US Certified Management Accounting(CMA) is gaining more and more popularity not only in India but also around the world. There are many reasons why most students today are choosing US CMA over other accounting courses. One of the main reasons is the duration of the course. You can finish this accounting in about 6 to 9 months based on your learning pace. It comes with two levels comprising 6 papers each. While the passing rate of this course is quite cutting-edge with 34% in part 1 and 46% in part 2, the opportunities offered to those who make it to the end are worth the whole learning journey.

If you are curious about what US CMAs and what they do on a day to day basis, what are their growth opportunities, career pathways and future scope, then you are at the right place. For we are about to unfold the world of US CMA professionals to you. Get ready for an actual sneak peek.

What is a CMA Certification?

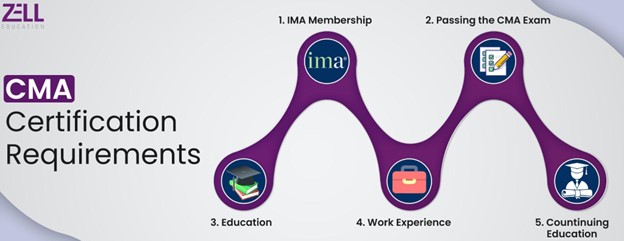

A Certified Management Accountant (CMA) certification is a globally recognised professional credential offered by the Institute of Management Accountants (IMA), USA. This certification validates expertise in financial planning, analysis, control, decision support, and professional ethics — making CMAs vital assets in strategic roles within organizations. Unlike traditional accounting certifications, CMA focuses more on management accounting and business decision-making, equipping professionals with the skills needed to lead finance teams and contribute to strategic business growth. The US CMA certification consists of two exam parts, which can typically be completed within 6–9 months, making it an efficient yet high-impact qualification for aspiring finance professionals.

Making the Most of Your CMA Certification

To get the best out of your CMA certification, you need to align your career goals with the wide variety of roles that the qualification opens up. Here’s how you can maximise its value:

- Leverage Your Global Credential: Since CMA is recognised in over 140 countries, target international roles of MNCs operating in your region.

- Build Cross-Functional Expertise: Pair your CMA with knowledge in finance technology, analytics, or business operations to position yourself for senior roles.

- Keep Networking: Engage with IMA events, LinkedIn groups, and CMA alumni networks to discover new job opportunities and mentorship.

- Upskill Continuously: The finance world evolves rapidly. Keep your knowledge current with short-term certifications in data analytics, budgeting tools, or ESG reporting.

What Does a CMA Do?

CMAs go far beyond bookkeeping or simple number crunching. They are strategic finance professionals who bridge the gap between raw financial data and executive decision-making. Here are the core functions they handle:

- Budgeting & Forecasting: Creating annual, quarterly, and monthly budgets, and aligning financial goals with business strategy.

- Financial Analysis: Monitoring financial performance, preparing variance reports, and suggesting cost-saving measures.

- Strategic Planning: Using financial data to support business growth strategies, risk management, and operational efficiency.

- Internal Auditing: Ensuring internal controls are in place and recommending improvements.

- Advisory Roles: Supporting CFOs and other senior leaders with insights for major business decisions.

From cost accountants to financial controllers and even CFOs, CMAs play a critical role in shaping the financial future of a company.

Skills of a US CMA

A Certified Management Accountant’s skill set isn’t just limited to calculating numbers, maintaining reports and presenting financial data to management. They are strategic thinkers and efficient planners who not only provide accurate data to the company they work for but also come up with strategic solutions to finance and accounting related concerns.

Basic skills needed for becoming a US CMA professional

- Basic knowledge of accounting, accounting principles(GAAP) and taxation rules

- Hands-on practice of various financial tools and understanding of economics

- Can handle financial and human capital management

- Needs to analyse financial statements and prepare a risk management plan

- Posses a range of essential soft skills like verbal and written communication, persuasion and other interpersonal skills.

Professional skills that a US CMA professional possesses

- Making investment-based decisions for the company

- Creating monthly, quarterly and annual budgets

- Tracking financial performance and managing it

- Creating financial reports and presenting the data

- Analysing total profits made by the firm

- Generating ways to maximise profits

Job Responsibilities of a US CMA

Job opportunities for a US CMA professional largely depend on the CMA job opportunities and what they choose after the successful completion of the course. Here are some of the job profiles and the responsibilities for each of them defined in the table.

| Job Profiles | Roles And Responsibility |

| Finance Controller | A Financial Controller is responsible for looking after the books, coming up with financial strategies, conducting internal analysis as well as important administrative tasks. |

| Budget Analyst | Budget Managers manage the overall budget of an organisation. They track the cash flows and approve spending requests sent by the employees based on the proof provided by them. They also review the budget and set future targets based on the past data and future projections. |

| Internal Auditor | An Internal Auditor is a professional who is responsible for evaluating the company’s business operations and financial activities. Through an internal audit, the company is able to determine whether the internal controls are adequate and the employees are working in line with their requirements. |

| Forensic Auditor | They are responsible for investigating the financial transactions of individuals and organisations. These professionals are often hired by the government or for legal cases to find out data on fraud or embezzlement. |

| Cost Accountant | They are required to look after the company’s expenditures and purchases to keep track of the accounting data. A Cost Accountant should have a strong understanding of business strategies and should be able to accurately organise accounting data to come up with observations and suggestions. |

Average Salary as per US CMA job opportunities

If you’ve already chosen the profile you think you could fit into and wish to pursue US CMA post your graduation, your next thought must be the salary of a US CMA. Just like the scope, the salary of a US CMA also depends on the job profiles that candidates choose to work into. Here’s a profile-wise distribution of the US CMA salaries.

| Job Profiles | Salaries |

| Accountant | 8 to 13 lpa |

| Management Accounting Analyst | 9 to 13 lpa |

| Financial Consultant | 6 to 10 lpa |

| Reporting Analyst | 5 to 8 lpa |

| Financial Advisor | 10 to 20 lpa |

Read more about US CMA salaries in India and Canada

US CMA is a short course that adds a lot of value to your accounting CV. If this is the career path you wish to choose, we assure you that US CMA job opportunities will never disappoint you no matter where you are in your career. We hope this article helped you achieve some gainful insights into the US CMA career and the opportunities that lie ahead.

Certified Management Accountant (CMA) is a credential awarded by the Institute for Management Accountants, USA. This global certification is open to all students who have completed their 10+2 or the high school equivalent. If you are interested in pursuing a career in accounting, check out our Certified Management Accountant (CMA) course.

Curious About CMA Career Paths?

Conclusion

The US CMA qualification is one of the most versatile and career-boosting credentials in finance today. Whether you’re a fresh graduate looking to fast-track your career or a working professional aiming to pivot into strategic roles, the CMA certification equips you with the skills, recognition, and global opportunities needed to excel. With a relatively short completion timeline and high ROI in terms of job roles and salary potential, a CMA designation is a powerful step forward in your accounting and finance career. If you’re ready to make your mark in the finance world, Zell Education’s US CMA course can help you get there.

FAQs on CMA Career Paths

What are my career opportunities after US CMA?

Job opportunities after US CMA include Cost Manager, Finance Manager, Financial Analyst, Cost Accountant, Financial Controller, Financial Risk Manager, and career progression to important roles like Chief Financial Officer.

Where are the US CMA exams generally held?

The exams are held in 8 Prometric centres across India. The exams are closely proctored, with candidates not being allowed to carry any items not necessary for the exam to the center. The exams are held in Mumbai, Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, New Delhi and Trivandrum.

How can a non-graduate get a CMA certification?

Once the candidate clears both US CMA exams, they get a period of 7 years (beginning from the date of the 2nd exam cleared) to produce the necessary graduation proof & 2 years of work experience. If the candidate fails to produce these documents in the 7-year spell, the exam credit lapses and they would have to reappear for both the exams.