International Financial Reporting Standards, also known as IFRS, were earlier introduced in the form of International Accounting Standards (IAS). These standards came into existence in the year 1973 and 2001, to ensure a globally acceptable language for business accountancy that can be followed and understood by individuals throughout the globe. In other words, IFRS is nothing but the global parameters in the field of accountancy for data presentations. The core idea is to maintain documentation, books, and other accounting-related data in a relevant format for internal and external users to comprehend.

Since IFRS, as a global accounting standard, has become mandatory for accountants in different parts of the world, several local, international and government organisations require an IFRS expert who can keep the accounting activities and data as per these global standards. If you are considering a career in IFRS, here are some of the IFRS benefits and the career scope after the certification.

Let’s Understand the Course

The Diploma in IFRS offered by ACCA is a three-month certification course designed specifically for finance and accounting professionals who want to expand their knowledge of international standards. It provides an in-depth understanding of the key concepts and principles of IFRS and how they are practically applied. The course covers various areas, including financial statement preparation, disclosure requirements, and reporting practices under IFRS.

Professionals pursuing the IFRS Diploma learn how to interpret and implement standards accurately, which enhances their ability to navigate global financial reporting challenges. The course is flexible and can be pursued alongside a job or other academic programs, making it highly accessible for working professionals aiming to globalize their careers.

Benefits of IFRS Course and Why you Should Consider

IFRS is a short term three-month course offered by the ACCA body. This course provides essential international financial reporting knowledge and principles that will equip candidates to operate in an increasingly competitive global marketplace. Here are some of the other benefits of IFRS that will make you consider this short term course.

1. Adds More Value to Your Accounting Career

Whether you have a CPA, CA, ACCA, Company Secretary (CS), or a Certified Financial Planner(CFP) degree, the benefit of IFRS course is that it will add more value to your existing degree with added knowledge and responsibilities. Since there are very few professionals who’ve received IFRS training along with their professional accounting courses, the demand for these professionals is quite high. One of the major IFRS benefits is gaining a global accounting perspective, which eventually adds more value to your career.

2. Makes You a Global Professional

As mentioned earlier, IFRS is a singular language that needs to be used and implemented by all financial sectors and other companies throughout the world. Large firms that implemented IFRS at an earlier stage discovered smooth financial functioning, transparency, accountability and increased efficiency. IFRS benefits include the removal of information gaps and the international comparability advantage, which further enable investors and other participants to make informed decisions. Having knowledge of IFRS helps you learn and work as per global accounting standards.

3. Opens Doors to Global Career Opportunities

With a Diploma in IFRS you can work in any part of the world, based on your preference. A Diploma in IFRS not only makes you eligible for the best accounting opportunities in India but also abroad. About more than 120 countries have adopted IFRS standards, and are hiring experts on a large scale. With this accounting certification, you can improve your global career prospects within no time.

What is the Career Scope After Completing a Diploma in IFRS

A diploma in IFRS is usually pursued in association with another accounting degree such as CA or ACCA. Since it is a short term course, it can easily be done during your long term accounting courses. After completing the three-month Diploma in IFRS course, there are many career opportunities that one can explore in the field of finance and accounting. Some of the most popular professions after completing the IFRS Certification.

- Financial Consulting

- IFRS Trainer

- Financial Analyst

- Chartered Accountant

- ACCA

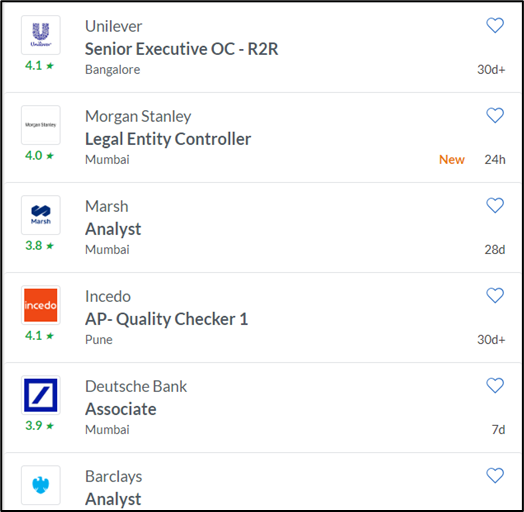

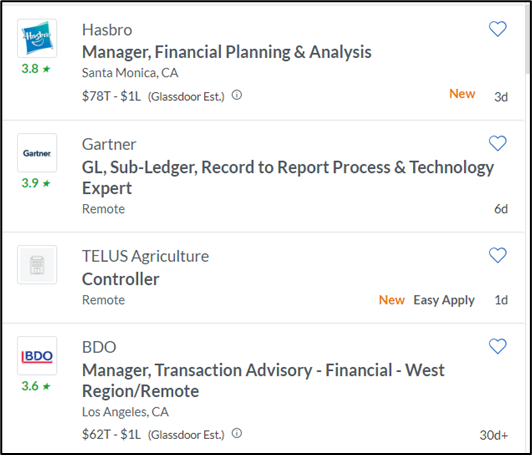

Indian firms that hire IFRS Experts

International firms that hire IFRS Experts

Different Focus Areas of IFRS

The IFRS framework is broad and touches many essential areas of accounting and finance. Some of the key focus areas include:

- Presentation of Financial Statements (IAS 1): Understanding the structure and components of a complete set of financial statements.

- Revenue Recognition (IFRS 15): Learning when and how to record revenue from contracts with customers.

- Leases (IFRS 16): Identifying how leases are accounted for both by lessees and lessors.

- Financial Instruments (IFRS 9): Gaining insights into the classification, measurement, and impairment of financial assets and liabilities.

- Business Combinations (IFRS 3): Recognizing and accounting for mergers and acquisitions.

- Income Taxes (IAS 12): Understanding the accounting treatment for current and deferred taxes.

- Fair Value Measurement (IFRS 13): Learning the principles behind the valuation of assets and liabilities at fair value.

These focus areas collectively prepare professionals to tackle the complex and dynamic nature of financial reporting in the international marketplace.

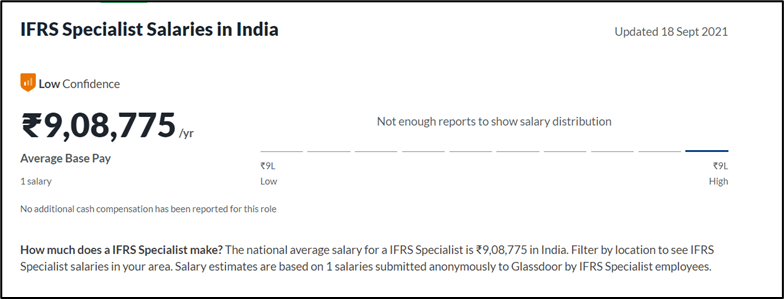

The Average Salary of an IFRS Expert

One of the major benefits of IFRS course is the high salary package that the innovative SMEs and MNCs have to offer. Not only does the IFRS open massive career pathways around the world but it also allows you to earn up to 25% higher than other financial professionals. Here’s an average salary presentation of an IFRS expert in India to give you better clarity on what lies ahead for you if you happen to choose this as your profession.

The International Financial Reporting Standards (IFRS) are important benchmarks in the field of accounting. If you are looking to enhance your knowledge about the IFRS, check out our Diploma in International Financial Reporting Standards (IFRS). This certification is issued by the Association of Chartered Certified Accountants (ACCA).

FAQ’s on Benefits of IFRS Course

How long is the IFRS course?

The IFRS course is a short term, 3-month course that provides qualified accountants or graduates, possessing relevant country-specific qualifications or work experience with an up to date and relevant conversion course. It offers practical and detailed knowledge of the key international financial reporting standards (IFRS® Standards) and how they are interpreted and applied.

Is IFRS better than GAAP?

While IFRS is the international accounting standard and GAAP is the Indian accounting standard. The major IFRS benefit is that it focuses on accurate, timely and comprehensive financial statements, GAAP focuses on the investors. Depending on the country and job requirements, they both are quite effective in their own ways.

What are the four basic principles of IFRS?

The four principles of IFRS on which the financial statements are prepared are clarity, relevance, readability and comparability.

Is IFRS a good career?

IFRS (International Financial Reporting Standards) is a good career choice for those who are interested in accounting and finance. It can lead to a rewarding career with opportunities for growth and advancement in a variety of industries.It is a specialized field that involves the application and interpretation of complex accounting principles and standards. Career opportunities in IFRS include roles such as financial analysts, auditors, consultants, and accountants, among others. The demand for IFRS professionals is expected to increase with the growing need for international financial reporting standards.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

Speak To A Course Expert To Know More