While looking for finance and accounting courses you must have often come across two most popular courses that may have caught your eye – CIMA for accounting and CFA for finance. When you read up about these courses, you must have felt that they have some similarities. For example they both are globally accepted and can be pursued along with graduation. They both have a 3 year duration and offer exciting opportunities. However, both of these courses are actually quite different from each other. While one focuses more on the accounting management side the other is an intensive finance course that trains a candidate on financial markets and investments.

While the future prospects of CIMA and CFA are incredibly bright, if you have to make the right choice, you need to consider the difficulty, duration, future scope and eligibility of each course.

Understanding CFA

The Chartered Financial Analyst (CFA) credential is one of the most respected and recognized investment management designations in the world. Administered by the CFA Institute, the CFA program focuses on strengthening investment analysis, portfolio management, and ethical standards.

CFA Topics:

The CFA syllabus is broadly divided into three levels, each focusing on different skill sets:

- Level I: Focuses on the foundations of finance, accounting, and ethical and professional standards.

- Level II: Emphasizes asset valuation, financial reporting, and quantitative methods.

- Level III: Concentrates on portfolio management, wealth planning, and advanced investment strategies.

Key topics include:

- Financial Reporting and Analysis

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

Key changes in the CFA 2024 curriculum include:

- Introduction of Practical Skills Modules: Students are now required to complete online practical modules on skills like financial modeling, Python programming, and analyst skills.

- Revised Topics: More focus on sustainability, artificial intelligence, decentralized finance (DeFi), and alternative investments.

- Streamlined Content: The 2024 curriculum places greater emphasis on skills needed for real-world application rather than theoretical knowledge.

Understanding CIMA

The Chartered Institute of Management Accountants (CIMA) certification focuses on developing accounting skills blended with strategic business and management expertise. It prepares candidates for key decision-making roles in organizations.

CIMA: Comprehensive Curriculum

The CIMA qualification is divided into four levels:

- Operational Level: Deals with management accounting, organizational management, and financial reporting.

- Management Level: Focuses on project management, relationship management, and advanced management accounting.

- Strategic Level: Covers strategic management, risk management, and financial strategy.

- Professional Level: Requires completion of the Strategic Case Study exam and gaining practical experience.

The curriculum trains candidates in:

- Financial reporting

- Risk management

- Business strategy

- Performance management

- Management accounting techniques

CFA vs CIMA: Key Differences

| Aspect | CFA | CIMA |

| Focus Area | Investment Management and Financial Analysis | Management Accounting and Business Strategy |

| Exam Levels | Three Levels | Four Levels |

| Duration | 2 to 3 years | 3 to 4 years |

| Eligibility | Undergraduate degree or equivalent work experience | After O Levels or 10th Grade |

| Career Roles | Investment Banker, Portfolio Manager | Management Accountant, Financial Analyst |

| Average Salary | INR 5–20 LPA | INR 5–8 LPA |

CFA vs CIMA Exams

- CFA Exam Structure:

- Divided into three sequential levels.

- Conducted twice a year (Levels I and II) and once a year (Level III).

- Focused on analytical skills, portfolio management, and ethics.

- CIMA Exam Structure:

- Divided into four levels.

- Combination of Objective Tests and Case Study exams at each level.

- Focused on business and accounting concepts with strategic decision-making.

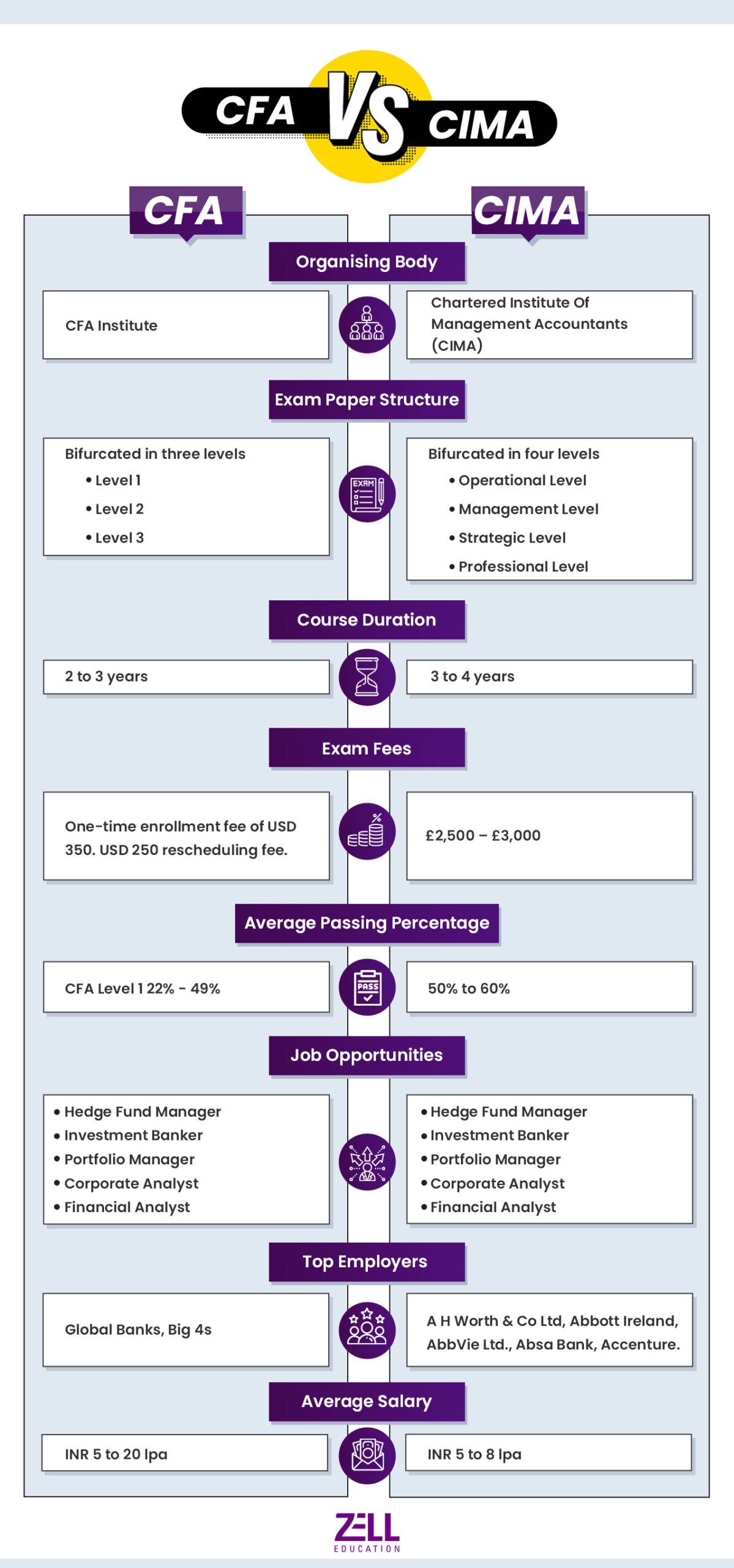

Quick Facts on CFA vs CIMA

| Differentiators | CFA | CIMA |

| Organizing Body | CFA Institute | Chartered Institute Of Management Accountants (CIMA) |

| Exam Paper Structure | Bifurcated in three levels

Level 1 Level 2 Level 3 |

Bifurcated in four levels

Operational Level Management Level Strategic Level Professional Level |

| Course Duration | 2 to 3 years | 3 to 4 years |

| Exam Fees | One-time enrollment fee of USD 350. USD 250 rescheduling fee. | £2,500 – £3,000 |

| Average Passing Percentage | CFA Level 1 22% – 49% | 50% to 60% |

| Job Opportunities | Hedge Fund Manager

Investment Banker Portfolio Manager Corporate Analyst Financial Analyst |

Financial Accountant

Management Accountant Financial Controller Financial Manager |

| Top Employers | Global Banks, Big 4s | A H Worth & Co Ltd, Abbott Ireland, AbbVie Ltd., Absa Bank,

Accenture. |

| Average Salary | INR 5 to 20 lpa | INR 5 to 8 lpa |

CFA vs CIMA: What Are The Skills Obtained?

The CFA course is a global professional course offered by the CFA institute. This course teaches everything you need to know about the financial markets. Right from financial planning to budgeting, from investment to risk management, completion of the CFA course equips students with modern and complex financial processes. There are multiple wealth management skills that one can gain after completing their CFA course. If you are in the final year of graduation, you can appear for the CFA level 1 examination. However, in certain cases, you may be eligible for CFA without graduation provided you have a minimum of 4 years of relevant work experience.

The CIMA course on the other hand is more of a skill-building course due to its mix of accounting and business management. CIMA is a management accounting course that prepares you for an exciting career in finance sectors like wealth management, banks, audit firms, investment banks, IT sectors, and even e-commerce. After completing the Chartered Institute Of Management Accountants course, a candidate can explore jobs in professions like Wealth Management, Treasury Management, Corporate Finance, Business Analysis, Financial Reporting, Financial Analysis, Project Finance, and Risk Management. As a CIMA professional you need to possesses strategic decision-making and management skills.

Curious About CIMA Vs CFA?

CFA vs CIMA Career Benefits and Compensation

CIMA and CFA both are professional learning courses that require dedication. While The CIMA course can be pursued right after your 10th or after completing your o levels, the CFA course generally requires at least and undergraduate. However, if you are a CIMA professional who wishes to pursue CFA, you are not only going to get the best finance and accounting knowledge, but also a high salary package for advanced skill sets.

However, keeping the aspect of dual certification aside, let’s take a look at the individual benefits of each of the courses.

| CIMA | Chartered Financial Analyst |

| Learn and apply transformative technology | A career in the exciting field of investments |

| Gives you analytical and problem-solving ability | Gives you cutting edge research skills |

| High compensation with recognition | High compensation with incentives |

| Prestigious career choice | Demanding career choice |

| Managing human capital | Global career options |

We hope that with this detailed differentiation between CIMA and CFA, you’ve got detailed information on both the courses – CIMA and CFA. When it comes to deciding which course you really want to pursue, the answer lies in your interest level. If you are more interested in the management side of accounting then CIMA is the course for you. However, if you’re more interested in investments, portfolio management, and risk aversion then CFA is the course for you.

Conclusion

Choosing between CFA and CIMA ultimately comes down to your career aspirations and interests. If you are drawn to financial markets, investments, and portfolio management, CFA is a natural fit. However, if business management, accounting strategies, and financial planning excite you more, then CIMA is the right course. Both are globally recognized and can lead to rewarding careers in finance.

FAQs on CIMA Vs CFA

Which is better, CIMA or CFA?

In terms of compensation and global opportunities, the CFA course is more acclaimed than CIMA

Is CIMA the same as CFA?

No, CIMA focuses more on the accounting management side and CFA is an intensive finance course that trains a candidate on financial markets and investments.

What is better than the CFA?

CFA pursued along with CIMA or CA gives you best of skills in finance and in accounting.

Can CIMA become an investment banker?

Yes, CIMA does train you in Investment Management, However CFA would be a better degree to pursue for Investment Banking.

Can I pursue both CFA and CIMA simultaneously?

Yes, it is possible to pursue both CFA and CIMA together if you can manage the workload. However, it requires excellent time management and dedication as both certifications are rigorous. Pursuing both can greatly enhance your skill set, combining deep financial expertise with strong management and accounting capabilities.