People with a non-commerce background may think that financial management must be a dull field involving endless balance sheets and relentless talking about money. However, financial management is more than just that. Importance of financial management entails managerial functions and handling an organization’s financial resources. Financial Managers are the backbone of firms, dealing with the most crucial business aspect – planning and organizing funds. This article will discuss the importance and scope of financial management in India and worldwide.

What Is Financial Management?

What is financial management, you may ask? So, financial management process includes planning for the future of an individual or a business enterprise to ensure a positive cash flow. Fund management is the application of general management to the financial resources of an enterprise.

Emerging Trends in Financial Management

Financial management today is not confined to traditional bookkeeping and fund allocation. It is evolving with new trends that are reshaping the industry. Some of the key emerging trends include:

- Sustainable Finance: Companies are increasingly focusing on ESG (Environmental, Social, and Governance) criteria while making investment decisions to ensure long-term sustainability.

- Fintech Innovations: The rise of fintech startups has brought forward new ways to manage finances, such as blockchain-based accounting and robo-advisory services.

- Behavioral Finance: Understanding the psychological factors that affect financial decisions is becoming important in designing financial strategies.

- Integrated Financial Planning: Businesses are moving towards a more holistic approach where financial planning is integrated with business strategy and operational goals.

- Automation and AI: Routine financial processes like invoicing, payroll, and compliance reporting are being automated, allowing finance professionals to focus on strategic tasks.

These trends are redefining the role of financial managers, making adaptability and continuous learning essential skills for success.

Financial Management Cycle

The circle for financial management process is the cycle of workflow in which these processes are based around;

- Financial Planning: Planning is done based on the decided allocation of resources.

- Planning Finance: Making arrangements towards funds and investments.

- Dividend Decision: Deciding the amount of profit to be distributed.

- Working Capital Management: Short-term assets and liabilities management.

- Protocol: To set policies and procedures in place for financing.

Importance of Financial Management

Financial management is vital for various reasons:

- Proper financial management ensures the economic growth and stability of an organization.

- Financial Managers help an organization in the procurement of funds for business operations.

- Financial Managers help organizations utilize money more efficiently.

- A fundamental responsibility of a Financial Manager is to suggest the right investment opportunities to the company. They lower the risk factor in any kind of investment.

- Financial Managers should make the right decisions to maximize their company’s profit.

- Managers help the company minimize the taxes any business has to pay.

Digital Transformation in Financial Management

Digital transformation is playing a pivotal role in shaping the future of financial management. It refers to the integration of digital technologies into all areas of finance, fundamentally changing how businesses operate and deliver value to customers. Key aspects include:

- Cloud-Based Financial Systems: Cloud computing allows for real-time financial reporting, enhanced security, and easier collaboration across departments.

- Artificial Intelligence and Machine Learning: AI is helping financial managers with predictive analytics, fraud detection, and personalized financial advice.

- Blockchain Technology: Financial management is leveraging blockchain for transparent and secure transactions, improving trust and reducing errors.

- Data-Driven Decision Making: Advanced data analytics enables finance teams to gain deeper insights into market trends, customer behavior, and operational efficiency.

- Digital Payment Systems: Mobile wallets, cryptocurrencies, and digital banking services are changing how businesses handle transactions globally.

Overall, digital transformation is enhancing efficiency, accuracy, and strategic financial planning capabilities, making it a must-have for modern finance teams.

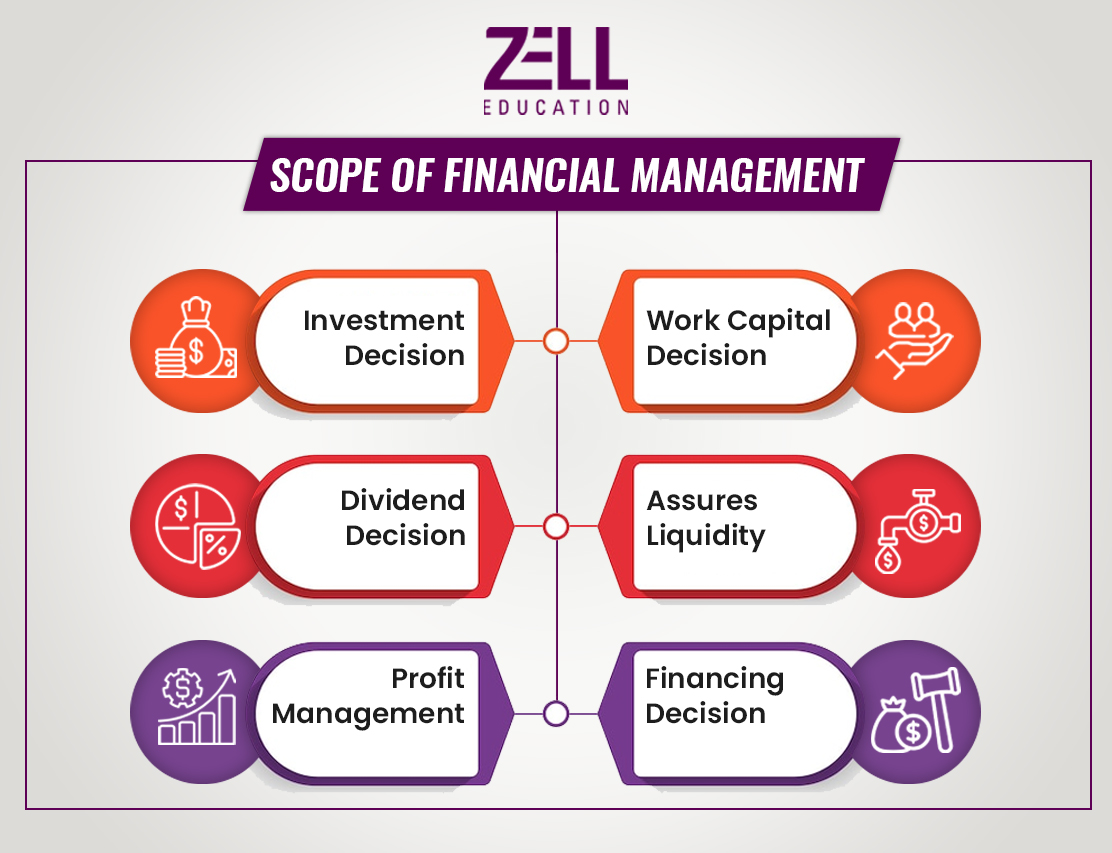

Scope of Financial Management

Nature of financial management encompasses several key areas:

- Planning: Setting financial goals and outlining steps to achieve them.

- Budgeting: Creating a detailed financial plan to allocate resources efficiently.

- Financial Decision: Deciding on investment and financing options.

- Dividend Decision: Establishing policies for profit distribution.

- Working Capital Management: Ensuring the organisation has sufficient short-term assets to cover its short-term liabilities.

Planning

Yes, planning in simpler terms is forecasting the future financial management cycle needs setting goals for it and deciding the best strategies to achieve that. Good planning enables an organisation to realise its financial objectives while bad or no planning will not.

Budgeting

The capital budgeting is sketching up a financial plan with resources being distributed across all activities and departments within an organisation. It helps in the cost control and efficient utilisation of funds.

Financial Decision

The need for money makes financial decisions which in turn govern the capital structure and therefore assets of a company These decisions are based on a combination of investment (capital budgeting) decisions, financing decisions debt or equity and dividends profit distribution.

Dividend Decision

The dividend decision lays out how much of the profits will be shared with shareholders and what percentage to keep for growth. This decision affects how satisfied investors will be and what the company will have to reinvest.

Working Capital Management

Definition of Working Capital Management: The management or the control over a company’s short-term assets and liabilities to ultimately ensure it can continue its operation is called working capital. That means managing inventories and accounts receivable and payable.

Procedures

Another importance of financial management procedures is that they are the standardised methods and protocols informing organisations how to efficiently and legally manage expenses, billing, and report preparation under various government agency regulations. These procedures assist in making sure that the financial reporting and decision-making are followed consistently and accurately as required.

Managing and Accessing Risk

Risk management and assessment include discovering conceivable financial risks management and implementing resolutions to avoid them. There are different types of risks such as:

- Market Risk: the threat of losing capital due to changes in market circumstances.

- Credit Risk: the threat of not getting paid back the credits given.

- Liquidity Risk: the threat of being incapable of paying sudden short-term debts or emergencies.

- Operation Risk: the threat of loss from deficient operations or unsuccessful internal systems.

The functions of financial management are based on specific characteristics termed the nature of financial management. It is an active method focused on continuous study, planning and reviewing of financial resources to achieve a planned and efficient goal. It includes numerous financial activities to generate the most out of it and present susceptibility in the organisation.

Nature of Financial Management

The nature of financial management is dynamic, involving continuous analysis, planning, and monitoring of financial resources to achieve organizational goals. It integrates various financial activities and ensures the optimal use of financial resources.

Objectives of Financial Management

The primary objectives of financial management are:

- Profit Maximization: Ensuring the company generates maximum profits.

- Wealth Maximization: Increasing the value of the company for shareholders.

- Liquidity Management: Maintaining adequate liquidity to meet obligations.

- Efficient Resource Allocation: Ensuring optimal use of financial resources.

Global Insights & Future Outlook

The future of financial management is set to become more global, interconnected, and dynamic. Here’s a glimpse of global insights and future prospects:

- Globalization of Finance: Cross-border investments, international trade, and global capital markets are creating new opportunities and challenges for financial managers.

- Focus on Risk Management: With economic volatility, financial managers worldwide are placing stronger emphasis on robust risk management frameworks.

- Regulatory Evolution: Stricter international financial regulations, such as IFRS (International Financial Reporting Standards) and GDPR (General Data Protection Regulation), are influencing financial management practices globally.

- Rise of Remote Financial Services: The pandemic accelerated the adoption of remote working tools and online financial services, a trend that continues to grow.

- Talent Demand: Globally, there is a high demand for finance professionals skilled in technology, data analytics, and strategic thinking, highlighting the need for continuous professional development.

Thus, financial management is becoming an even more critical and strategic function on the global stage, requiring innovation and agility to stay ahead.

Functions Of Financial Management

The key functions of financial management include:

- Investment Decision: Deciding where to invest funds to maximize returns.

- Financing Decision: Choosing the best sources of finance.

- Dividend Decision: Determining the distribution of profits.

- Liquidity Management: Ensuring sufficient liquidity to meet obligations.

- Financial Planning and Analysis: Planning and analyzing financial performance.

Types of Decision in Financial Management

Financial management involves several types of decisions, including:

- Investment Decisions: Choosing the right investment opportunities.

- Financing Decisions: Selecting the appropriate mix of debt and equity.

- Dividend Decisions: Deciding the proportion of earnings to distribute as dividends.

- Working Capital Decisions: Managing short-term assets and liabilities/

A Career in Financial Management

Financial management has a broad scope for those looking to make a career in this field. These career opportunities are not just lucrative but come with exciting challenges. Various companies, governments, and PSUs hire corporate finance professionals across departments. Finance Managers can also join banks, asset management companies, investment companies, brokerage firms and insurance companies.

Even sectors like technology, retail, real estate, and other non-financial industries hire executives with sound financial management skills.

Demand for skilled Financial Managers specializing in fund management and risk management is high in the job market.

The salary of Financial Managers varies based on different parameters such as experience and skillset. On average, the median salary of a finance executive in India is INR 10,11,274 per year. Professionals with advanced degrees like Chartered Financial Analyst (CFA) Course & US CMA Course (Certified Management Accountant) have a better scope of getting high-paying jobs.

Curious About Future Scope of Financial Management?

Difference Between Traditional and Modern Approach of Financial Management

Here’s the difference between traditional and modern approach of financial management.

Traditional Approach

The traditional approach to financial management focused primarily on:

- Procurement of funds.

- Managing financial resources.

- Emphasizing on external financial transactions.

Modern Approach

The modern approach is more comprehensive and includes:

- Resource Allocation: Optimal use of resources.

- Risk Management: Identifying and mitigating financial risks.

- Strategic Planning: Long-term financial planning and strategy.

- Financial Performance: Continuous evaluation of financial performance.

Modern Approach of Financial Management

The modern approach of financial management involves strategic planning, analysis, and control. It integrates financial decision-making with the overall strategic objectives of the organization, ensuring sustainable growth and value creation.

Goals of Financial Management

The primary goals of financial management are:

- Profit Maximization: Ensuring the company generates maximum profits.

- Wealth Maximization: Increasing the value of the company for shareholders.

- Sustainability: Ensuring long-term financial health.

- Liquidity: Maintaining sufficient liquidity to meet short-term obligations.

What People Are Also Searching Around the Topics

Here are some popular queries related to the future scope of financial management:

- Is financial management a good career for the future? Yes, financial management is a promising career with diverse opportunities across industries like banking, consulting, IT, and real estate.

- How is AI affecting financial management? AI is automating routine tasks, providing predictive insights, enhancing fraud detection, and improving financial forecasting accuracy.

- What skills are important for future financial managers? Key skills include financial analysis, risk management, technological proficiency (especially in fintech), strategic planning, and communication skills.

- What certifications boost a career in financial management? Certifications like CFA (Chartered Financial Analyst), US CMA (Certified Management Accountant), CPA (Certified Public Accountant), and FRM (Financial Risk Manager) are highly valued.

- What industries are hiring financial managers? Apart from traditional sectors like banking and insurance, industries like healthcare, technology, e-commerce, and renewable energy are actively hiring finance professionals.

Conclusion

Financial management is a critical function in any organization, ensuring efficient utilization of resources, Financial risk management, and achievement of financial goals. Understanding its principles, processes, and approaches is essential for anyone pursuing a career in finance.

FAQ’s on Future Scope of Financial Management:

What is the nature and scope of financial services?

Financial services encompass a wide range of activities, including banking, insurance, investment management, and financial planning. The scope includes providing financial products, advisory services, and managing financial risks.

What is the scope of financial management?

The scope of financial management includes investment decisions, financing decisions, dividend decisions, and working capital management. It also involves strategic financial planning, risk management, and financial analysis.

What are the 5 A’s of financial management?

The 5 A’s of financial management are:

- Anticipation: Predicting future financial needs.

- Acquisition: Procuring necessary funds.

- Allocation: Allocating resources efficiently.

- Administration: Managing financial operations.

- Analysis: Evaluating financial performance.

What is the scope of finance?

The scope of finance includes personal finance, corporate finance, public finance, and international finance. It involves managing funds, investing, financial planning, and risk management.