What Is Capital Budgeting & It’s Process

Capital Budgeting is a financial process that’s followed by several companies starting from SMEs to MNCs. As per this process, the expenditure on large projects such as buying fixed assets, investing in tools and resources, and funding research and development is calculated. Since all of these are heavy expenses, it is essential to set a budget for them, to ensure optimal income and revenue.

Capital budgeting as a concept and as a profession is gaining momentum because companies are now realising how important it has become for their revenue and expenditures efficiently. The covid pandemic has instilled a sense of financial management among all business owners. By bringing in capital budgeting as a part of the financial process, the companies can set long-term financial goals and ensure seamless functioning.

What is Capital Budgeting?

Capital budgeting, as mentioned earlier, is the technique of analysing expenditures to track the revenue gained from these expenditures. These expenditures are often project-based. If a company is confused between two projects, with the help of capital budgeting, they would be able to analyse whether they would be able to invest in one project or both. In case they have the budget to only invest in one project, then based on the investment and revenue analysis provided by the capital budgeting, the company will go ahead with any one project.

The most frequent question in today’s corporate financial world – What is Capital Budgeting?

Capital budgeting is the process of planning and managing investments in long-term assets, such as buildings, equipment, or projects. It involves analyzing potential investment opportunities, estimating their costs and benefits, and determining whether they align with the organization’s financial goals and objectives. Several companies from SMEs to MNCs follow the process of capital budgeting to ensure optimal income revenue.

Understanding Capital Budgeting

When understanding capital budgeting, you must understand a business constantly looks to create value for its stakeholders. The process of capital budgeting involves evaluating potential investment projects to determine their value. The process typically utilizes three main approaches: the payback period, which assesses how long it takes to recoup the initial investment; the internal rate of return, representing the expected return on the project; and the net present value, which compares the profitability of the project to alternative investments. Among these methods, net present value is often considered the most effective in guiding investment decisions.

Why Do Businesses Need Capital Budgeting?

Wondering why do businesses need capital budgeting? Here’s a glimpse into the real picture.

- Capital budgeting fosters accountability and measurability, essential for responsible resource allocation in businesses.

- Without understanding risks and returns, investing in projects can be viewed as irresponsible by owners or shareholders.

- Effective capital budgeting allows businesses to measure the effectiveness of investment decisions, crucial for survival in competitive markets.

- Limited capital and mutually exclusive decisions are common in business scenarios, necessitating careful allocation of resources.

- Management relies on capital budgeting to outline project expectations, facilitating comparison with other potential investments.

- The process serves as a measurable means for businesses to evaluate the long-term profitability of investment projects.

- While short-term sales forecasts may be manageable, assessing the long-term outcomes of major investments requires capital budgeting.

- Capital budgeting enables businesses to assess risks, plan ahead, and anticipate challenges, ensuring informed decision-making and sustainable growth.

Methods Used in Capital Budgeting

The methods used in capital budgeting include three main methods – discounted cash flow analysis, payback analysis and throughput analysis. Let’s understand them more in detail.

Discounted Cash Flow Analysis:

- Companies utilize discounted cash flow techniques to assess cash flow timing and the implications of currency devaluation over time.

- It incorporates project inflows and outflows, aiming to calculate a target discount rate or specific net cash flow at project completion.

Payback Analysis:

- Focuses on the timing of when specific benchmarks, like breaking even or reaching a certain profit level, are achieved.

- Requires careful cash flow forecasting to ensure accuracy, as any deviation from estimates can significantly impact the timing of reaching payback metrics.

Throughput Analysis:

- Utilizes revenue and expenses analysis across the entire organization, not just for individual projects.

- Involves subtracting variable costs from revenue to determine how much profit each sale contributes to covering fixed costs.

- Targets a specific amount of capital available after variable costs to cover operational expenses, with management setting expectations for capital budget contributions back to operations.

Metrics Used in Capital Budgeting

When faced with a capital budgeting decision, firms often employ various metrics used in capital budgeting to determine project profitability. These include:

Payback Period (PB):

- Calculates the time needed to recover the initial investment.

- Used when liquidity is a major concern, as it focuses on recouping the initial investment.

- Simple to calculate but does not consider the time value of money (TVM) or cash flows occurring later in the project’s life.

Internal Rate of Return (IRR):

- Represents the discount rate resulting in a net present value (NPV) of zero.

- If the IRR exceeds the cost of capital, the project is considered profitable.

- Provides a benchmark for comparing projects based on returns on invested capital but doesn’t allow for easy comparison of mutually exclusive projects.

Net Present Value (NPV):

- Discounts after-tax cash flows by the weighted average cost of capital to determine project profitability.

- Projects with a positive NPV should be accepted, while those with a negative NPV should be rejected.

- Provides a direct measure of added profitability and allows for simultaneous comparison of multiple projects.

While each method has its advantages and drawbacks, NPV is often considered the most intuitive and accurate approach, providing a direct measure of added profitability and allowing for comparison of mutually exclusive projects. It also allows for sensitivity analysis to identify potential future concerns.

What Are Common Types of Budgets?

Budgets can take various forms, such as incremental, activity-based, value proposition, or zero-based. While zero-based budgets start from scratch, incremental or activity-based budgets may build upon a prior-year budget to establish a baseline. When it comes to the process of capital budgeting, any of these methods can be employed, but zero-based budgets are particularly suitable for new projects.

The Process of Capital Budgeting

Wondering what the process of capital budgeting seems like? Here’s a glimpse into the real picture.

- Identifying the project and creating it: The initial step involved in capital budgeting is to identify the investment opportunities and create a proposal for the same. These projects need to be based on high returns so that the management can approve them on the basis of profitability. These projects could either be an extension of the existing product range or something entirely new.

- Project evaluation and analysis: Based on the company’s short-term and long-term objectives, the project needs to be formulated. While evaluating the project, details of the overall expenditure, time spent and the expected benefits need to be calculated and presented to the management in order to make a sound decision.

- Controlling capital expenditure: While selecting the project based on the revenue is the main objective of capital budgeting, it is not the end. The expenditure still needs to be controlled. The process of capital budgeting ensures that the expenses are further controlled by setting the right budget.

- Searching the right fund sources: The Capital Budgeting Incharge needs to quantify the total expenditure to ensure the funds that need to be borrowed and from where exactly. A balance needs to be created between funds borrowed from different sources and the revenue distribution.

Factors affecting Capital Budgeting

Capital budgeting is interdependent on several other financial factors that make this process more intensive and requires multiple tasks to be carried out. If you are planning to enter this profession, here is a list of tasks you will have to look after.

- Understanding the need for a project

- Creating a project

- Finalising the working capital

- Structuring the working capital

- Analysing the economic value of the project

- Checking the availability of funds

- Finding the lending terms of the financial institutions

- Reading up on taxation policies

- Reading up on government policies

- Using accounting methods

- Forecasting capital returns

Capital Budgeting Tools

While capital assets are only a small part of the company’s total assets, they still are the ones in line with the organisation’s long-term goals. They are strategically planned in order to generate revenue. Capital budgeting professionals that hope to maximise their revenue are always on the lookout for investment opportunities.

Here are some of the capital budgeting tools used by professionals to prepare a full-proof model:

- Internal rate of return calculation

- Net present value report

- Profitability index

- Accounting rate of return

- Pay period

Deciding on Capital Budgeting

Since the major goal of capital budgeting is increased profitability, the selection of the project is based on maximum revenue or reduced costs. Here’s a glimpse of how most capital budgeting decisions are made.

1. Accept/Reject Decision: Generally the projects that yield a higher return on investment get accepted while the ones that do not seem as profitable often tend to get rejected. Most independent projects get approved, but those competing with one another have a chance of being further shortlisted.

2. Mutually exclusive project decision: As mentioned earlier, competing projects have a chance of being further shortlisted. If there are 5 such proposals submitted at the same time then the acceptance of any type would mean the others get rejected instantly. This is referred to as a mutually exclusive project decision.

3. Capital rationing decision: In a case where a firm has a huge chunk of capital to invest in the projects the proposals submitted at an individual level get accepted quite easily. The rest of the proposals are then rated as per the revenue they might bring in and the acceptance of the proposals depends on the ranking.

Conclusion

In conclusion, we hope that with this detailed article on capital budgeting you have received an in-depth understanding of what the process of capital budgeting looks like and what to expect. If you are interested in getting into this exciting and equally dynamic field, then pursuing an Association of Chartered Certified Accountants Course or US CMA Course degree is the direction to take. To know more about each of these degrees click on the WhatsApp icon at the side of this blog and get in touch with our experts directly.

FAQ

1. What are the objectives of the capital budgeting process?

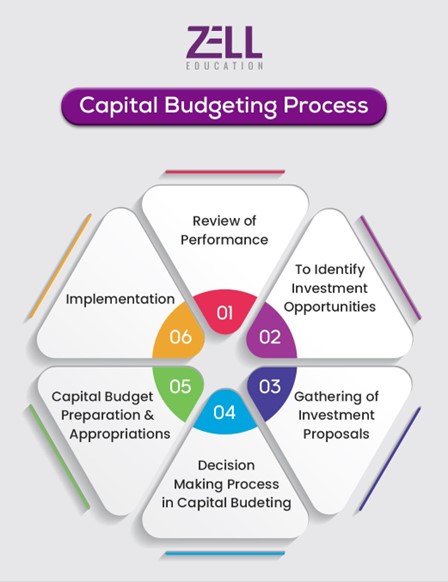

There are multiple objectives of capital budgeting, but 6 of the most essential ones are – identifying investment opportunities, gathering investment proposals, decision-making processes, capital budget preparations and appropriations, and implementation and review of performance.

2. What are the different types of working capital?

Working capital refers to the funds necessary for a company’s day-to-day operations. It can be categorized into gross working capital, representing total current assets, and net working capital, which deducts current liabilities from current assets to indicate liquidity.

3. What are different types of capital?

Different types of capital include financial capital, which is used for financing operations, human capital, representing individuals’ skills and knowledge, and physical capital, consisting of tangible assets like machinery and buildings. Social and natural capital are also recognized, encompassing social networks and natural resources, respectively.

4. What are the six steps in the capital budgeting process?

The process of capital budgeting includes 6 essential steps and they are: identifying investment opportunities, gathering investment proposals, decision-making processes, capital budget preparations and appropriations, and implementation and review of performance.

5. What are the 7 capital budgeting techniques?

The seven essential capital budgeting tools or techniques include payback period, discounted payment period, net present value, profitability index, internal rate of return, and modified internal rate of return.

6. What are the five steps of capital budgeting analysis?

The first step of capital budgeting includes exploring new opportunities followed by estimating costs, determining the benefits, assessing any potential risk involved, and making the final decision.