7 Reasons to do an ACCA Course : Why do ACCA?

The Association of Chartered Certified Accountants (ACCA) is a UK-based accounting body that offers a globally recognised accounting qualification. This qualification allows you to work in any country where ACCA has signing authority, or in companies that are based out of the UK and the European Union.

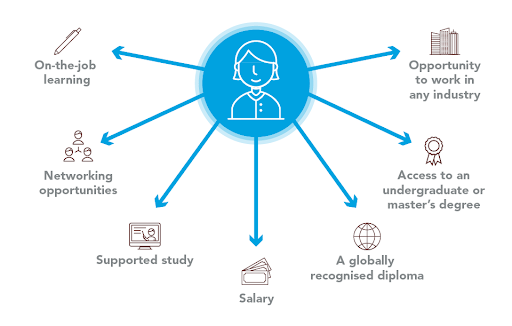

As an ACCA member, you get access to a lot of additional resources, such as an exclusive job portal and networking opportunities with other ACCA professionals, that help you improve your skills and excel in your career. If you are still not convinced and need a bigger push, here are 7 very good reasons why you should consider pursuing ACCA.

7 Reasons to Do an ACCA Course

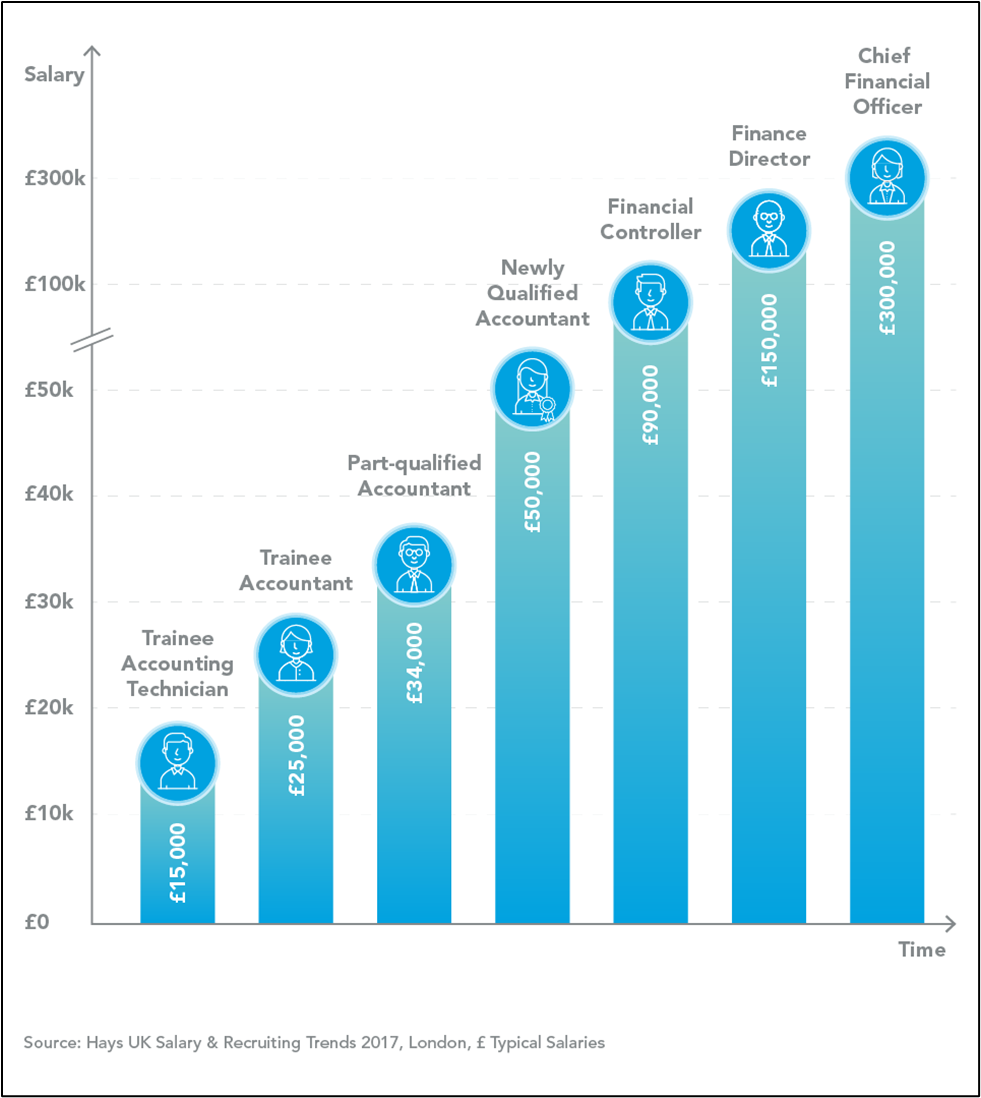

1. You can expect a better Salary Package

The ACCA qualification holds a lot of value in India in the field of accounting and finance. If you are planning to work in accounting firms at the same position as an Indian CA, the ACCA is definitely the right path to take. Such professionals may be able to earn a starting salary of an ACCA is anywhere between INR 6 to 8 lpa, which will only increase as you gain more experience.

Even when you get the opportunity to work outside India, you will be able to claim an impressive salary package which is at par with that country’s industry standards.

Source: ACCA Global

2. Better job Prospects in Various Industries

Over the years, the ACCA body has partnered with employers across the world. ACCA is currently paired with over 8,500 employers that offer more opportunities to ACCA members as well as affiliates.

Such partnerships have largely helped in increasing the career opportunities that are being made available to ACCA members and affiliates. These partnered companies sometimes also offer their own courses for students studying for ACCA exams.

As of now, in India, the Big 4 (KPMG, PwC, EY and Deloitte) as well as other reputed accounting firms such as BDO, Grant Thornton, etc are actively hiring ACCAs in roles such as accounting advisory or in the vertical of statutory audit.

#PopQuizwithZell: ACCA allows you to work in which country?

- United Kingdom

- United Aram Emirates

- Australia and New Zealand

- All of the Above

3. A globally recognised qualification

One of the biggest perks of becoming an ACCA member is that you will be able to explore career opportunities in accounting firms across 180+ countries. These include countries like the UK, Ireland, Singapore, Hong Kong and Australia. Currently, ACCA already has over 200,000 members and 486,000 students working towards getting their membership.

If you are aiming to explore opportunities abroad in the future or would prefer to earn a qualification that is more globally recognised, ACCA is definitely a great choice to make. Even if you don’t necessarily want to work abroad but would like to work in multinational companies operating in India, ACCA will definitely give you an advantage.

4. You can earn your Bachelor’s and Master’s degree in ACCA-accredited Universities

The ACCA body is also affiliated with Oxford Brookes University. Since a student is eligible for ACCA right after completing their 12th grade, there are quite a few ACCA professionals that have chosen not to pursue a Bachelor’s degree.

However, after completing ACCA, you are eligible to get a BSc (Hons) Degree in Applied Accounting. All you need to do is write a research paper and submit it to the university. After getting this Bachelor’s degree, you can also proceed to get a Master’s if you wish to do so.

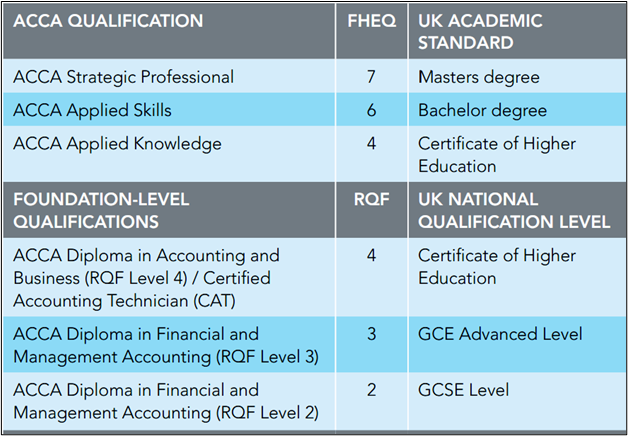

In the European Union, the UK and other ACCA-accredited Universities, ACCA membership is considered equivalent to a Masters’ degree.

5. Network With Multiple Accounting Professionals

After successfully clearing all the exams of ACCA and becoming an official member, you get access to several benefits that are exclusive to ACCA members. Some of them include access to an exclusive job portal on ACCA, the opportunity to attend professional networking events with industry leaders and access to other ACCA professionals in case you are in need of a mentor.

6. Scope after ACCA

There is immense potential for growth after completing a globally recognised course like ACCA. In India, as well as outside of India, ACCA members and affiliates are usually hired at similar job profiles as a Chartered Accountant.

In India, there has been a surge in the number of multinational companies and start-ups in the last decade. Such companies and accounting firms are looking to hire professionals that have internationally recognised qualifications. So needless to say, there won’t be a shortage of job opportunities for you after ACCA.

7. On-the-job training with Continuous Professional Development

As an ACCA member, you are required to keep up with Continued Professional Development (CPD). The ACCA body requires all ACCA members to continuously update their professional skills and remain at par with the current market standards.

As an ACCA member, you are required to keep track of your CPD throughout the year and keep updating your information with the ACCA.

Based on your profession and working schedule, CPD can be done in one of the four routes –

- Unit route: Members working full time and organising their own CPD

- Unit route (part-time or semi-retired): Members that work part-time or are semi-retired

- Approved employer route: Members working for an ACCA Approved Employer – professional development.

- IFAC body route: Members that belong to another IFAC-member body and follow their CPD requirement.

The demand for ACCA in India has grown immensely over the last five or so years. Students are gravitating toward qualifications that will help them expand their horizons and travel the world for professional opportunities. Moreover, since you can start preparing for the ACCA exams right after completing your 12th grade, it is possible to get started with your career in accounting and finance very early in your life.

If you are interested in pursuing ACCA, it is important to get the right guidance before taking any decision. If you’ve made the decision to become a global CA and are contemplating your next move, we can help you take a step forward. Check out our Association of Chartered Certified Accountants (ACCA) course to learn more.

FAQs:

1. Can I pursue ACCA after CA?

Yes, you can. In fact, if you are a qualified CA or are in the final stage of becoming a CA, you may be eligible for up to 9 exemptions.

2. When are the ACCA exams conducted?

The Knowledge Level exams are available on-demand for students throughout the year. The Skill and Professional level exams can be taken 4 times a year.

3. How long does it take to complete ACCA?

If you are attempting all papers without claiming any exemption, the ACCA course should take you approximately 2 to 2.5 years to complete.