You must have heard from several acquaintances about the best-paying jobs in finance that are super exciting. And in every story, you must have also heard about the international opportunities that each of them offers after working for some years in India. This must have piqued your interest in knowing some of the job opportunities that offer the best of both – the highest paying finance jobs and international opportunities. If that’s the thought that made you stumble upon this article as well, then let us break it up to you, you don’t need to look any further because we’re about to bring you a list of the highest paying jobs in finance and the skills you would require to get into them. However, one thing you must remember before you begin your search for the top professions in finance is that the coaching institute you choose really matters. A coaching institute not only imparts in-depth professional knowledge but also helps you build industry-relevant skills.

Want to know all about the highest paying jobs in finance? Here’s an industry-wise bifurcation of the top jobs and their pay scale.

Want to know all about the highest paying jobs in finance? Here’s an industry-wise bifurcation of the top jobs and their pay scale.

Highest Paying Jobs in Finance

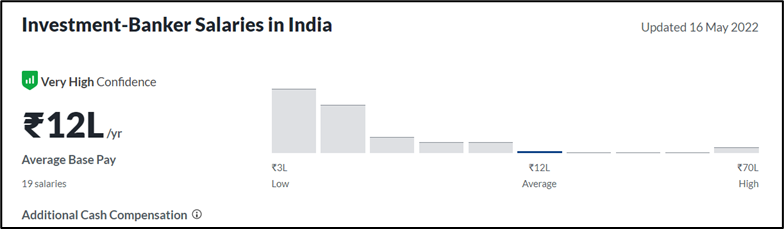

1. Investment Banker

As the name suggests, an Investment Banker is an investment professional who works at accounting firms to raise capital for businesses and individuals. This highest-paying job in finance enables professionals to work towards increasing the savings of their clients by investing in capital markets by issuing debt or selling equity in the companies. They implement short-term and long-term financial goals for their clients and help them achieve them through different investment plans. You can become an Investment Banker by pursuing a Chartered Financial Analyst course after your graduation.

Courses to apply for: Chartered Financial Analyst, MBA in Investment Banking, Financial Modeling Certification.

Skills required to become an Investment Banker

- Strong communication skills

- Networking skills

- Researching qualities

- Deal structuring and closing principles

- Quantitative skills

2. Portfolio Manager

Anyone with knowledge of the finance market and a knack for investments can apply for this profession. A Portfolio Manager is responsible for managing their client’s investments in stocks, SIPs, policies and other investments. Portfolio management is one of the best-paying jobs in finance. You can apply for this position to complete your Chartered Financial Analyst Course. This three-year course equips you with all the concepts of financial management and investment. Portfolio Managers make an exorbitant income through commission and annual management fees.

Courses to apply for: Chartered Financial Analyst, MBA in Portfolio Management, MBA in Finance

Skills required to become a Portfolio Manager:

- Ability to work independently

- Great analytical skills

- Communication skills

- Research skills

- Using new-age computer programs

- Being updated with the industrial knowledge, stocks and revenue

- Buy and hold fixed-income securities

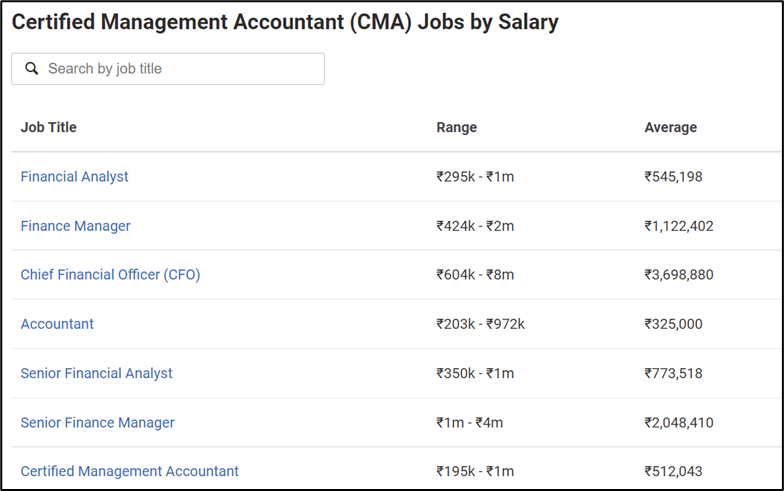

3. Certified Management Accounting

When we talk about the highest paying finance jobs, nothing can outrank US Certified Management Accounting. Compared to all the other accounting courses, Indian and global, US CMA offers a better scope and salary. US CMA enables you to not only earn a handsome salary in India but also in other countries. Every company today requires Management Accountants for the analytical and problem-solving skills they possess. You can choose several professions after completing your CMA degree, like Financial Manager, Financial Analyst, Financial Controller, Cost Accountant or CFO, no matter which job profile you choose, you’ll be welcomed with a good salary package in a US-based MNC.

Courses to apply for: US Certified Management Accounting

Skills required to become a Management Accountant

- Strategic planning

- Performance tracking

- Reporting and control

- Technology and analytical skills

- Understanding of business operations

- Decision-making and problem-solving skills

- Leadership skills

- Professional ethics and values

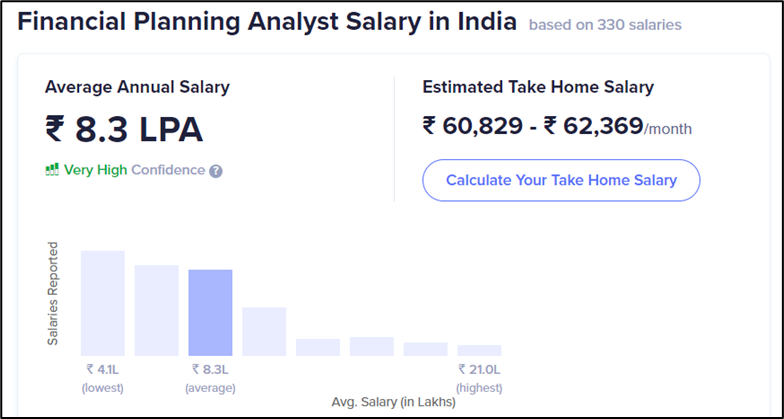

4. Financial Planner & Analyst

In this profession, the Analyst is responsible for preparing the company’s profit and loss statement. You will also be required to give certain projections in order to grow the net sales more effectively and speedily. A Financial Planning and Analysis expert has to ensure that the cost of the products sold is in line with the marketing expenses. They also need to make sure that the revenue and profits made by the company are moving as per the target.

Courses to apply for: Certified Financial Planner, US Certified Management Accounting

Skills required to become a Financial Planner & Analyst

- Strategic thinking

- Data recording and sorting skills

- Presentation skills

- Technologically savvy

- Decision-making skills

- Attention to detail

- Verbal and written fluency

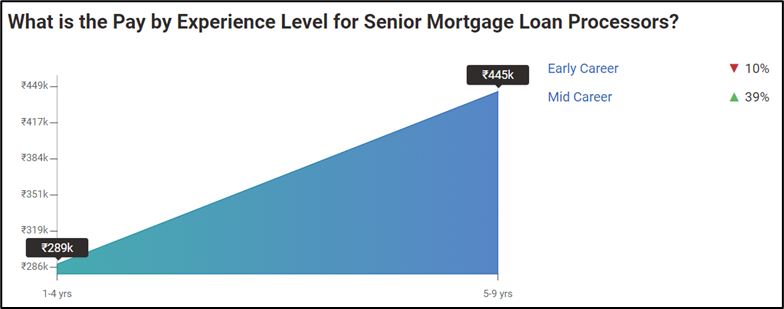

5. Senior Loan Processor:

A senior loan processor as the name suggests is responsible for making an account of client loan transactions and gathers all the information about the assets the client possesses. They also record their income and total debts to make an informed decision on whether the client is eligible for the loan or not. They ensure the accuracy and authenticity of the documents submitted.

Courses to apply for: MBA in Finance, Bachelor’s in Banking and Finance

Skills required to become a Senior Loan Processor

- Research skills

- Excellent communication skills

- Analytical skills

- Client servicing

- Leadership management

Read our blog on Difference between CFA and MBA in Finance

Here was a glimpse into some of the highest-paying jobs in finance. If you are interested in any of these professions you should check the minimum eligibility criteria required to apply for the relevant courses and start with a learning journey right away. In case, the field of investment interests you, the CFA course would be a great option for you. The Chartered Financial Analyst is a globally recognised qualification in the field of finance and investment. If you have recently completed your graduation or are appearing for your final semester, you may be eligible to become a CFA. Interested? We highly recommend checking out our Chartered Financial Analyst (CFA) course.

However, if you want to get into Management Accounting, Certified Management Accountant (CMA) is what you should be applying for. CMA is a credential awarded by the Institute for Management Accountants, USA. This global certification is open to all students who have completed their 10+2 or the high school equivalent. If you are interested in pursuing a career in accounting, check out our Certified Management Accountant (CMA) course.

Curious About Highest Paying Jobs in Finance

What Are the Steps to Start a Finance Career?

A successful career in finance requires a combination of academic credentials, hands-on experience and continuous skill-building. The path may differ based on interests and industry focus but the foundational steps are largely consistent.

STEP 1: Earn a Bachelor’s or Master’s Degree

A degree in finance, accounting, economics, business administration or mathematics builds a strong theoretical base.

- Common undergraduate options: B.Com, BBA, BA Economics or B.Sc. Finance

- Postgraduate degrees such as an MBA in Finance or M.Com can provide additional depth and better roles.

Most finance employers view a degree as a minimum qualification for core roles.

STEP 2: Pursue Internships Alongside Academics

Internships provide practical exposure and help clarify your preferred finance domain.

- Apply during or after your second year of undergraduate studies

- Choose internships in banking, insurance, asset management or accounting firms

- Focus on learning tools like Excel, financial modeling and analytics

Real-world experience through internships builds confidence and boosts employability.

STEP 3: Invest in Certifications & Skill Development

Certifications help differentiate you in a competitive job market.

- Popular certifications include:

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Certified Management Accountant (CMA)

- Learn essential tools: Excel, Python, Power BI, Tableau and Bloomberg Terminal

Developing analytical thinking, attention to detail and technical proficiency strengthens your finance profile.

STEP 4: Start Networking

Professional connections open doors to internships, interviews and mentorship.

- Attend finance webinars, conferences and student chapters of financial associations

- Build a strong LinkedIn profile and connect with alumni and professionals

- Join relevant online forums, finance clubs and groups to exchange knowledge

Networking is often the bridge between opportunity and access.

STEP 5: Enter Through Entry-Level Jobs

Begin with roles that provide exposure to core finance concepts and client interaction.

- Common entry-level roles include:

- Financial Analyst

- Audit Associate

- Tax Associate

- Risk Analyst

- Treasury Analyst

- Operations Executive

- Apply through campus placements, company portals and recruitment drives

These roles build the foundation to advance into specialised finance careers.

Industries Hiring Finance Professionals

Finance careers are not limited to banks. Many industries seek finance professionals for planning, analysis, compliance and investment roles.

- Consulting – Strategy, valuation and financial transformation

- Banking & Finance – Retail, investment and commercial banking services

- Insurance – Risk evaluation, claims analysis and actuarial functions

- Healthcare – Financial planning, insurance management and compliance

- Public Sector – Budgeting, auditing and financial policy roles in government institutions

- Fintech – Product finance, data analysis and payments strategy

- Edtech – Financial planning, pricing strategy and investor relations

Each sector presents unique challenges and learning opportunities.

Future Scope of Finance Jobs in 2025

The finance industry is expected to undergo major transformations driven by technology, sustainability and changing regulations.

- Automation will streamline routine tasks, increasing demand for analytical and strategic skills

- ESG and sustainable finance will gain momentum globally

- Cryptocurrencies and decentralised finance will create new roles

- Demand for risk management, compliance and data-centric roles will increase

Adapting to these trends will be essential for future-ready finance professionals.

Unconventional Careers in Finance

Beyond traditional roles, new-age finance careers are emerging for those willing to explore niche areas.

STEP 6: Grow Within Your Niche

Once you gain experience, specialisation allows deeper learning and faster growth.

Crypto/Blockchain Finance Roles

- Involve roles such as crypto analysts, token economists, blockchain auditors and digital asset advisors

- Growing demand in exchanges, DeFi platforms and blockchain startups

ESG/Sustainability Finance

- Combines finance with environmental and social responsibility

- Roles include ESG analyst, impact investment associate and green finance consultant

Financial Content Creators

- Professionals who simplify financial concepts via blogs, videos or newsletters

- Collaborate with fintech brands or build independent income streams

Finfluencers

- Use social media to share finance advice and product reviews

- Income sources include partnerships, affiliate marketing and platform monetisation

These roles often combine finance expertise with communication skills and personal branding.

Salaries in the Finance Industry

Salaries vary by qualification, role and location but finance offers strong earning potential.

- Entry-Level (0–2 years):

₹4–7 LPA in India; $55,000–$75,000 in the US - Mid-Level (3–7 years):

₹10–20 LPA; $80,000–$120,000 - Senior-Level (8+ years):

₹25 LPA and above; $150,000+ depending on role and specialisation

Bonus and incentive structures are common, especially in investment banking, equity research and private equity.

Planning to Pursue Accounting and Finance Career?

To Book Your Free Counselling Session

FAQs on Highest Paying Jobs in Finance

What are some of the most common skills required for a finance job?

Professionals in the field of finance and accounting are expected to have analytical, mathematical and accounting skills with some business intelligence.

What are the soft skills required to ace a finance job?

The soft skills required to ace your finance job are top communication skills, problem-solving skills, financial reporting, hands-on knowledge of digital tools and the will to innovate.

Which investment related job offers the highest salary?

Portfolio Managers and Hedge Fund Managers draw the highest salaries in the field of investment. While a Portfolio Manager makes an average of 7 to 8 lpa, a Hedge Fund Manager also makes around the same exclusive of the incentives.