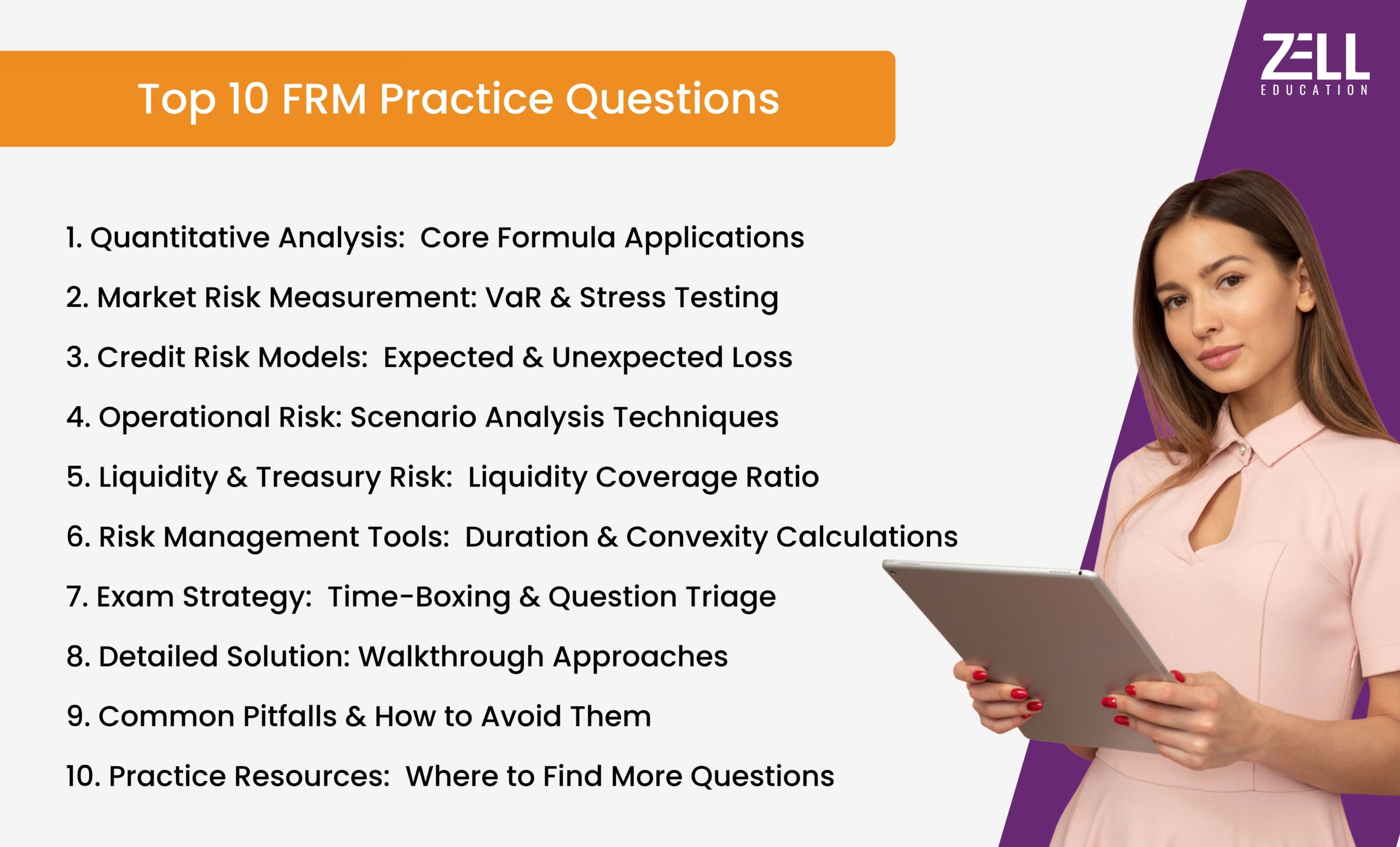

Preparing for the FRM exam can be overwhelming but becomes easier with targeted FRM practice questions. The following guide presents the best 10 FRM practice questions across several topics, with detailed solutions to enable you to master the material and prepare for the exam day.

Quantitative Analysis: Core Formula Applications

Quantitative analysis is core to the FRM exam. In Part I in particular, your skills in math fundamentals like probability, regression analysis, and financial math will be put to the test.

Example FRM Practice Question:

You are given the following data:

- Stock A has a return of 10%

- Stock B has a return of 12%

- The correlation coefficient between Stock A and Stock B is 0.75

- Standard deviation of Stock A is 18%, and of Stock B is 22%

Calculate the portfolio’s expected return and its standard deviation if the portfolio consists of 50% Stock A and 50% Stock B.

Solution:

- Expected Return (Portfolio) = (Weight of A * Return of A) + (Weight of B * Return of B)

= (0.5 * 10%) + (0.5 * 12%) = 11% - Portfolio Standard Deviation (σ) = √[(Weight of A)² * (σ of A)² + (Weight of B)² * (σ of B)² + 2 * (Weight of A) * (Weight of B) * (Correlation coefficient) * (σ of A) * (σ of B)]

= √[(0.5)² * (0.18)² + (0.5)² * (0.22)² + 2 * (0.5) * (0.5) * 0.75 * 0.18 * 0.22]

≈ 0.2007, or 20.07%

The following question assesses your knowledge of the concept of portfolio theory and how two assets’ correlation impacts the risk of the overall portfolio.

Market Risk Measurement: VaR & Stress Testing

Value at Risk (VaR) is an important concept for risk measurement in the context of market risk. In FRM, you will be required at times to apply this concept in various conditions. Stress testing also assists in evaluating how severe market conditions may impact your portfolio.

Example FRM Practice Question:

You manage a portfolio worth $1,000,000, and you know that its daily returns are normally distributed with a mean of 0.1% and a standard deviation of 2%. What is the 1-day VaR at the 99% confidence level?

Solution:

- VaR Formula:

VaR = Portfolio Value * Z-Score * Standard Deviation of Returns - For a 99% confidence level, the Z-score is -2.33 (from standard normal distribution tables).

VaR = $1,000,000 * 2.33 * 0.02 = $46,600

This question allows you to learn how to compute VaR, an essential risk measurement of market risk utilised in risk management.

Credit Risk Models: Expected & Unexpected Loss

Credit risk is a significant part of the FRM course, and knowing the concepts of expected loss (EL) and unexpected loss (UL) is vital. Expected loss is the average loss to be anticipated from the loan or credit exposure, while unexpected loss is the deviation in the potential outcomes.

Example FRM Practice Question:

A bank has a portfolio of $5 million in loans. The probability of default (PD) is 3%, and the loss given default (LGD) is 60%. What is the expected loss?

Solution:

- Expected Loss (EL) = Loan Value * PD * LGD

= $5,000,000 * 0.03 * 0.60

= $90,000

This is a test of your knowledge of credit risk modeling and calculation of the expected loss.

Operational Risk: Scenario Analysis Techniques

Operational risk is defined as the risk of loss caused by insufficient or failed internal processes, systems, or external circumstances. One of the techniques to quantify the probable loss from extreme but credible circumstances is scenario analysis.

Example FRM Practice Question:

You are assessing operational risk for a financial institution. Using scenario analysis, you estimate a potential loss of $1 million in a low-impact event, $5 million in a moderate event, and $10 million in a high-impact event. The probabilities of these events occurring are 40%, 30%, and 30%, respectively. What is the expected operational loss?

Solution:

- Expected Loss (EL) = Σ (Loss Amount * Probability)

= ($1,000,000 * 0.40) + ($5,000,000 * 0.30) + ($10,000,000 * 0.30)

= $400,000 + $1,500,000 + $3,000,000

= $4,900,000

This question makes it clear to you the significance of scenario analysis in assessing operational risk.

Liquidity & Treasury Risk: Liquidity Coverage Ratio

Liquidity risk is the risk of not being in a position to meet short-term financial responsibilities. The Liquidity Coverage Ratio (LCR) is hence an important measurement of liquidity risk in ensuring an institution can meet short-term liabilities using liquid assets.

Example FRM Practice Question:

A bank has the following assets:

- High-quality liquid assets (HQLA) of $500 million

- Net cash outflows over the next 30 days of $400 million

What is the Liquidity Coverage Ratio (LCR)?

Solution:

- LCR Formula:

LCR = HQLA / Net Cash Outflows - LCR = $500,000,000 / $400,000,000 = 1.25 or 125%

This FRM test questions requires your skill in calculating and interpreting the Liquidity Coverage Ratio (LCR), an essential metric of an institution’s liquidity position.

Risk Management Tools: Duration & Convexity Calculations

Duration and convexity are the primary concepts in measuring interest rate risk. Duration is used to calculate the interest rate sensitivity of a bond, while convexity accounts for the curvature of the relationship.

Example FRM Practice Question:

A bond has a duration of 5 years and a convexity of 50. If interest rates increase by 1%, what is the expected percentage change in the bond’s price?

Solution:

- Formula:

Percentage Change in Price = – (Duration * Change in Interest Rates) + (0.5 * Convexity * (Change in Interest Rates)²) - Percentage Change in Price = – (5 * 1%) + (0.5 * 50 * (1%)²)

= -5% + 0.25%

= -4.75%

This question assesses your knowledge of duration and convexity as risk management instruments and in the context of interest rate risk.

Got Questions Regarding FRM Practice Questions?

Click Here for a Free Counselling Session

Exam Strategy: Time-Boxing & Question Triage

Time-boxing is one of the most important strategies to accomplish in performing the FRM exam questions. Managing your time smartly means devoting a certain amount of time to each problem or section in the exam. It is crucial not to get stuck on complicated questions.

Example FRM Practice Question:

If you have 4 hours to complete the FRM exam and 120 questions to answer, how much time should you allocate to each question?

Solution:

- Time per Question = Total Time Available / Number of Questions

= 240 minutes / 120 questions = 2 minutes per question

This approach helps keep you on track and finish all the FRM exam questions.

Detailed Solution Walkthrough Approaches

While reviewing FRM practice questions, it’s not only necessary to be aware of the right answer but also to know why it is correct. Here’s how to go about the solution:

- Identify Key Concepts: Identify the main concept being examined (e.g., market risk, credit risk) and the formula used.

- Break Down the Problem: Structure the given information and go through the solution step by step. Working systematically reduces errors.

- Interpret Results: Analyse the meaning of the solution in the context of the problem.

- Learn from Mistakes: Observe frequent mistakes in your solutions and do not repeat them in subsequent questions.

Carefully reviewing solutions is what ultimately enhances your understanding of the material and helps to increase problem-solving skills at exam time.

Common Pitfalls & How to Avoid Them

- Misinterpreting the Question: Misinterpreting what one is being asked can result in wrong responses.

How to avoid it: Read the question thoroughly, underline important information, and be certain of the goal before solving.

- Making Calculation Errors: Little calculation errors can yield costly points.

How to avoid it: Divide problems into steps, calculate using a calculator, and check calculations twice.

- Poor Time Management: Proper time management can help in avoiding unfinished questions.

How to avoid it: Practice time-boxing, prioritise simple questions initially, and do not get bogged down by hard ones.

- Failing to Use Varied Practice Resources: Dependence on one source may curb exposure to various formats of questions.

How to avoid it: Use multiple resources (GARP, Schweser, Kaplan) for diverse practice.

These strategies will assist you in maintaining concentration and minimising mistakes as you prepare for exams.

Planning to Pursue an FRM Finance Career?

To Book Your Free Counselling Session

Practice Resources: Where to Find More Questions

Using a variety of resources in your practice can help prepare you for the FRM exam questions. Following are some sources where high-quality FRM practice questions can be found:

- GARP (Global Association of Risk Professionals): Provides official practice questions and study materials.

- Schweser: A renowned supplier of FRM study materials and practice exams.

- Wiley: Provides sample questions and exams in various formats for FRM Part I and FRM Part II.

These resources contain questions and solutions to allow you to thoroughly learn the material.

FAQs on FRM Practice Questions

What are the most common FRM Part I quantitative analysis questions?

Common topics include time value of money, probability distributions, regression analysis, and portfolio theory.

How do I approach VaR calculations for market risk problems?

Always apply the appropriate Z-score for the chosen confidence level and note that both standard deviation and the value of the portfolio are used in VaR calculations.

Which credit risk models should I focus on for FRM Part II?

Key models to consider are the CreditMetrics model, the CreditRisk+ model, and the Merton option-pricing model.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

Speak To A Course Expert To Know More