After finishing your class 12 exams, you will have a very small window of time to decide what career path to take next. If you are planning to work in the field of business management or accounting and finance, there are several courses that you can choose from.

For students who are planning to work outside of India or would like to have that option open when the opportunity arrives, you should consider globally recognised courses such as ACCA, CMA, or CIMA. If you are confused between the three courses and would like to see some important factors that separate them, then here’s a quick look at what each course offers.

1. Certified Management Accountant (US CMA)

The Certified Management Accountant course is conducted by the Institute of Management Accountants (IMA). If you are interested in business management and accounting, pursuing US CMA might be a step in the right direction for you. In addition to accounting firms, a US CMA will also find opportunities in consumer-based businesses and brands like Coca-Cola, Colgate, and Mastercard.

Moreover, with the US CMA qualification, you will be able to work in India as well as in countries such as the US, Canada, Australia and New Zealand

Eligibility

Students can enrol for US CMA right after their class 12.

Source – US CMA Eligibility

Course Structure:

The US CMA course consists of two parts –

- US CMA Part 1 – Financial Planning, Performance, and Analytics

- US CMA Part 2 – Strategic Financial Management

Scope of US CMA

After the US CMA, you will be eligible to work as a Management Accountant in some of the most prestigious accounting firms in India as well as in North America and Australia. Companies like the Big 4 (KPMG, EY, PwC, and Deloitte), Grant Thornton, J. P. Morgan, Blackstone and BDO.

Career Opportunities

If you are a finance or accounting professional, pursuing CMA would be a productive move. CMA would help you to become a financial leader in your career. Pursuing a CMA course will help you to get crucial management skills that will help you to stand out from others. CMA-qualified professionals are extremely sought after by the Big Four’s like Deloitte, EY, PWC and KPMG.

Planning to Pursue US CMA Accounting Career?

To Book Your Free Counselling Session

Why Pursue US CMA?

CMA USA, or Certified Management Accountant, is an elite designation for finance professionals. It establishes expertise in financial planning, analysis, control, and decision support. CMA USA is the best certification for those looking for leadership roles, and being a globally recognised designation that adds considerable value to your career prospects and earning potential, CMA USA is an exceptional certification for a successful career in corporate finance.

2. Association of Chartered Certified Accountants (ACCA)

The ACCA full form is the Association of Chartered Certified Accountants, a UK-based accounting body that conducts the ACCA exam. ACCA, which is also known as the Global CA, is a professional accounting course that trains candidates in subjects similar to a Chartered Accountant and provides them with the skills and foundation required.

Since the ACCA course is globally recognised, students often prefer this to other local courses. In addition to India, you can work in over 180 other countries, including the UK, Singapore, New Zealand and Australia.

Eligibility

10 + 2 Examination with 65% aggregate in Maths/Accounts and English and a minimum of 50% in other subjects.

Source – ACCA Eligibility

Course Structure

The ACCA course consists of 13 papers that are split into three different levels.

- Knowledge Level (3 papers)

- Skill Level (6 papers)

- Professional Level (4 papers)

Scope of ACCA

The ACCA certification is one of the most recognised qualifications in the field of accounting and finance in India as well as in countries in the European Union. After completing ACCA, you may be hired in similar positions as a Chartered Accountant in companies like KPMG, Deloitte, PwC, and EY.

Career Opportunities

Achieving the ACCA qualification opens up career pathways all around the globe. There are opportunities in all sectors, including public practice and corporate finance, working in roles such as auditor, tax consultant, financial analyst and management accountant. Many ACCA-qualified professionals also go on to be in senior positions such as Chief Financial Officer (CFO).

Why Pursue ACCA?

ACCA is a globally recognised degree that helps you to get the required exposure. ACCA helps you to get a secured job or position at any multinational company. Pursuing ACCA would help you find your place in any sector or any industry. Pursuing ACCA helps you understand technical skill sets, strategic thinking, professional values, and other competencies that are required for a competitive edge in the market.

Planning to Pursue ACCA Accounting Career?

To Book Your Free Counselling Session

3. Chartered Institute of Management Accountants (CIMA)

If the field of management accounting appeals to you and your priority is to be able to work in countries outside of India, then CIMA could be the right choice for you. CIMA is a globally recognised qualification in the field of management accounting. It is accepted in around 180 countries and has MRAs with several accounting bodies across the world, including CMA Canada and CPA Australia.

Eligibility

To be eligible for US CMA, you need to have a bachelor’s degree from any accredited college or university. You need to also have work experience of two years in financial management and accounting management. You must pass both parts of the US CMA exam within three years. The exam parts are Financial Planning & Analysis and Financial Decision Making.

Course Structure

The CIMA course consists of four levels that are split into a total of 16 exams (13 papers and 3 case studies).

- Certificate in Business Accounting

- Professional Operational

- Professional Management

- Professional Strategic

Scope of CIMA

As a result of the MRAs, a qualified CIMA can become a member of CPA Australia or CMA Canada without having to give additional exams for the same. In addition to leading accounting firms in the world, CIMA professionals may also get hired by consumer-based companies or large brands such as Toyota, Amazon, Apple, and Google.

Career Opportunities

By becoming a CIMA-qualified professional, you can become eligible for positions like Management Accountant, Business Analyst, Management Consultant, Forensic Accountant, Financial Controller, and Project Manager. Several high-level accounting jobs open their doors to CIMA-qualified professionals.

Why Pursue CIMA?

The main reason why you should pursue CIMA is that it gives you enough career opportunities. Pursuing CIMA also helps you in networking and you can get to know several influential people in the financial industry. CIMA helps in building skill sets, business acumen, and financial leadership.

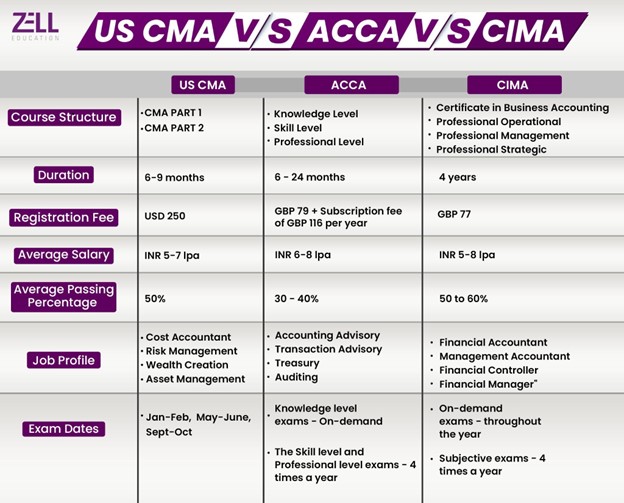

Key Difference Between US CMA vs ACCA vs CIMA

For Management Accounting, Is CIMA better than CMA USA?

If a career in Management Accounting sounds appealing to you, then you may want to consider US CMA and CIMA. Which course you choose largely depends on where you plan to work in the future.

If your current plan is to start working in India and also explore job opportunities in North America and Australia, the IMA’s Certified Management Accounting course might be the right one for you. CMA is also a great starting course when you want to figure out your interests right after class 12th. Since it can be completed in under a year, US CMA has become quite popular among students in the recent past.

On the other hand, if your primary goal is to work abroad in large companies like Toyota or Apple as a Management Accountant, then it is definitely worth it to consider CIMA. CIMA will offer more opportunities for growth outside of India and is much more recognised in a lot of different countries. With enough experience and skill, you may even get promoted to be the CFO of a company.

To work in the UK, what serves better – Accounting or Management Accounting?

For those who plan to work in the UK or other countries in the European Union, the two career paths that you could take are ACCA or CIMA. You might be wondering, is US CMA recognised in the UK? No, it isn’t as widely recognised as ACCA or CIMA. Your decision should be on the basis of your interest in the respective fields. If you would prefer to work as a management accountant and want to learn about business strategies involved in accounting, then CIMA might be the right one for you.

But if you want to specialise in Accounting and be on the same level of qualification as a Chartered Accountant, then you should definitely go for ACCA. Not only will you get the opportunity to work abroad, but you will also get a similar salary package as a CA or Chartered public accountant.

Conclusion

An accounting and finance career can be quite rewarding if you proceed with the right guidance. If you would like to know more about courses in accounting and finance, you can reach out to us, or you can check out the courses offered at Zell Education on the website.

FAQs on US CMA vs ACCA vs CIMA

Which qualification is better: US CMA, ACCA, or CIMA?

There isn’t a single “best” one. The right choice depends on your career goals, as US CMA focuses on corporate finance, ACCA on a broad range of accounting, and CIMA on strategic management.

How do the salaries of US CMA, ACCA, and CIMA professionals compare?

Salary depends on your experience and location. Generally, all three qualifications lead to high-paying jobs, with US CMA holders often earning higher salaries in North America and ACCA in the UK.

Are the job opportunities different for US CMAs, ACCA, and CIMA professionals?

Yes. US CMA opens doors in corporate finance and management accounting. ACCA leads to roles in public practice like auditing and taxation. CIMA is best for business management and strategic leadership roles.

How long does it take to complete the US CMA, ACCA, or CIMA?

The duration varies. US CMA is the fastest, typically taking 6-12 months. ACCA and CIMA are more extensive, usually taking 2-3 years to complete all exams and requirements.

Which of these is the most difficult to clear: US CMA, ACCA, or CIMA?

Difficulty is subjective, but US CMA has only two exams, while ACCA and CIMA have multiple papers, which can make them seem more challenging and time-consuming.

Do these certifications have global recognition?

Yes, all three are globally recognised, but their regional strengths differ. US CMA is strongest in the US, ACCA in the UK and Commonwealth countries, and CIMA is globally respected for management accounting.

Is there a possibility of getting an exemption after completing one of these qualifications?

Yes. If you complete one certification, like ACCA or CIMA, you may be eligible for significant US CMA exam exemptions, and vice versa, depending on the professional body’s agreements.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

10-Year Zell Discount: Secure Your Offer Now!