Are you an accounting enthusiast considering which career path will yield the best results? Well, you are not alone, as most aspirants have difficulty figuring out what will be best for a secure future full of exciting opportunities.

ACCA and ACA are two of the most talked about accounting courses with global acceptance. Both of them come with a host of advantages, similarities, and dissimilarities that you should consider before you make a choice.

If you are looking for answers to ACCA vs ACA salary, ACCA vs ACA difficulty, and other aspects of the two courses, then you are at the right place. Read on to learn more.

What is ACCA?

Eligibility

Listed below are the eligibility criteria for the ACCA course:

- ACCA aspirants must complete their 10th grade examinations.

- Aspirants must secure a minimum of 65% in mathematics, accountancy, and English and at least 50% in other subjects.

- Aspirants who do not fulfil the conditions mentioned above can opt for the ACCA course via the Foundation in Accountancy (FIA) route.

If you want to take up ACCA, don’t forget to check out our blog on the best ACCA books you must read for reference.

Why Pursue ACCA?

There are several benefits of pursuing an ACCA course. Some of the advantages you will be exposed to are listed below:

- The ACCA qualification is recognised in as many as 180+ countries, making you employable in almost any part of the world. No matter where you go, you will never have a dearth of job opportunities.

- The exams are conducted in quarterly sessions, and certain exams are also conducted on demand. This gives you the freedom to complete all the levels of exams at your own pace.

- ACCA-qualified professionals are in demand globally because of their ability to advance their organisations via strategic thinking, technical proficiency, and professional values.

- You gain a thorough understanding of accounting and financial topics through ACCA. Additionally, an ACCA course will help you stay current on all new tax law developments and accounting industry standards and regulations.

Check out our blog “7 Reasons to do an ACCA Course: Why do ACCA?” if you want detailed insights into why you should do an ACCA certification.

Course Duration

The ACCA qualification typically takes 3 to 4 years to complete, depending on your prior education and the pace at which you choose to take the exams. Since ACCA allows you to sit for up to four exams per session and provides quarterly exam windows, the flexibility enables candidates to finish faster if they’re consistent.

Fees

The total cost for ACCA can range from INR 2.5 to 3.5 lakhs, depending on the registration fees, annual subscription, and exam fees. Additional expenses may include tuition and learning materials. Scholarships and exemptions can reduce the overall cost for eligible candidates.

Exam Pattern and Difficulty

The ACCA exam structure is divided into three levels:

- Applied Knowledge (3 exams)

- Applied Skills (6 exams)

- Strategic Professional (4 exams – 2 Essentials and 2 Options)

The difficulty level is moderate but requires strong dedication and strategic planning. The flexible exam pattern with quarterly windows and on-demand exams makes it manageable for working professionals.

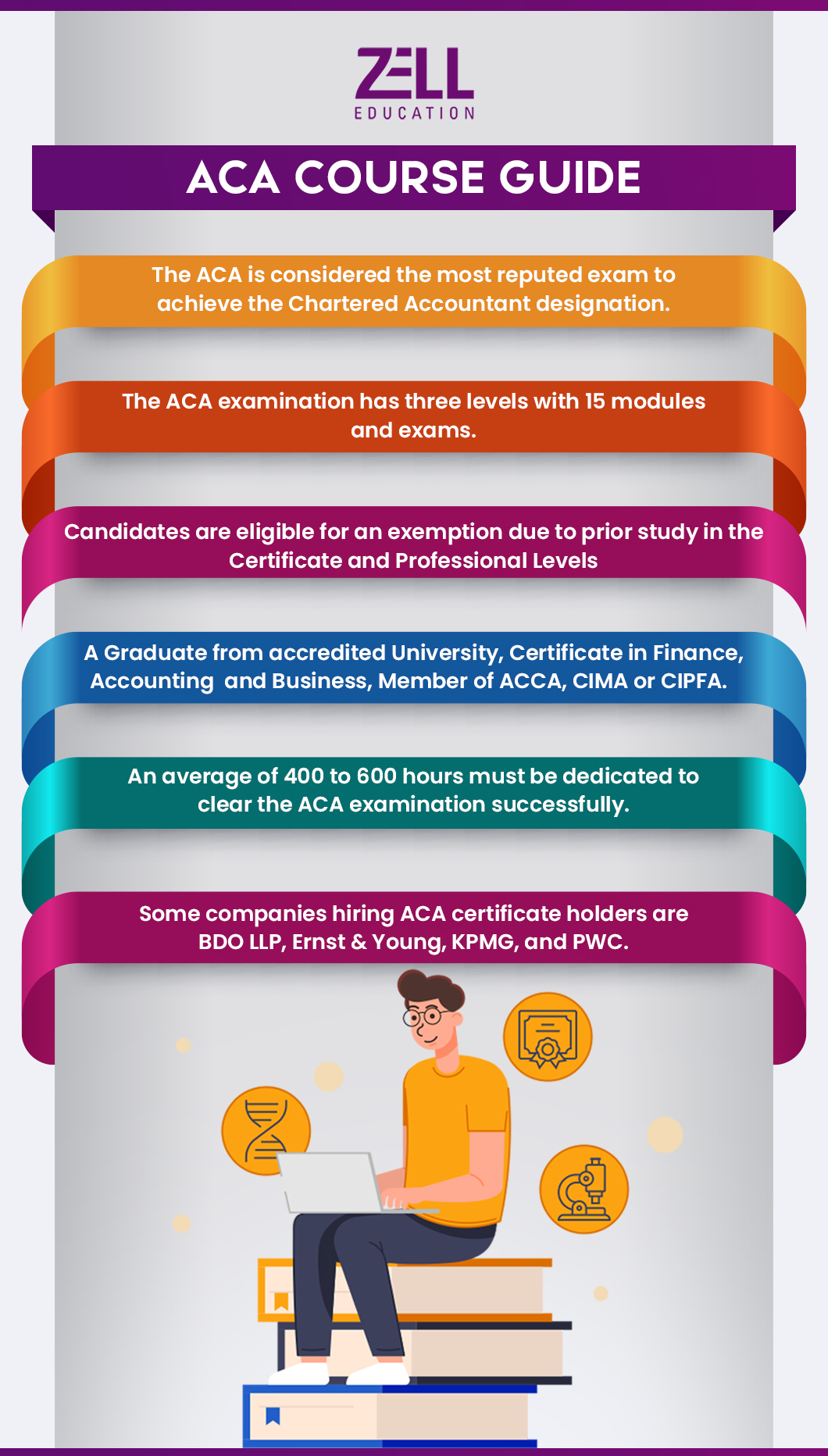

What is ACA?

Eligibility

Here are the eligibility criteria for taking the ACA course:

- Candidates must have an accredited college or university degree in the UK or Ireland, as well as GCSEs, A levels, and Scottish Qualification Certificates.

- For overseas students, entry can also be based on professional accounting degrees

Why Pursue ACA?

- Whether the market is booming or in a slump, having the ACA certificate will guarantee that you are qualified to manage various financial operations within any business.

- The ICAEW offers adequate post-qualification support, a one-of-a-kind gesture. This allows students to improve themselves continually and stay at the top of their professions.

- Graduates from a finance background as school graduates can obtain the ACA qualification.

- Most professional courses fail to provide you with a technical understanding and a practical approach. But an ACA qualification gives both.

Course Duration

The ACA qualification takes around 3 years to complete, provided candidates fulfil both exam and practical work experience requirements concurrently. The duration can vary depending on whether the candidate is studying full-time or part-time.

Fees

ACA fees can be higher than ACCA. For international candidates, the total ACA cost including tuition, learning materials, registration, and exam fees may go beyond INR 4.5 to 6 lakhs. However, many candidates pursue ACA via employer-sponsored training contracts.

Exam Pattern and Difficulty

The ACA exam path includes:

- Certificate Level (6 exams)

- Professional Level (6 exams)

- Advanced Level (3 exams)

In addition to exams, candidates must complete 450 days of practical work experience. The exam pattern is rigorous, with integrated case studies and application-based questions that test real-world knowledge, making ACA more intense for some.

ACCA vs ACA: Key Differences

Is ACA better than ACCA? Or is ACCA the better choice? These questions come to every finance aspirant’s mind all the time.

The table below summarises the key differences between ACCA and ACA:

| Point of comparison | ACCA | ACA |

| Organising body | ACCA is conducted by the Association of Chartered Certified Accountants Institute, United Kingdom. | ACA is conducted by the Institute of Charted Accountants of England and Wales. It is the acronym for Associated Chartered Accountant. |

| Levels | The ACCA has three levels of exams:

Applied Knowledge Applied Skills Essentials exam and Options exams The Applied Knowledge paper comprises three exams, and the Applied Skills paper has six. There are two Essentials exams and four Options exams. |

The ACA includes three levels:

Certificate Professional Advanced The Certificate and Professional levels each have six exams, while the Advanced level has three exams in total. |

| Duration | The duration of this course is 3-4 years. | The course duration is 3 years. |

| Syllabus | Key areas covered by the ACCA syllabus are:

Taxation Financial Reporting Financial Management Accounting and Auditing Ethical and Professional Standards |

Some of the main areas covered in the ACA syllabus are:

Financial Accounting & Reporting Corporate Reporting Business & Finance Management Information Business Planning Audit and Assurance Accounting Business Strategy |

| Job roles | Some of the job roles that ACCA qualified candidates get offered are:

Financial Accountant Financial Controller Auditor Tax Consultant |

Some typical job roles after ACA qualification are:

Forensic Accountant Business Analyst Internal Auditor Finance Manager |

Read more about Career options after ACCA.

Got Questions Regarding ACCA vs ACA?

Click Here for a Free Counselling Session

Global Recognition vs Local Strengths

ACCA boasts global recognition in over 180 countries, making it ideal for aspirants aiming for international careers. ACA, while primarily focused on the UK and Commonwealth regions, carries significant prestige and is highly regarded in corporate and auditing roles within these areas.

Exam Structure and Flexibility

ACCA is known for its flexible structure—you can schedule exams quarterly or on-demand, and even study part-time. In contrast, ACA has a fixed structure and timeline, often tied to employer training contracts, which makes it more rigid but also more structured.

Salary Potential

Both qualifications can lead to high-paying roles, but ACA graduates may command higher starting salaries in the UK due to the qualification’s prestige and employer partnerships. ACCA professionals, on the other hand, enjoy wider salary ranges globally depending on geography and industry.

Practical Experience

ACCA requires a 36-month Practical Experience Requirement (PER) which can be fulfilled before, during, or after passing exams. ACA, however, mandates 450 working days under an approved employer contract, making it more demanding in terms of structured work experience.

Pros and Cons Summary

| Feature | ACCA | ACA |

| Flexibility | High | Moderate |

| Global Reach | Extensive | Regional (UK-focused) |

| Employer Support | Optional | Often mandatory |

| Practical Experience | Flexible | Structured and fixed |

| Cost | Affordable | Higher |

When to Pursue ACCA or ACA?

Choose ACCA if you’re looking for global opportunities, flexible learning, and a scalable qualification at your own pace.

Opt for ACA if you’re targeting a career in the UK or a structured firm-backed training programme, and you thrive under a more traditional and intense professional development framework.

Planning to Pursue ACCA Accounting Career?

To Book Your Free Counselling Session

Wrapping up

Both ACCA and ACA expose aspirants to rewarding career opportunities. However, it might be overwhelming to choose one over the other. Questions like “ACCA vs ACA salary” or “ACCA vs ACA difficulty” are common and essential to address before making a decision.

With Zell Education, you can take a step closer to realising your dreams of becoming a certified ACCA. Through individualised study programmes, interactive online classes, and faculty coaching, Zell attempts to enable comprehensive skill development. The curriculum stands out due to its 80% pass rate, one-on-one mentorship, and 100% placement help.

FAQs on ACCA vs ACA

What’s the difference between ACCA and ACA?

ACA offers in-depth knowledge in financial management, tax compliance, and accounting and reporting. On the other hand, ACCA helps candidates gain expertise in global accounting, auditing, and taxation, among others.

Can I do both ACCA and ACA?

Yes. Since there are several entry points to both these courses, you can pursue both these qualifications.

Is ACA tougher than CA?

It is difficult to draw comparisons on which one is tougher. However, an ACA qualification can be completed in three years, whereas people take several years to complete CA.

Is ACA the hardest?

The ACA exam is undoubtedly challenging. It is one of India’s top 10 most difficult exams.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

10-Year Zell Discount: Secure Your Offer Now!