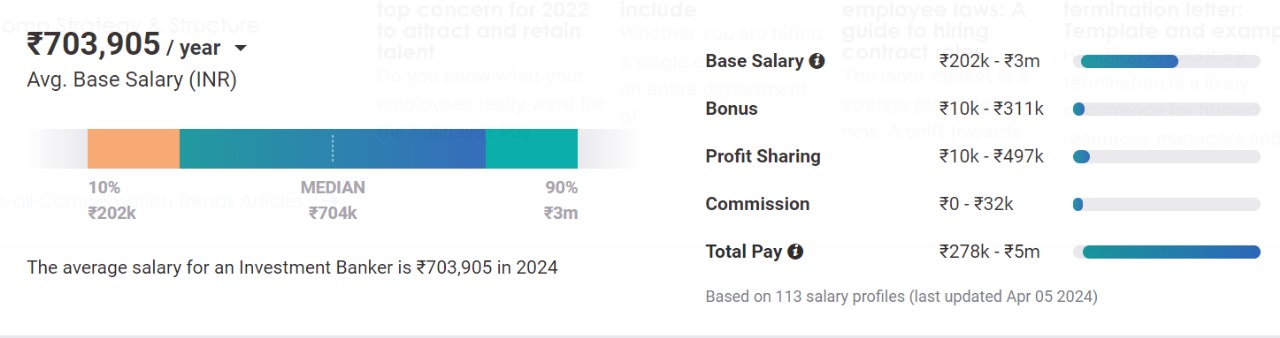

| Investment Banker | 9,00,000 to 10,00,000 |

| Hedge Fund Manager | 10,00,000 to 15,00,000 |

CFA Job Profiles

If you are planning to pursue a CFA course, there are a lot of profiles that you can work in, depending on your preference and skills.

1. Financial Analyst

As a Financial Analyst, you will be responsible for going through the financial data and determining the next steps that should be taken to maximize the amount of profit/revenue earned. A financial analyst will also predict financial outcomes based on the current market trends and participate in making business decisions.

The average Salary of a Financial Analyst is around 56,000 Per Month

2. Portfolio Manager

A Portfolio Manager’s primary task is to make important decisions concerning investment, either for themselves or for a client. Such professionals employ several investment strategies to help their clients meet certain financial goals. This job requires a lot of research and strategic thinking to know when to let go of certain investments and when to modify them to get the best outcome.

The average Salary of a Portfolio Manager is around 52,000 – 54,000 Per Month

Source: Calculate Your take Home Salary

3. Finance Manager Salary

A Finance Manager is someone capable of overseeing the financial operations of a company. In a smaller company, they may be required to manage the entire portfolio of the company, whereas, in a larger company, they may be required to specialize in specific tasks and aspects of finance. Some tasks handled by a finance manager include budgeting, cash flow management, making financial forecasts, and managing potential risks.

The average Salary of a Finance Manager is around 84,000 Per Month.

4. Financial Advisor

The primary role of a Financial Advisor is to give guidance on how their client or a company can manage their money and finances in a better way. This includes making new trades, creating financial plans, evaluating existing investments, and making the necessary changes.

The average Salary of a Financial Advisor is around 33,000 Per Month.

5. Investment Banker

A career in investment banking has gained a lot of popularity in the last few years. One of the main reasons behind the increase in demand for CFA across the world is that people want to work as Investment Bankers in prestigious companies. An Investment Banker is someone who handles all the investments for a company, a client, or themselves. This includes issuing stocks, arranging purchases and sales, looking after mergers and acquisitions, and preparing bond offerings.

The average salary of an Investment Banker is around 77,000 Per Month.

6. Hedge Fund Manager

A hedge fund manager is someone responsible for looking after the operations of a hedge fund. Hedge funds are pooled investment funds made by high-net-worth individuals who have the potential to give high returns with the help of different kinds of investment strategies.

The average salary of a Hedge Fund Manager is around 125,000 Per Month.

Factors Influencing CFA Salaries

Other than the fact CFA is itself a prestigious certificate to obtain a stable and secured income, several factors influence the CFA salaries. We will be discussing those factors in a more elaborate manner.

Educational background

Educational background plays a pivotal role in determining the salary structures of CFA professionals in India. For example, a CFA professional with an MBA qualification will potentially have more earning prospects than a CFA professional with a B.Com.

Industry and Firm Size:

The type and size of the industry also determine the salaries of CFA professionals. High-growth industries such as technology, finance, pharmaceuticals, and consulting generally offer higher pay scales due to their profitability and market demand. On the other hand, traditional industries like manufacturing and retail might offer moderate compensation but often provide long-term job security and incremental growth.

Certifications

Additional certifications and global access to growth opportunities also affect the salary structure of CFA professionals. Employers seek professionals who have stable global exposure along with other prestigious certifications like ACCA, CFA, or CA.

CFA Eligibility

Students who have completed their graduation or are in their final year of graduation can register for the CFA exams.

CFA Exam Structure

The exam structure of CFA is quite simple. It consists of 3 levels, i.e., Level 1, Level 2, and Level 3.

Level 1 exams can be given in February, May, August, and Nov; Level 2 can be given in February, August, and November, and Level 3 in May and August.

Your salary after CFA may largely depend on the kind of work experience you have and your academic qualifications. Moreover, even after you start working as a financial analyst, the trajectory of growth you experience, and your salary package depends on your skills in finance and the kind of impression you make on your peers.

The Chartered Financial Analyst is a globally recognized qualification in the field of finance and investment. If you have recently completed your graduation or are appearing for your final semester, you may be eligible to become a CFA. Interested? We highly recommend checking out our Chartered Financial Analyst (CFA) course.

Planning to pursue a global accounting career?

To Book Your Free Counseling Session

Comparative Analysis: CFA vs. Other Financial Salary and Career Growth Comparison

Below is a comparative table showcasing the average salaries and career growth prospects of CFA and other popular financial qualifications in IndiaCertifications

| Certifications | Average Salary (INR) | Career Growth Prospects | Industry Commonly Employed |

| CFA (Chartered Financial Analyst) | 8-20 LPA (varies by experience) | High in investment banking, asset management, equity research | Investment Banking, Portfolio Management, Equity Research |

| CA (Chartered Accountant) | 7-25 LPA | Strong in accounting, taxation, auditing, and finance | Auditing, Accounting, Taxation, Corporate Finance |

| ACCA (Association of Chartered Certified Accountants) | 6-15 LPA | Strong, especially in multinational firms | Financial Accounting, Compliance, Consulting |

| CPA (Certified Public Accountant – US) | 8-22 LPA | High in MNCs and consulting firms | Accounting, Auditing, Financial Reporting |

Future Trends and Market Outlook

The growth of the multinational company across India is increasing the demand for CFA professionals. Employers are seeking professionals who are aware of all the international finance policies and procedures. As India is reaching out to be a global financial hub, the need for skilled and certified professionals like CFA charter holders is very significant. The upward economic trajectory in India’s GDP guarantees the need for skilled professionals like CFA charter holders in most organizations.

Impact of Technological Advancements

Technological advancements are reshaping the financial industry, directly influencing the roles and earning potential of CFA professionals. Key trends include:

Digital Transformation: Automation, robo-advisors, and AI-driven financial modeling are reducing manual tasks while increasing the need for professionals skilled in interpreting complex data and making strategic investment decisions.

Data Analytics & Big Data: The ability to analyze vast amounts of financial data is becoming a crucial skill for CFA professionals. Firms are increasingly seeking individuals who can leverage predictive analytics and machine learning to optimize investment strategies.

Blockchain & Cryptocurrency: As digital assets gain mainstream acceptance, CFA professionals with expertise in cryptocurrency markets, blockchain technology, and decentralized finance (DeFi) will be highly sought after.

Conclusion & Next Steps

In conclusion, you can understand the CFA stands in a very stable position along with broader career scopes and high salaries. With the economic growth in India, multinational companies are in huge want of CFA professionals with their knowledge and expertise. The salary structure of CFA professionals depends largely on various factors like the size of the firm, technological advancements, global exposure, certifications, and many other factors.

FAQs on CFA Salary in India:

What is the starting salary for CFA professionals in India?

The starting salary for a CFA professional in India ranges from about 6-12 LPA INR.

How does location affect earnings?

Salaries in major financial hubs like Mumbai, Delhi, and Bangalore are higher.

What skills can boost my CFA salary?

Skills like financial modeling, risk management, investment banking, and data analysis can significantly boost your CFA salaries.

What is the salary of a CFA fresher?

As a CFA Level 1 fresher, you can expect to earn 4-8lpa.