CFA is accepted in 165+ countries and can land you a job across top finance firms. This course is considered the gold standard of finance for all the right reasons. The role of a Chartered Financial Analyst is gaining more popularity than ever before.

While this popularity has led us to some lesser-known facts we weren’t aware of earlier, there are still some facts that are yet to be discovered. If you are planning to embark on a journey towards becoming a Chartered Financial Analyst, these interesting facts are sure to leave you feeling astounded. Wondering what they are? Here’s a list you shouldn’t miss.

Read on to find out the six interesting facts you didn’t know about the Chartered Financial Analyst qualification.

1. The CFA Exam is no Cake-Walk

The CFA exam is one of the most challenging exams in the world. However, the key to clearing this particular exam is a lot of practice and conceptual clarity. You may have heard some rumours regarding the Chartered Financial Analyst course being a comparatively easier course because the level 1 exams are easier. But the truth is, CFA exams are difficult to crack right from the start.

These exams test your understanding of each concept and your ability to apply these concepts and solve real-world problems through them.

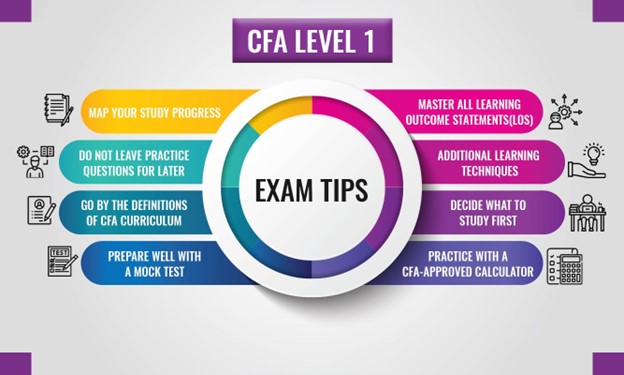

2. Developing a Study Plan Will Take you a Long Way

While practice is important when it comes to the CFA examination, making sure that your practice is going in the right direction is also equally important. Create a study plan which includes attending coaching lectures, practicing through the end of the chapter questions, and taking breaks in between to freshen up your mind.

3. The CFA Exams are Now Fully Computerized

Gone are the days of writing your exam on paper for hours together. The CFA exams are now fully computerized. The importance of being extremely familiar with your calculator cannot be understated.

Now, it is extremely essential to be familiar with the exam environment and hence it is always advisable to practice on similar systems. To get hands-on experience of working on these systems, you can get enrolled with training institutes Zell Education that extensively coach you for the exam environment and not just the curriculum.

4. You Need to Keep your Calculators Handy

The Chartered Financial Analyst course does include some mathematical subjects. However, the good news is that most of these concepts just require basic math with an understanding of statistics and algebra. So before appearing for your CFA exams, you must keep your calculator handy beforehand. And to avoid last-moment mishaps ensure that you carry extra calculator batteries with you, in case the power runs out just when you need it.

5. The CFA institute’s Learning Material is Quite Dry

Most students who have already enrolled for the Chartered Financial Analyst course will agree that the study material provided by the institute can be quite boring. That’s why you need a coaching institute like Zell Education that offers its own learning material curated by industry experts that understand the real-world challenges and have solutions to them. Moreover, Zell also delivers its lectures through case studies and relevant examples. This makes it easier for you to prepare for your CFA exams and ace all three levels.

6. You can Complete CFA in Just 18 Months

We know it’s a little hard to believe, but it’s true. The average duration of a Chartered Financial Analyst course ranges from two to three years. But you have the option of speeding up your learning and examination process to achieve the degree much earlier.

Contrary to belief, the CFA course can be completed in 18 months. The institute requires you to keep a minimum of 6 months between each exam. If you are someone who has time on your hands to practice thoroughly, you can complete the course within 18 months!

Planning to Pursue CFA Accounting Career?

To Book Your Free Counselling Session

CFA Level 1 Exam Dates 2025

| Exam Period | Exam Dates |

| May 15-21, 2024 | February 6, 2024 |

| August 20-26, 2024 | May 14, 2024 |

| November 13-19, 2024 | August 7, 2024 |

| February 17-23, 2025 | November 7, 2024 |

CFA Level 2 Exam Dates 2025

| Exam Period | Exam Dates |

| May 22-26, 2024 | February 6, 2024 |

| August 27-31, 2024 | May 14, 2024 |

| November 20-24, 2024 | August 7, 2024 |

CFA Level 3 Exam Dates 2025

| Exam Period | Exam Dates |

| February 15-18, 2024 | November 8, 2023 |

| August 16-19, 2024 | May 14, 2024 |

| February 13-16, 2025 | November 7, 2024 |

Got Questions Regarding CFA Exam Dates?

Click Here for a Free Counselling Session

CFA Exam Checklist

| What you’ll need | What not to carry |

| Approved CFA calculator and keystroke card | No writing tools or scratch paper allowed |

| Your confirmation number | Mobile phones or other devices |

| Pre-approved medication or items such as ear plugs or rubber gloves | Watches, clocks or timers |

| Valid international travel passport | Jewellery, hats, or ornaments |

The Chartered Financial Analyst course is the most well-recognized financial course in the world and is often considered to be the gateway into investment banking and other finance domains.

This course is globally accepted in well over 165+ countries and can land you a job across all top finance companies. CFA is often considered the gold standard of finance and covers absolutely everything you need to know to create a career in finance.

We know that becoming a Chartered Financial Analyst requires a lot of hard work and dedication, but if you’ve made your choice, we assure you, you’re going places with this highly prestigious degree on your resume. So keep these facts in mind as you make your final decision. If you have recently completed your graduation or are appearing for your final semester, you may be eligible to become a CFA. To know more about the Chartered Financial Analyst course click on the WhatsApp icon at the side of this blog and get in touch with our experts directly.

Latest CFA Exam Trends and Updates

As the finance world rapidly evolves, the CFA Institute continues to adapt its curriculum and exam structure to match industry demands. If you’re preparing for the CFA exam in 2025, here are the latest trends and updates you should know:

- Fully Computer-Based Testing (CBT): All three levels of the CFA exam are now computer-based, allowing more flexibility with exam scheduling and a smoother exam-day experience. This change also allows the CFA Institute to hold multiple testing windows each year, making it easier for candidates to plan their exam journey.

- Shorter Exam Duration: The exam now spans approximately 4.5 hours with optional breaks, rather than the older 6-hour structure. This has been done to reduce candidate fatigue and improve focus.

- Updated Curriculum Focus: Recent updates to the CFA curriculum include deeper emphasis on data science, AI in finance, ESG investing, and Python basics — ensuring candidates are equipped with knowledge that’s relevant to today’s financial landscape.

- More Testing Windows per Year: With four annual windows for Level 1 and two each for Levels 2 and 3, candidates have more flexibility than ever. This opens up the possibility to fast-track completion, provided they meet the minimum six-month gap between exams.

- Pass Rate Stabilization: After a sharp drop in pass rates during the pandemic years, recent pass rates have begun to stabilize. This may be due to improved preparation resources, awareness about the exam’s difficulty, and more strategic study approaches by candidates.

Staying up to date with these changes is crucial for planning a successful CFA journey, so make sure to visit the CFA Institute’s official site or speak with expert coaching institutes like Zell Education for the latest prep strategies.

Conclusion

Becoming a Chartered Financial Analyst is not just about clearing exams — it’s about transforming the way you think and solve problems in the financial world. With its global acceptance, relevance across finance domains, and a curriculum that adapts to real-time industry trends, the CFA course truly lives up to its title as the gold standard in finance.

Yes, the journey is rigorous — but with the right preparation strategy, consistent effort, and guidance from experienced mentors, it’s absolutely achievable. Whether you’re fresh out of college or a working professional aiming for a career leap, the CFA charter can open doors to high-impact roles in investment banking, portfolio management, equity research, and beyond.

So if you’ve got the drive and the dedication, take the plunge — and remember, you’re not just preparing for an exam, you’re preparing for a world-class career.

FAQs on Things You Need to Know Before Your CFA Exam

How do I start preparing for CFA?

Since CFA is a tough course to clear, you’ll need a coaching institute like Zell Education that will help you with the preparation for your CFA exams. Once you’ve enrolled for the right coaching program, practice and persistence are key to passing the exams.

Is the CFA course worth pursuing?

CFA is one of the toughest accounting courses to crack, but it is also an in-demand profession with high earning potential.

Why is the CFA programme so hard?

CFA requires time commitment, patience and hard work which can often get difficult for those who want to fast-track their career.

Which level of CFA is the toughest?

As per several CFA charter holders, Level 3 of the CFA exam is considered to be the toughest.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

Speak To A Course Expert To Know More