US CPA Course Duration: After 12th, Graduation & CA

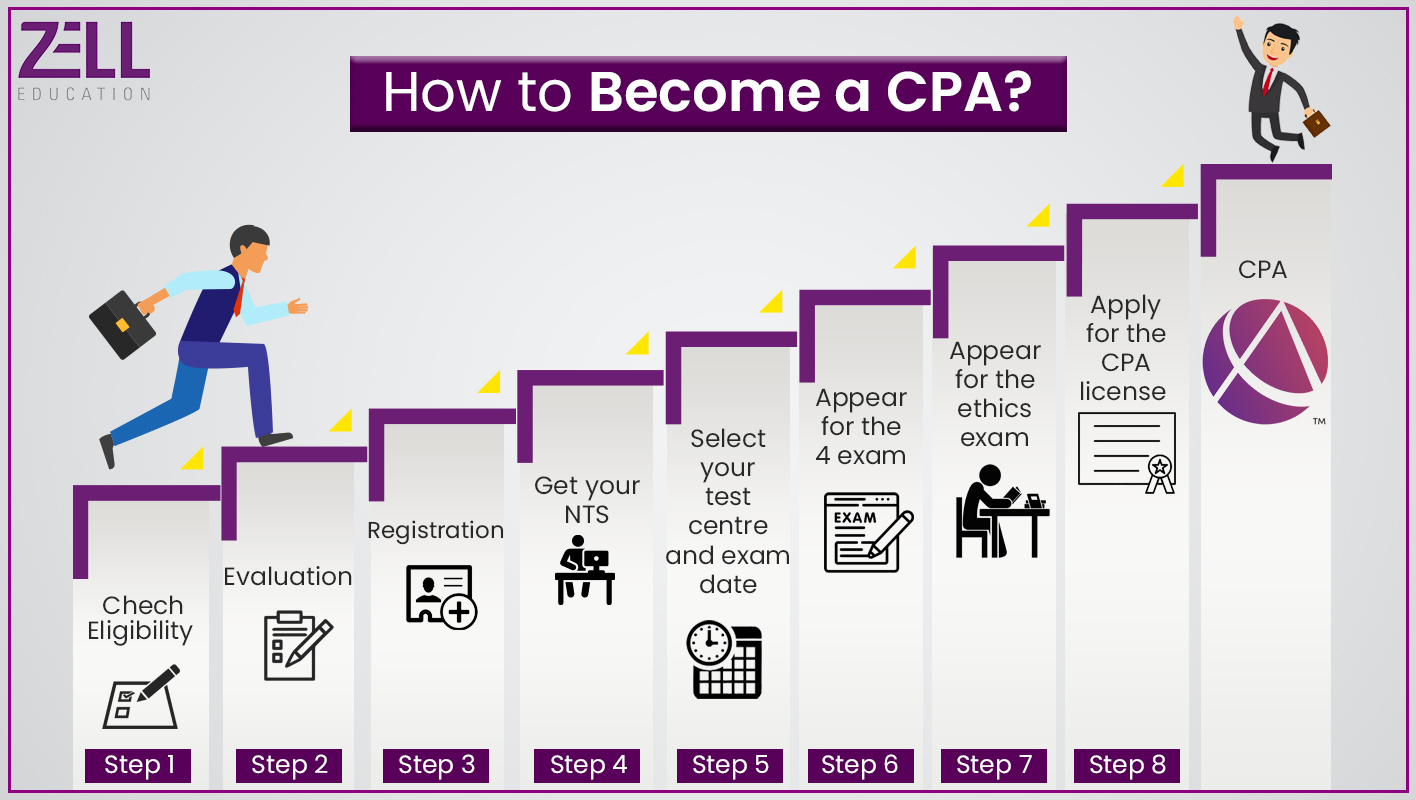

Most of us who know about US CPA know that this course makes you the CA of the US. The Certified Public Accounting course is a well-known course offered by the American Institute of Certified Public Accountants (AICPA). Those who want to wish to practice Chartered Accountancy in the US, often prefer choosing this course post-graduation. Compared to Indian Chartered Accountancy, the US CPA is a shorter course with just four papers that can be completed within 1.5 to 2 years. However, for completing the Indian CA, you need a set learning period of 5 to 6 years which includes your articleship training of at least 3 years. The US CPA course is a globally recognized course that on completion, gives you the chance to work in the US jurisdictions like Hawaii, Guam, Puerto Rico, the Virgin Islands, and the Northern Mariana Islands.

The US CPA duration, as mentioned earlier, takes a maximum of 1.5 to 2 years until completion. But you must remember that this duration does not include the mandatory work experience. To clarify all your doubts regarding the exact duration of the CFA course, exemptions and the best time to pursue this course here’s a detailed article to guide you through.

The US CPA Course Duration

The US CPA course is a US-based course for which you can choose to give your examinations in India or the US. Until 2020, the US CPA exams could be taken only four times a year. But in July 2020, NASBA announced that the exams can be given all year round. This further reduces the US CPA course duration and makes learning more convenient and flexible.

Here’s a Breakdown of the US CPA Course duration.

| Breakdown | Time duration |

| Average course period | 2 years |

| Mandatory work experience | 2,000 hours |

US CPA Course After 12th, Graduation or CA

Most students who are planning to pursue US CPA often wonder when is the best time to take up this course. The minimum eligibility for US CPA is a graduation degree or 120 college credit hours. While there are no exemptions for US CPA, you can choose any commerce or accounting course and post your 12th grade and then complement it with a US CPA degree. Those who have already completed their Chartered Accountancy course or are working as Chartered Accountants in India but wish to work in the US can also choose to pursue US CPA. Since the salary of a US CPA professional is way higher than that of a CA, most accounting students prefer taking the combination of CA + US CPA. This not only ensures the accounting professional gains a vast amount of knowledge on different accounting concepts, principles and practices but also opens up a wide range of opportunities in India and the US.

If you are planning to pursue the US CPA certification after graduation, here are some of the benefits that you should look out for.

- A wide range of global opportunities await you on completion of your US CPA

- You could get a chance to work in some of the best US-based MNCs in India

- If you plan to work in the US, you can choose to work in cities like Hawaii, Guam, Puerto Rico, the Virgin Islands, and the Northern Mariana Islands.

- As mentioned above, your earning potential drastically increases after pursuing the US CPA course. Whether you choose to work in a US-based MNC in India or in the States, be assured of a high salary package

US CPA vs US CMA

If you’re stuck between US-based professional accounting courses, you should certainly consider the two most prestigious ones, and by that, we mean US CPA and US CMA. However, to finally understand your calling, you need to know these courses in a better way. Here’s a quick differentiation of the two accounting courses based on some important factors. Take a look, weigh your options, and choose the right course that suits you best.

We hope that with this detailed overview of the US CPA course duration and eligibility, your decisions are further simplified. To know more about this course, we suggest you check out our Certified Public Accountant (CPA) course. You could also simply get in touch with us by clicking on the WhatsApp or calling icon on the left-hand side of this article.

FAQ

How much time does it take to prepare for US CPA?

A student should dedicate a total of 400 hours to prepare for their US CPA examinations. This means about 100 hours of undisturbed study time for each of the 4 sections.

How much does US CPA cost?

The candidate applying for US CPA needs to pay 250 USD for exam application and 225 USD to NASBA for Evaluation.

Can I pursue US CPA without CA?

Yes, you can pursue US CPA without CA. The minimum eligibility for US CPA is a bachelor’s degree from an accredited university.