Just a decade ago, India had not placed itself on the global map for start-ups. Today, India has pulled itself to the list of the top twenty start-up ecosystems.

Supported by proactive initiatives of the Indian government like Start Up India, Make in India, Skill India, and Stand Up India, entrepreneurs have dared to take risks and build successful businesses that have placed us on the global financial map as the third-largest start-up ecosystem. As of data collected in 2025, India boasts as many as 80,152 startups officially recognised by the Department for Promotion of Industry and Internal Trade (DPIIT).

As we enter 2025, with a strong foundation already built for us, the present and future of startups in India look brighter than ever. So, plan, do your research, and if you are planning to let the entrepreneur within you shine, take inspiration from the most innovative startups and upskill yourself with suitable courses to get you started in the right direction.

Read our blog on ‘Top 7 Professional Degree Courses in India’ to explore the best courses to start your entrepreneurship journey.

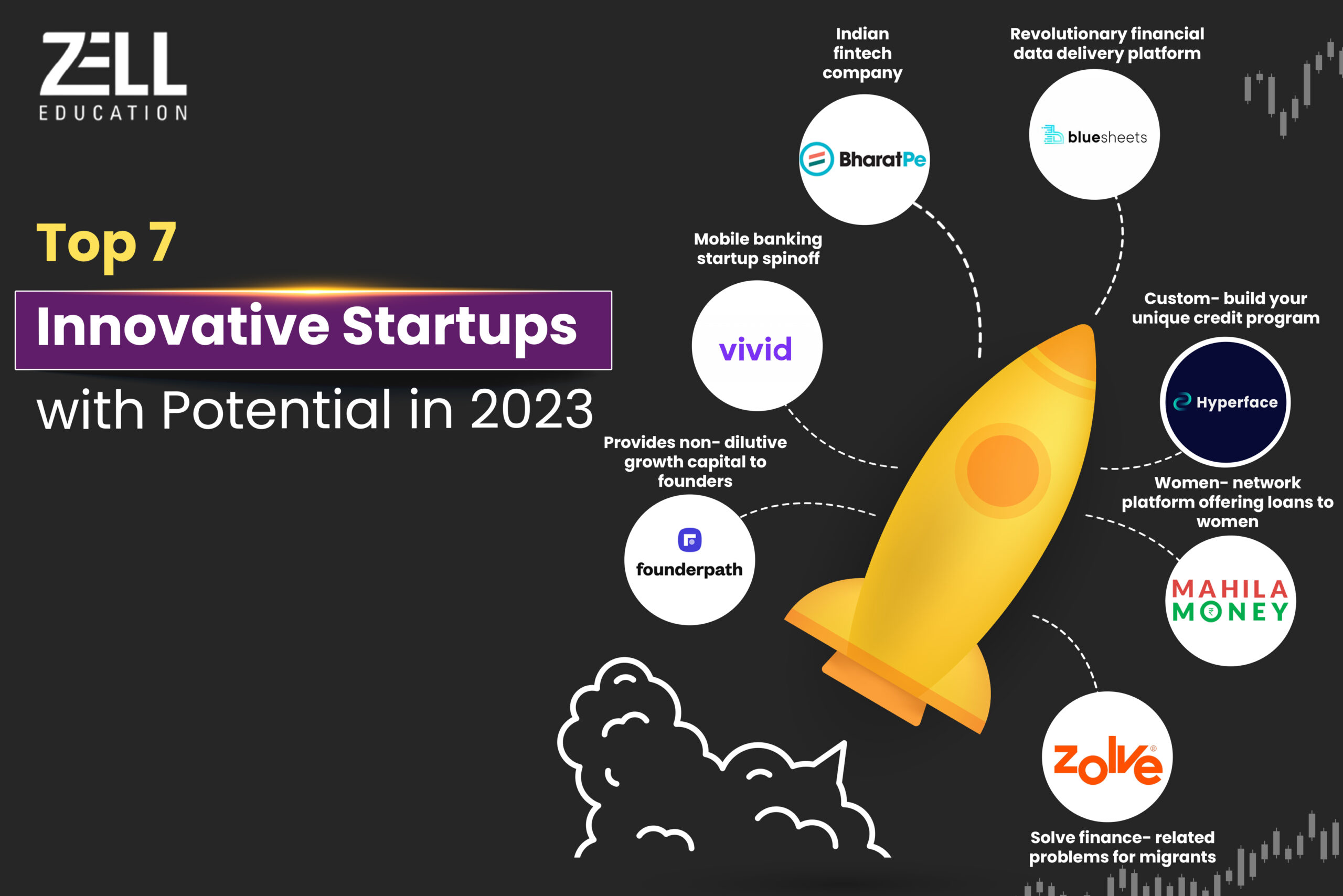

Top 7 innovative startups to follow in 2025

Among a pool of 80,000+ startups, it can leave you in a pickle when you try to filter out the right ones to take inspiration from. To help you out with that and more, here is a list of the seven most innovative startups to look out for this year:

1. Ensuredit

Founded in 2019, Ensuredit is a platform that enhances customer experience for insurance intermediaries. It is an excellent virtual POSP network platform and also provides other services like after-sales support.

2. Bluesheets

Organisations no longer have to spend long hours in bookkeeping activities. Founded in 2020, this has made life easier by making AI do all the hard work required for precise and error-free accounting.

3. Vivid Money

Dealing with multi-currency has always been something that people sweat about. With Vivid Money, this becomes easier. The finance and banking app also offers high interest on savings accounts. Their latest update has introduced brokerage features that let users deal with stocks. To make it all the better, they offer attractive cashback offers.

4. Founderpath

Getting loans has always involved long-term negotiations and a tedious verification process. Founderpath brought a unique solution to this problem by offering loans to bootstrapped SaaS startups. To date, they have given loans to over 3000 such startups.

5. Hyperface

Based in Bengaluru, Hyperface helps companies design and manage credit card programmes. This helps in creating a smoother experience and starting credit card programmes within a matter of weeks.

6. Mahila Money

Founded in 2021, Mahila Money is a one-of-a-kind women-network platform offering loans to women. The entire application process is online and hassle-free, as it requires no guarantor. The loan is meant for financing women-led small businesses.

7. Zolve

Founded in 2021, Zolve is a platform meant to solve finance-related problems for migrants. They are currently only working for immigrants moving between India and the US. They provide customers with high-limit credit cards and debit cards based on their credit scores in their home country.

8. FinX Innovations

FinX Innovations is revolutionizing the way small businesses handle financial transactions. Established in 2022, this startup focuses on integrating AI-powered automation into digital payments, bookkeeping, and invoice management. FinX helps businesses streamline their financial processes by offering real-time expense tracking and automated reconciliation, reducing manual work and errors.

With a strong emphasis on security and compliance, FinX Innovations uses blockchain technology to ensure transparent and fraud-proof transactions. Their intuitive platform is gaining traction among SMEs, making financial management more accessible and efficient. As digital payments continue to grow in India, FinX is positioned as a game-changer in financial automation.

9. FinEdge Ventures

FinEdge Ventures is a startup accelerator that specializes in funding and mentoring early-stage FinTech startups. It bridges the gap between innovative financial solutions and investors by providing strategic guidance, networking opportunities, and seed funding.

With a portfolio that includes cutting-edge AI-driven investment platforms and decentralized finance (DeFi) startups, FinEdge Ventures is at the forefront of fostering the next generation of FinTech leaders. Their ecosystem supports entrepreneurs with market insights, legal assistance, and growth strategies, making them an essential player in India’s startup boom.

10. Capital Pulse

Capital Pulse is transforming financial data analytics with AI-driven insights for investors, traders, and businesses. The startup provides real-time financial data aggregation and predictive market analytics, allowing investors to make data-driven decisions.

What sets Capital Pulse apart is its machine-learning algorithms that analyze global economic indicators, social media trends, and historical market patterns to forecast investment opportunities. As financial markets become increasingly data-driven, Capital Pulse is emerging as a must-have tool for retail and institutional investors looking to gain a competitive edge.

Curious About Top Innovative Finance Startups?

Courses to Succeed in Finance Entrepreneurship

Education is the stepping stone to success when it comes to entrepreneurship. You need to make decisions and take several risks, which should be calculated and well-researched. To ensure you have the proper understanding of the business before you begin your venture, consider these courses to steer your career in the right direction:

-

Association of Chartered Certified Accountants (ACCA) course

ACCA course trains candidates in accounting skills. ACCA benefits candidates with entrepreneurial spirit in several ways. If you are starting your own business, accounting skills are always a plus point that can help you understand the accounts and finances of your business and make improvements wherever possible.

Learn more about the ACCA course and ACCA benefits in our blog, ‘Top 5 Benefits of Getting an ACCA Certification’.

-

MBA in Finance

An MBA in Finance trains candidates in the financial management aspects of a business. From decision-making to understanding organisational economics, the course covers it all. Such vast knowledge will be beneficial for you to manage and control your company’s financial resources efficiently. The course will also give you deep insights into the corporate world and its technicalities.

-

Chartered Financial Analyst Course (CFA)

A certified Chartered Financial Analyst has expertise in understanding a firm’s financial and investment technicalities. Any startup is built upon investments and returns that make up a chunk of its finances.

One of the easiest ways to earn this certification is by signing up for CFA courses online that offer you the flexibility and benefits of online education.

It is worth mentioning here that the business tycoon Mr Nathan Anderson, the founder of Hindenburg Research, is a CFA. This should give you a good understanding of how far the proper certification can take you on your entrepreneurial journey.

-

Certified Management Accountant (US CMA) course

One of the most popular accounting courses, the US CMA course is great for budding entrepreneurs inclined to learn business strategies in accounting and finance. From planning and budgeting to forecasting finances, CMAs are responsible for a chunk of a firm’s financial operations and decisions.

Being a certified CMA will always give you an edge over your competitors since you will have a better understanding of the financial technicalities of your business.

If the US CMA course is the certification that your heart is set on, read our blog on ‘US CMA Syllabus and Paper Pattern’.

Global FinTech Insights

The FinTech sector is witnessing unprecedented global growth, driven by rapid digitalization and evolving consumer demands. From AI-powered banking solutions to decentralized finance, the industry is constantly evolving. Key markets like the US, UK, Singapore, and India are leading the charge, fostering innovation through regulatory support and investment-friendly policies.

With global FinTech funding crossing $200 billion in 2024, the sector is attracting interest from venture capitalists and institutional investors alike. As more businesses adopt FinTech solutions, financial accessibility and efficiency are reaching new heights.

Global Startup Heat Map Highlights

The global startup landscape is experiencing a surge in FinTech innovations, with hubs like Silicon Valley, London, Berlin, and Bangalore emerging as key players. The Startup Heat Map reveals the following trends:

- Silicon Valley & New York: Leading in AI-driven trading platforms and blockchain-based finance solutions.

- London & Berlin: Home to pioneering RegTech (Regulatory Technology) startups ensuring compliance automation.

- Singapore & Hong Kong: Dominating the digital banking and cross-border payments landscape.

- Bangalore & Mumbai: Rapidly growing in digital lending, neobanking, and AI-powered financial services.

This dynamic distribution highlights how global startups are shaping the future of finance through technology.

Emerging FinTech Trends to Watch

As we enter 2025, several FinTech trends are set to redefine the financial industry:

- Embedded Finance: More companies are integrating financial services directly into non-financial apps, making transactions seamless.

- Decentralized Finance (DeFi): The rise of blockchain-based platforms is offering financial services without traditional banks.

- AI-Powered Wealth Management: Robo-advisors are using AI to provide personalized investment strategies.

- Digital Currencies & CBDCs: Central Bank Digital Currencies (CBDCs) are gaining traction, with governments exploring digital versions of their currencies.

- Green Finance & ESG Investing: Sustainable finance solutions are attracting investors looking for eco-conscious investments.

The FinTech industry is evolving rapidly, and staying ahead of these trends will be crucial for businesses and investors alike.

Conclusion

We have covered the top innovative startups that must be on your radar in 2025. You can witness their growth and learn from the ones who have done it right before starting your own journey on this path. Zell Education can materialise your entrepreneurship dream and help you in your quest to own your multinational business with its finance and accounting courses. The faculty members are all leaders in their fields and will teach you everything you need to know before starting your venture in the business world. Visit Zell Education for more information about the ACCA, CFA Certification and US CMA courses.

FAQs on Innovative Finance Startups

What is the ACCA course?

ACCA course is offered under the UK curriculum and covers various aspects of chartered accountancy. While CA teaches accounting that is accepted in India, an ACCA certification is accepted globally.

What is the US CMA course?

The Institute of Management Accountants (IMA), USA, administers the US CMA course. It is a globally recognised management accounting certification.

What are the best courses for finance?

Among the best finance courses, you have the ACCA course, US CMA course, CFA course, MBA in Finance, and CA course. Zell Education provides quality education with the best resources and industry-leading mentors in both online and classroom modes.

What are various possible ways to finance startups in India?

With the introduction of the StartUp India initiative by the Indian government, getting funding for your startup business has become smoother than ever. Alternatively, you can pitch your business idea to angel investors or apply for bank loans.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

Speak To A Course Expert To Know More