Guide to Become a US CMA in 2024

Stepping ahead is one of the most significant decisions you have to make in life. It requires a lot of thought about your preferences, prospects for the future, employment opportunities available currently, the future of the respective field you are planning to get into, among many other aspects. It becomes even more difficult to single out one specific path with vast choices available. Considering a particular field of accounting or management, there are many roads that you can take to make your way into the industry. One of which is the Certified Management Accountant (CMA). Do you want to know the job of a CMA and the process to become one? Don’t worry; we are here to clarify all your doubts and provide you with a roadmap to follow for becoming a CMA.

What is CMA?

The Certified Management Accountant (CMA) designation, awarded by the Institute of Management Accountants (IMA), is a highly sought-after professional credential obtained by successfully passing the examination and meeting the necessary requirements. CMAs are in high demand within companies due to their expertise in Financial Accounting and Strategic Management. Their meticulously prepared reports significantly enhance the company’s financial statements, offering valuable insights to top management on various aspects such as Human Resource Management and Budgeting. While the specific responsibilities of CMAs vary across industries, they commonly handle tasks such as internal audits, budget creation, and ledger management. If you’re considering enrolling in a chartered accountant course in India, it is advisable to compare the distinctions between CA and CMA to determine which career option aligns better with your aspirations.

How to Become a CMA?

Like other certifications in the finance and accounting field, CMA has a complex and gruelling procedure. We encourage you to go through the pointers carefully and keep these in mind for future reference.

Here’s what you need before you apply to become a CMA (US):

- You should be a member of the Institute of Management Accountant (IMA)

- You should have completed a Bachelor’s degree from a recognized university or should have professional accounting certification.

Applying for the IMA Membership

The next step is to apply for the IMA membership. You can choose from different types of memberships available, namely IMA Professional, IMA Student, IMA Academic.

- The IMA professional Membership is for current professionals in finance or accounting.

- The fee for the first year is USD 245 and USD 230 annually afterwards.

- If you are currently a college student, you must apply for an IMA student membership.

- Students can get the membership for USD 39 annually.

- IMA Academic Membership is for full-time faculty members of the institution.

- The fee for the first year is USD 135 in the first year and USD 120 annually thereafter.

The Clock Starts Ticking Now!

You have to enrol in the CMA programme once you get the membership of the IMA. The programme gives you access to the CMA exam support package. You must take the examination within 12 months once you enrol in the programme.

What you need to Study for the Examination:

To Become a CMA Examination consists of two parts- Part 1 and Part 2.

The examinations are 4-hour long, consisting of 100 MCQs and 2 essay questions. Aspirants are granted 3 hours to complete the MCQ questions and 1 hour to complete the Essay type questions. The examinations contain the MCQ and Essay questions in the proportion of 3:1.

Part 1

- External financial reporting decisions

- Planning, budgeting, and forecasting

- Performance management

- Cost management

- Internal controls

- Technology and analytics

Part 2

- Financial statement analysis

- Corporate finance

- Decision analysis

- Risk management

- Investment decisions

- Professional ethics

Cost to you Bear to Become a CMA (US)

The cost of the CMA Examination is different for students and professionals. If you are a student, you have to pay USD 39 as the IMA Membership fee, USD 622 as the exam fee for both papers, and USD 188 as the Certification Entrance fee. On the other hand, if you are a professional, you need to pay USD 245, USD 830, and USD 188 as IMA Membership fees, exam fees, and Certification Entrance fees respectively.

No paper is difficult if you prepare well

The CMA exams are pretty lengthy and challenging in nature. You should start with your preparation by taking ample time in hand. Also, each section should be given equal focus and importance. It is necessary to practice timed mock tests to improve your efficiency and test your skills. It would be even better if you prepared in a group. This way, you can easily clear your doubts and plan strategies. Also, discussing with fellow aspirants boosts morale and makes the entire process easier.

Gain the Relevant Work Experience

After passing the exam, you have to meet the final requirement specified by the IMA for getting the CMA certificate. You also need to have 2 years of work experience in areas such as management accounting and financial management.

CMA (US) Exam Dates

The CMA examination is conducted by the IMA. It provides 3 testing windows in a year.

Testing Window 1 is between January and February. Testing Window 2 goes on from May to June while Testing Window 3 is active between September and October.

Salary of a CMA

The average salary of a CMA in India is about INR 7 lpa. Although it depends upon many factors such as job location, work experience, company, to name a few, the salary varies from INR 2.9 lpa to INR 40.2 lpa.

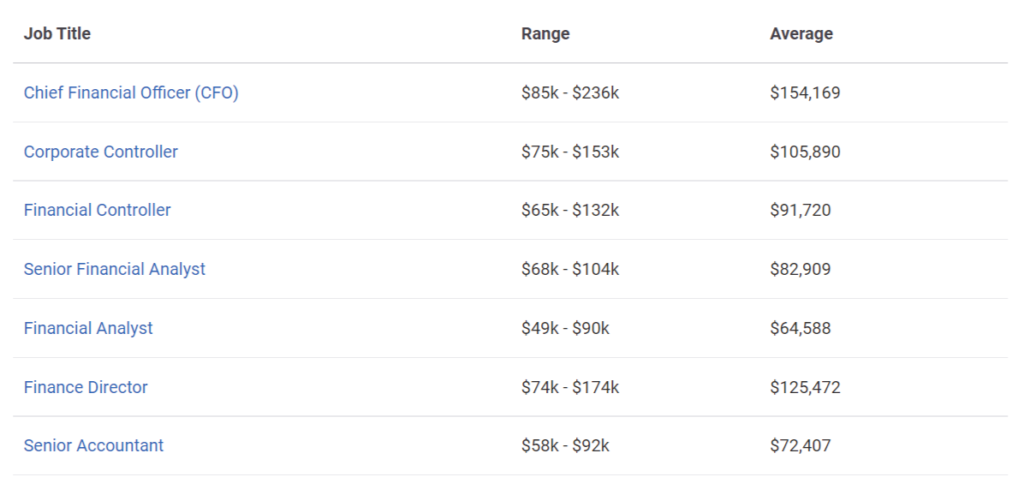

Certified Management Accountant (CMA) Jobs by Salary

CMA Salaries in India

CMA Salaries in US

CMA is a career that provides you with many opportunities available and vast exposure in the finance industry. Coming years would bring a spurt in the job openings for CMAs in different companies across various industries. The demand for CMAs is projected to grow by 4% between 2019 and 2029. The job as a CMA is rewarding in terms of professional growth and monetary compensation. You should see whether your goals for the future align with what the profession has to offer before going forward with the CMA examination.

Here, we explained the process of becoming a CMA in simple and easy steps, which would save you the hassle of collecting the bits and pieces of information from different sources. We hope that this information helps you chart out your plan and wish you the best for the future. If you wish to pursue CMA, you can check out our Certified Management Accountant course and take your first step towards a successful career in finance.

FAQs

How many attempts can you take for the CMA exam?

There is no limit on the number of times you can take the exam. But several companies take into consideration the candidate’s attempts and shortlist candidates who have cleared the exam on the first attempt.

What is the pass percentage of the CMA exam?

The pass percentage of the CMA examination is 45% for both Part 1 and Part 2 examinations.

Can the exams be taken in any order?

You can take the two parts of the CMA exam in any order according to your convenience.