The present era is hugely driven by investment strategies. People worldwide are gradually starting to see investments as an alternate source of income that can add to their wealth and give them a sense of financial security during turbulent times. This is when people need the guidance of a Financial Advisor.Even large organisations need Financial Advisors for better management of their finances. They help companies consider ways to make the business profitable by providing projections on their finances. They also help companies avoid costly mistakes by analysing their business expenditures and guiding them correctly.

How To Become a Qualified Financial Advisor?

The need for investing across most sections of society is expanding. Financial Advisors can guide us with the right kind of investment depending on our needs, capacity, and risk appetite

They suggest suitable investment instruments, the right stocks and the frequency of investing depending upon our unique requirements. But, you must have some basic qualifications to be a Financial Advisor.

Here’s a guide to becoming a qualified Financial Advisor:

- Obtain a Bachelor’s degree: A Bachelor’s degree is the minimum requirement to become a Financial Advisor. People with an academic background in Commerce, Mathematics, Accounting or Economics have an added advantage.

- Take up a CFA course: After pursuing a Bachelor’s degree, you will have to take up a credible CFA course, that is, the Chartered Financial Analyst course. A CFA course is often considered at par with a Master’s in Business Administration.

- Apply for Internships: Ensure you gather enough experience from reputed enterprises before applying for jobs. Internships will give you exposure and hands-on experience while helping you better understand the profession’s responsibilities.

Qualified Financial Advisor Roles and Responsibilities

It is essential to understand that the scope of a Financial Advisor varies with the kind of clients and seniority of the individual in the management hierarchy. The following are the roles of a Financial Advisor:

- Financial Advisors are the key personnel involved in the formulation of investment strategies and portfolio management of clients.

- Creating or interpreting customers’ investment performance reports, income estimates, and summaries of financial documents.

- Interacting with customers to gather data on their spending habits, earnings, long-term and short-term financial goals, income tax, risk tolerance, and other factors necessary to create a financial plan.

- Evaluating client accounts from time to time to determine whether situational problems, financial performance, or economic events call for changes in the client’s plan.

- Financial Advisors are integral to Financial Planning and Analysis teams across all major MNCs and Conglomerates. They are responsible for financial analysis alongside budgeting and forecasting.

Qualified Financial Advisor Salary

With the increasing need for streamlined financial management, the demand for highly skilled Financial Advisors has also increased. Everyone needs to plan their finances well, from corporate enterprises to high net-worth individuals, so any contingency, big or small, is not an impediment.

More and more people are putting their money in the financial market due to increasing awareness about wealth management and sustainable investments. The trend has become more prominent with the COVID-19 crisis redefining how people manage their wealth. These changes indicate that the scope of Financial Advisors is widening.

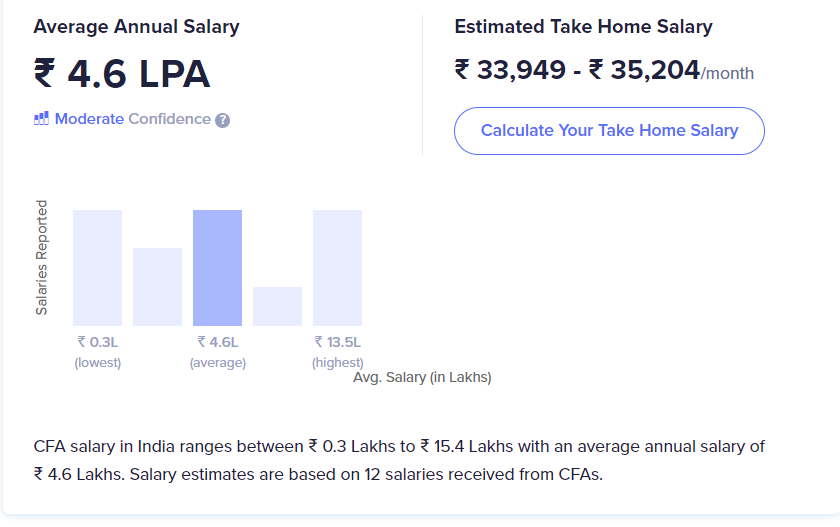

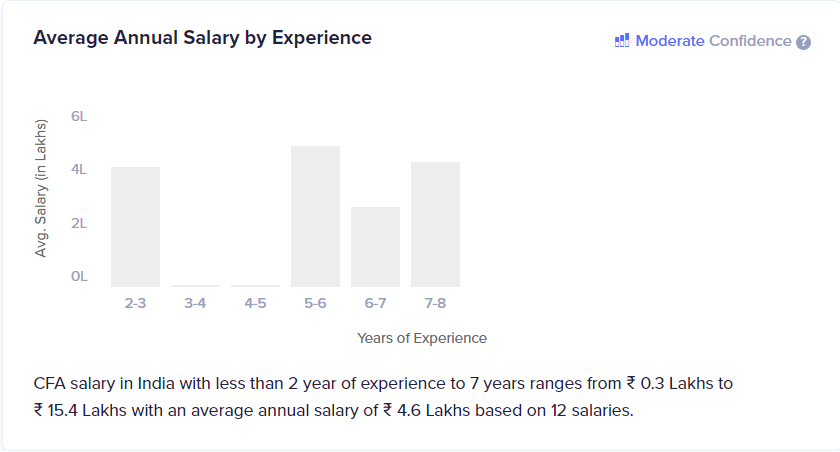

A qualified Financial Advisor’s salary in India upon completing a CFA course is around 4.6 LPA. However, the pay package can go up to 15.4 LPA depending upon experience and skill set.

Emerging Trends in Financial Advisory

The financial advisory sector is evolving rapidly with the influence of technology and changing client expectations. Here are some emerging trends shaping the future of this profession:

- Digital Advisory Services: Robo-advisors are automating the investment process, but human Financial Advisors are still crucial for offering personalized advice, especially for complex financial needs.

- Sustainable and ESG Investing: Clients are becoming more conscious of ethical investing. Financial Advisors are increasingly required to guide clients toward portfolios that align with environmental, social, and governance (ESG) criteria.

- Holistic Financial Planning: The role of Financial Advisors is expanding beyond just investment advice. Modern advisors offer complete financial planning, including retirement, tax, estate, and insurance planning.

- Behavioral Finance Integration: Understanding client psychology and decision-making behaviors is becoming a key part of advisory services to help clients make better financial choices.

- Cybersecurity Focus: With the rise in digital finance, Financial Advisors are also expected to help clients understand data protection and cybersecurity best practices.

Average Salary with Experience

Global Salary Comparisons & Industry Insights

The demand for Financial Advisors is growing worldwide, and salaries vary significantly based on region, experience, and qualifications like CFA:

- United States: The average salary for Financial Advisors is around USD 95,000 annually. Experienced advisors working with high-net-worth clients can earn well over USD 150,000.

- United Kingdom: Financial Advisors earn an average of GBP 60,000 annually, with top earners making above GBP 100,000.

- Australia: Average salaries for Financial Advisors range from AUD 85,000 to AUD 120,000 per year.

- India: As mentioned earlier, the starting salary is around INR 4.6 LPA, with experienced professionals earning up to INR 15.4 LPA.

Industry Insights: The global financial advisory market is projected to grow significantly, driven by increased wealth creation, an aging population needing retirement planning, and the rise of digital finance. Earning a CFA designation provides a strong competitive advantage in this growing market.

Importance of Financial Advisors

It is usual for people who do not know about the intricacies of investing to wonder whether they need to consult specialists.

From a practical point of view, it is wise to consult a Financial Advisor to chart your financial goals and make correct decisions. The money market is where people make irreversible losses and gain huge profits; therefore, protecting your hard-earned money is paramount.

Individuals and big MNCs are in dire need of qualified and skilled Financial Advisors. They help forecast profits and losses and plan budgets for big firms with their analytical skills

Here are a few reasons why consulting a Financial Advisor is necessary:

- They help you understand how to pave the path towards financial freedom and create wealth with consistency and discipline so that you never have to worry about money.

- They help you with practical advice, the philosophy that should drive your financial journey, and accountability for significant expenses like buying a house or saving enough for your life post-retirement.

- Even if you hire a Financial Advisor, gaining knowledge on every investment you make is a step towards financial freedom. They offer systematic goal-based planning that helps you understand the “why” behind your investments so that you not only amass wealth but also have systems to realise the profits.

What People Are Also Searching Around the Topics

- Best courses to become a Financial Advisor

- Financial Advisor vs Wealth Manager

- Is CFA mandatory for Financial Advisor careers?

- How to get high-paying Financial Advisor jobs

- Financial Advisor job growth projections

- Importance of financial planning for individuals

- What is a robo-advisor?

- Salary difference between CFA and CFP holders

Curious About Qualified Financial Advisor Salary and Job Roles?

Conclusion

Financial Advisors can seek employment in the insurance sector, wealth management enterprises, investment banking firms, financial consultancies, and the banking sefictor.

A CFA course will take you a step closer to becoming a qualified Financial Advisor. It is one of the most sought-after certifications accepted globally, and a CFA course can open multiple career opportunities for you.

Zell offers a comprehensive Chartered Financial Analyst (CFA) course to individuals aspiring to become Financial Advisors. Over 10000 students have benefited from Zell, thanks to our eminent faculty. Enrol now if you are looking for a CFA course to help you achieve your dream of becoming a Financial Advisor!

FAQs on Qualified Financial Advisor Salary and Job Roles

What is the minimum salary of a Financial Advisor?

In India, the average salary for qualified Financial Advisors is Rs. 4.6 LPA.

What should be the qualification of a Financial Advisor?

A Financial Advisor must have a Bachelor’s degree in Accounting, Mathematics, Economics, or Commerce. They can take a CFA course after pursuing their Bachelor’s degree to be a Financial Advisor.

What is the highest salary for a Financial Advisor?

In India, a qualified Financial Advisor with a CFA can make a maximum of 15.4 LPA.

How much do financial advisors earn?

The earning potential of a Financial Advisor varies depending on qualifications, experience, and location. In India, Financial Advisors typically start with a salary of INR 4.6 LPA, which can rise to INR 15.4 LPA with experience and certifications like the CFA. Globally, salaries are higher, especially in the US and UK, where skilled advisors can earn upwards of USD 95,000 and GBP 60,000 annually, respectively.