Comprehensive Summary of the ACCA vs CPA Course

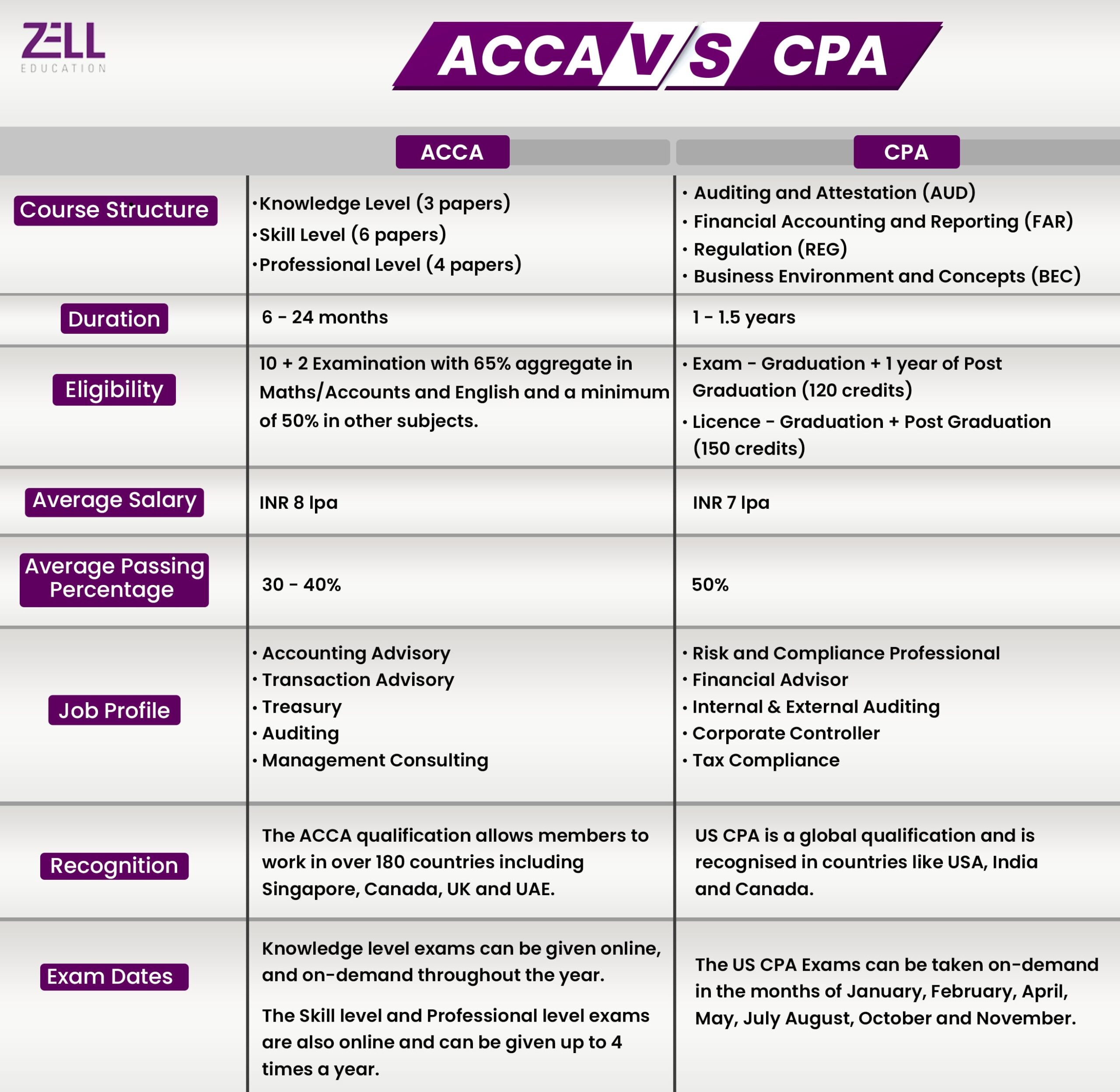

- ACCA vs CPA Global Recognition: ACCA holds acceptance in over 180 countries, providing a wide pathway for global career mobility.

- ACCA vs CPA Core Curriculum: The ACCA syllabus emphasizes International Financial Reporting Standards (IFRS) and a broad global finance perspective.

- ACCA vs CPA Geographic Focus: The CPA qualification is centered around the United States, focusing on US GAAP, taxation, and federal regulatory frameworks.

- ACCA vs CPA Examination Structure: ACCA candidates typically complete up to 13 papers plus an ethics module, offering flexibility in exam sequencing.

- ACCA vs CPA Career Authority: CPA grants statutory audit authority at the federal and state levels within the US, a key distinction for public accounting roles.

- ACCA vs CPA Program Duration: The CPA program is generally shorter, with an expected completion time of 18 to 24 months, while ACCA can take three to four years.

What is ACCA?

ACCA stands for Association of Chartered Certified Accountants. This is a globally recognised professional body that accredits accountants across the globe. ACCA-qualified professionals are globally accepted to work as accountants in big multinational firms.

The ACCA body was founded in 1904 to widen the scope of accountancy across the globe. ACCA-qualified professionals are equipped with business and finance skill sets in the field of accounting.

Planning to Pursue ACCA Accounting Career?

To Book Your Free Counselling Session

What is CPA?

The full form of CPA is Certified Public Accountant. CPA is often considered to be equivalent to the course of CA in English-speaking countries. CPA-qualified professionals are legally allowed to practice accounting across the globe. CPAs are qualified to prepare tax returns, conduct audits and investigations, help clients make financial decisions, and review records to ensure accuracy.

What is the Difference Between ACCA and CPA?

Both ACCA and CPA are widely accepted accounting qualifications. However, ACCA is an accounting qualification that is accepted globally, and CPA qualification is primarily focused on the United States. ACCA has more exams than CPA.

However, ACCA exams do not have any sequence, while CPA exams need to be taken in a particular sequence. ACCA graduates can pursue jobs in banking, auditing, consulting, taxation, and law, while CPAs can pursue jobs in finance, tax accounting, and public accounting

Syllabus

ACCA course subjects are designed to focus on the detailed planning and study of business accounting. The syllabus has been so designed that it can focus on both theoretical and practical understanding of business accounting.

The ACCA syllabus includes three levels: Applied Knowledge, Applied Skill Level, and Strategic Professional Level.

Applied Knowledge

Business Technology (BT)

In this paper, you dive into the basic principles of business and how they blend with today’s technologies.

- Understanding the organisational structure, leadership, and management within a business.

- Exploring the environmental factors affecting business operations.

- Focus on accounting principles and functions in the business context.

- Examining control processes in accounting and finance within a business.

- Effectively managing a business, including its resources and finances.

- Developing efficient teams and optimising business functions.

Management Accounting (MA)

While attempting this paper, you’ll learn essential principles and the skills needed to make decisions that truly benefit your organisation.

- Understanding the concept of cost and management accounting.

- Exploring types of costs, their behaviour, and associated goals.

- Grasping the fundamentals of business mathematics and spreadsheets.

- Applying cost accounting techniques and conducting calculations.

- Engaging in costing, budgeting, planning, and analysis within a business context.

- Implementing management techniques for informed decision-making.

Financial Accounting (FA)

With this paper, you learn the basics of managing money wisely. We explore the rules and guidelines that govern how financial statements are created and presented.

- Exploring the principles of financial accounting.

- Utilising double-entry accounting methods.

- Understanding the basics of financial reporting.

- Preparing journals, ledgers, and trial balances.

- Handling financial data and preparing financial statements.

- Analysing income, cash flow statements, and balance sheets.

Applied Skill Level

Corporate & Business Law (LW)

The Corporate and Business Law paper examines the rules businesses need to follow. This includes essential business and corporate law topics that help you make smart decisions. The paper is called LW Shortly and is known as the F4 paper of the ACCA curriculum.

- Examining the comprehensive framework of the legal system

- Exploring laws about business, companies, and financial affairs.

- Understanding the establishment and structure of business organisations.

- Addressing capital, business finance, and the regulation of companies.

- Analysing the application of Company Law acts within the business context.

- Examining the application of Business Law acts within the business environment.

Performance Management (PM)

The paper is called PM Shortly and is known as the F5 paper of the ACCA curriculum.

- Understanding cost accounting principles and various methods.

- Applying financial data for decision-making, business forecasting, and planning.

- Utilising business mathematics and statistics for analysis.

- Implementing standard costing, variance analysis, and other statistical tools.

- Conducting performance evaluation and management in a business setting.

- Integrating quantitative and qualitative data for assessing business performance.

Taxation (TX)

This paper prepares students to deal with the intricacies of business taxes. The paper is called TX Shortly and is known as the F6 paper of the ACCA curriculum.

- Understanding the concepts of taxation and exploring tax systems worldwide.

- Examining taxes on capital, profits, income, and business.

- Performing computations for both personal and business taxes.

- Understanding the structure and functioning of corporation tax.

- Analysing income tax, capital gains tax, and value-added tax.

- Using the tax framework of the UK as a reference for other countries.

Financial Reporting (FR)

The paper is called FR shortly and is known as the F7 paper of the ACCA curriculum.

- Creating financial statements for a business.

- Examining and interpreting financial statements.

- Utilising ratio analysis and other analytical tools.

- Adhering to regulatory requirements for financial reporting.

- Conducting financial reporting based on prepared statements.

- Communicating financial information to various stakeholders of the business.

Financial Management (FM)

This paper helps you learn how to make smart financial decisions and effectively handle money matters.

- Understanding the concepts of financial management.

- Assessing the valuation of businesses and associated parameters.

- Effectively managing the finances and capital of a company.

- Skilfully handling the working capital of a business.

- Conducting financial risk analysis for businesses.

- Exploring the economic life cycle of a business.

Audit and Assurance (AA)

The paper is called AA Shortly and is known as the F9 paper of the ACCA curriculum.

- Exploring the principles of auditing and the processes involved in conducting an audit.

- Examining regulations related to auditing.

- Identifying areas for auditing and establishing parameters for the audit.

- Managing business risk and identifying risks through the audit process.

- Implementing quality assurance processes for a business.

- Performing audits and preparing audit reports.

Strategic Professional Level

Strategic Business Leader (SBL)

This paper focuses on building strategic and leadership skills in real business situations.

- Optimising the management of an organisation for enhanced efficiency.

- Understanding the roles and functions of governance within the realm of management.

- Establishing an ethical framework to guide professional values and decision-making.

- Integrating business strategies with corporate governance principles.

- Formulating internal control policies and implementing audit procedures for development.

Strategic Business Reporting (SBR)

The paper is called SBR shortly and is known as the P2 paper of the ACCA curriculum.

- Establishing a framework for financial reporting within a business context.

- Examining the intersection of corporate governance and financial reporting.

- Assessing potential financial reporting issues and their consequences.

- Analysing the impact of changes in accounting regulations on financial reporting.

- Keeping abreast of current accounting and audit developments and their implications for businesses.

- Utilising case studies to navigate complex business reporting environments.

Advanced Financial Management (AFM)

The paper is called AFM shortly and is known as the P4 paper of the ACCA curriculum.

- Exploring business investments and the financial industry’s structure.

- Familiarising with investment banking, acquisitions, and mergers.

- Understanding financial and regulatory approaches to restructuring companies.

- Engaging in fund management, treasury functions, and advanced risk management.

- Examining the intersection of business finance, the economic environment, and global trade.

- Exploring emerging concepts in finance and financial management.

Advanced Performance Management (APM)

The paper is called AFM for short and is known as the P5 paper of the ACCA curriculum.

- Implementing strategic planning and control models to navigate the effects of risk and uncertainty.

- Assessing and appraising the design elements inherent in performance management systems.

- Optimising strategic performance measurement methodologies.

- Examining external factors and economic conditions to conduct a comprehensive analysis.

- Exploring real-world case studies showcasing effective business performance management strategies.

Advanced Taxation (ATX)

The paper is called ATX Shortly and is known as the P6 paper of the ACCA curriculum.

- Understanding the UK taxation system and tracing the origins of other tax systems.

- Examining various facets of the contemporary tax system.

- Analysing the effects of taxes and the interplay between different tax types, focusing on business taxes.

- Developing strategies for tax planning in the context of business operations.

- Exploring the International Taxation framework, including Customs and other duties.

- Illustrating complex tax planning systems through case studies.

Advanced Audit and Assurance (AAA)

The paper is called AAA Shortly and is known as the P7 paper of the ACCA curriculum.

- Exploring sophisticated concepts in auditing within the regulatory framework.

- Conducting audits of intricate financial statements.

- Generating elaborate and thorough audit reports for business entities.

- Utilising analytical tools and techniques for interpreting audit reports effectively.

- Engaging in assurance reporting for various assurance engagements.

- Examining real-world case studies depicting audit and assurance reporting in complex business scenarios.

CPA Syllabus

The CPA syllabus covers a wide range of topics, including:

- Auditing and Attestation (AUD): Covers auditing processes, ethics, and risk appraisal

- Business Environment and Concepts (BEC): Covers corporate governance, economic concepts, and IT systems

- Financial Accounting and Reporting (FAR): Covers financial reporting, including US Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS)

- Regulation (REG): Covers federal taxation, business law, and professional responsibilities

Exam Pattern

Exam Pattern of ACCA

The ACCA exam pattern includes mostly MCQs-type question set. The exams are 2 hours long in duration. Three levels of exams include Applied Knowledge, Applied Skill Level, or Strategic Professional Level. These exams are flexible, which means you can take these exams at any given time.

Exam Pattern of CPA

The Certified Public Accountant (CPA) exam is a four-part test that consists of multiple-choice questions, task-based simulations, and written communication.

Course Duration for ACCA vs. CPA

Completion of the ACCA course can take up to three to four years. However, this duration can vary depending on how fast you can take up the syllabus or if you have any prior experience.

Completion of the CPA can take up to 18 to 24 months, which includes a four-part assessment section.

Recognition

Both ACCA and CPA would give you global recognition, ensuring that you are accredited to work in business accounting in any part of the world. After qualifying for these exams, you can grab a job opportunity across the globe.

Exam Dates

A student can take an ACCA exam at any given time frame. The ACCA exams take four cycles in a year. Based on your learning capacity, you can be able to complete the exam of ACCA.

The exam dates for CPA are as follows for 2025:

- April 1st–30th

- June 1st–30th

- July 1st–31st

- October 1st–31st

Jobs for ACCA

There are several job profiles for ACCA because of its global recognition. These job profiles include Accountant, Financial Analyst, and Forensic Accountant.

On the other hand, CPA-qualified professionals can work in any accounting firm, corporate finance, or even government agencies.

ACCA full form is Association of Chartered Certified Accountants, and CPA means Certified Public Accountant. Many of you must be wondering which one is better. Who earns more, ACCA or CPA? Can I do ACCA and CPA together? There are plenty of questions that come to mind when you think about choosing a course between ACCA and CPA.

While Certified Public Accountant (CPA) makes you a Chartered Accountant of the US, the Association of Chartered Certified Accountants (ACCA) course makes you a global Chartered Accountant. This means you can practice Chartered Accountancy in 180 different countries.

Before we get into the differences, there are some similarities between the two courses that you should take note of before you make your final decision.

If becoming a Chartered Accountant is what you’ve been aiming for, with these two courses you can fulfil your dream, as they both allow you to practice Chartered Accountancy overseas. Additionally, these two courses hold immense prestige in the world of accountancy.

Professionals with this degree are welcomed into the corporate world with interesting job opportunities and impressive salary packages. However, to know more about the differences between these two accounting courses, here’s a detailed differentiation between ACCA vs CPA in India.

Got Questions Regarding Course Duration?

Click Here for a Free Counselling Session

ACCA vs CPA

Is ACCA Harder than CPA?

A question that’s often asked by several students: the toughness of the syllabus, along with the number of papers that one needs to appear for, really makes a difference. While both the courses are tough to clear in their places, here are some differentiating factors that help us understand which course might be easier to take up and clear.

| Differentiators | ACCA | US CPA |

| Duration | 6 to 24 months | 12 to 18 months |

| Number of Papers | 15 papers | 4 papers |

| Maximum Exemptions | 9 | No exemptions |

| Passing Rate | 40 to 50% | AUD – 52%, BEC – 65%, FAR – 50%, REG – 62% |

Looking at these numbers, you may think that both these papers are equally tough; however, there’s a possibility of completing US CPA in a shorter period due to the number of papers that you need to appear for. In both these courses, the professionals are well-versed with IFRS, which is the international accounting standard. The ACCA course has about 16 subjective exams, and the US CPA course has all 4 objective-based examinations.

Which has a better scope, ACCA or US CPA?

When it comes to better scope in a career for ACCA or CPA, both these courses are globally recognised and add value to your accounting career. As per certain renowned universities, US CPA is considered to be more prestigious than ACCA, as the entry requirement for CPA is equivalent to a master’s degree with stringent work experience that needs to be showcased. But when it comes to scope, here are parameters that you should take a look at.

| Differentiators | ACCA | US CPA |

| Global Acceptance | 180 countries | Recognized in the US and anywhere with US regional offices |

| Audit | Can audit in several countries except the US and India | Audit for Federal and State levels in the US |

| Job Roles | Financial Accountant

Management Accountant Corporate Treasurer Financial Controller Finance Manager |

Corporate Controller

Public Accounting Tax Examiner Business System Analyst Forensic Services |

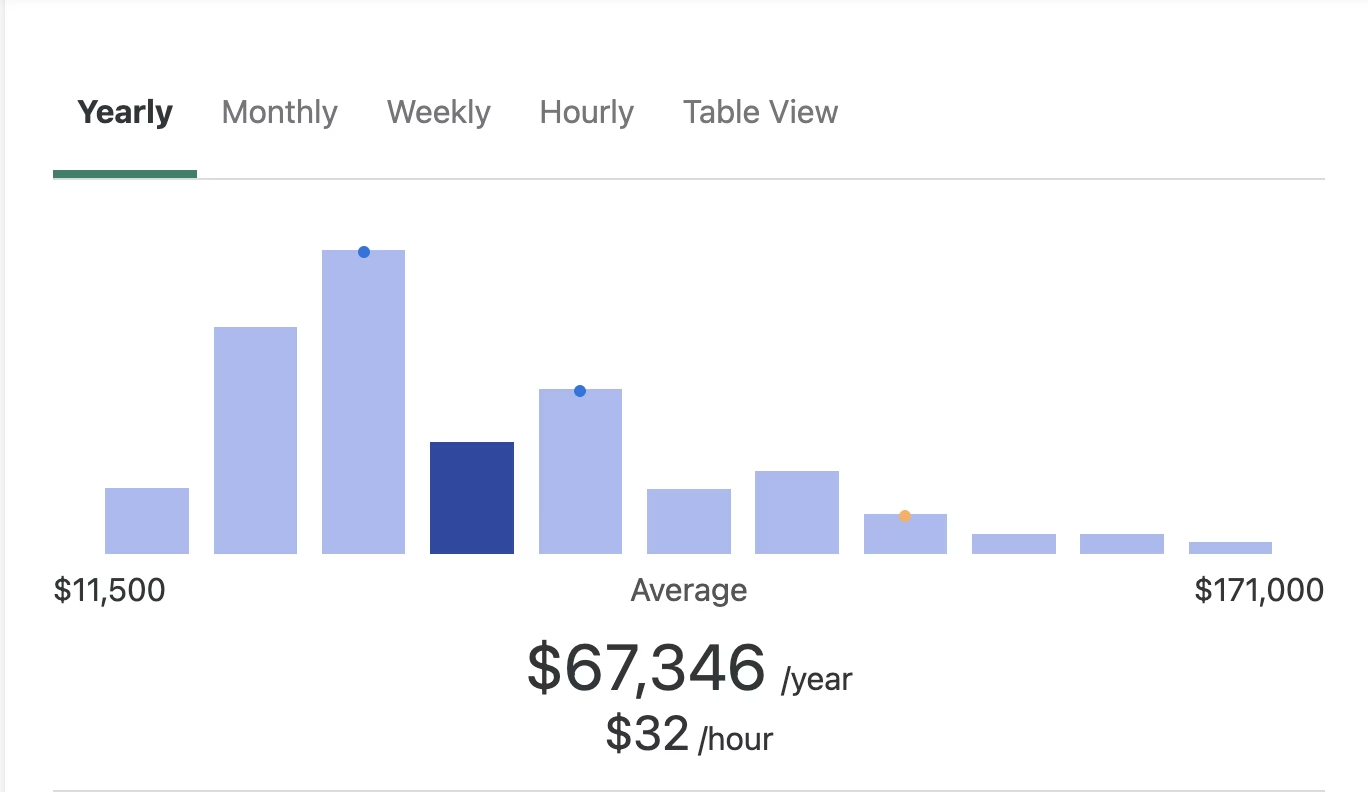

| Salary | INR 5 LPA to 16 LPA | $38,000 to $90,000 |

Average Salary of an ACCA professional

Average salary of a US CPA in the US

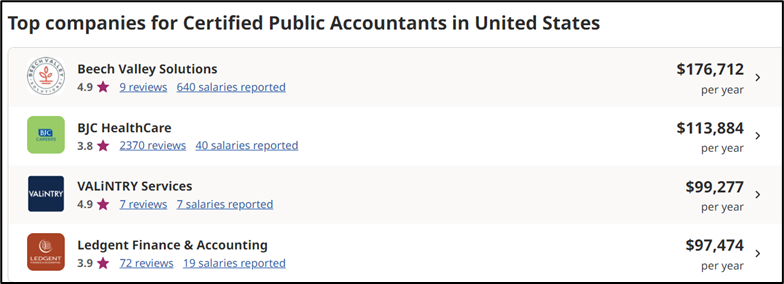

Top employers of ACCA and US CPA?

From the above comparison, your weighing scales must probably be favouring ACCA due to the opportunities and high salary package it has to offer. But, we’d recommend you hold on just for a bit and check out the top hiring firms for these two professions and then make your final decision.

Since it’s going to be the decision of a lifetime, it’s best to consider all parameters. So here’s another engaging comparison of the companies that might require your skillset after you choose any of these courses. And what they are willing to offer.

Top Hiring firms for ACCA

Top Hiring firms for US CPA

What are the Eligibility Criteria for ACCA and US CPA?

Now that you’ve got a fair idea of the job opportunities, scope, salary, and other details of the ACCA, it’s time to consider how difficult it would be to take up these courses. And by that, we mean considering the ACCA eligibility criteria.

Here are some of the eligibility requirements you need to fulfil before you can qualify as an ACCA or US CPA professional.

| Requirements | ACCA | US CPA |

| Documents | Students should have qualified for their 10+2 examinations with an aggregate of 65% in Mathematics / Accounts and English and a minimum of 50% in other subjects. | You will require 120 credits to appear for the CPA examination and 150 credits to achieve the certification and title. |

| Students’ degree | Students who have just cleared their class 10 examinations or do not qualify as per the aforementioned criteria can still register for the ACCA qualification via the Foundation in Accountancy (FIA) route. | You can also appear for the CPA exam if you are an international CPA candidate from India and a first-division graduate in any three-year commerce degree from a NAAC-A-rated university. |

| Work experience | 36 months | 2000 hours (covered in a minimum of 2 years) |

Which course is better, ACCA or US CPA?

Both the accounting courses, Certified Public Accountant (CPA) and Chartered Accountant of the Association of Chartered Certified Accountants (ACCA), are equally important in their places.

While US CPA is a USA-based course, ACCA is a UK-based course and thus will enable you to get better opportunities in that country. So based on your learning, opportunity, growth, work, and living preferences, you should make a choice that suits you the best. And no matter what course you choose, we at Zell Education will be there to guide you.

The ACCA qualification is recognised in over 180 countries, including Canada, Singapore, and Australia. If you’ve decided to become a global CA and are contemplating your next move, we can help you take a step forward. Check out our Association of Chartered Certified Accountants (ACCA) course to learn more.

The US CPA qualification is recognised worldwide and can open doors to opportunities in Europe, Asia, and North America. If you are an accounting professional looking to boost your career or just curious to learn about the course, we suggest you check out our Certified Public Accountant (CPA) course to learn more.

FAQs on ACCA Vs CPA

Which is better for a global accounting career, ACCA or US CPA?

For truly broad global recognition, ACCA has an edge, being accepted in over 180 countries and following IFRS. The US CPA is the gold standard for American accounting and is highly respected globally, especially for US-centric roles. Your career destination shapes the better choice.

Who earns more, an ACCA or a US CPA?

Generally, a US CPA often earns more, especially within the United States or with US-based multinational firms. Their salary can range from $60,000 to $150,000+ annually. ACCA, while globally recognised, typically sees average salaries of $40,000-$120,000 depending on location.

Does the Big 4 hire CPA professionals in India?

Yes, absolutely. The Big 4 firms (Deloitte, EY, KPMG, and PwC) actively hire US CPA professionals in India. They value the global accounting expertise, especially for roles in audit, tax, and advisory, particularly for international clients and global service centres.

Is it possible to switch from ACCA to CPA later on?

Yes, you can absolutely pursue CPA after ACCA. There’s no direct “switch” via a mutual recognition agreement with US CPA. However, your ACCA qualification often helps meet some educational requirements, potentially reducing the coursework needed to sit for the US CPA exam.

ACCA vs CPA: Which qualification is easier to complete?

Neither is “easy”; both are challenging. ACCA has 13 papers but offers more flexibility in exam scheduling and significant exemptions. The US CPA has only 4 exams but is highly intensive, with a strict 18-month completion rule and a deeper focus on US GAAP and tax law.

What’s the fee difference between ACCA and CPA?

ACCA generally costs less overall than US CPA. ACCA fees (registration, exams, and annual subscription) in India might range from ₹3-4 lakhs. US CPA, including application, exam, and international testing fees, can cost ₹6-8 lakhs for Indian students, plus review course fees.

How long does it take to complete ACCA vs CPA?

ACCA typically takes 3-4 years on average, including exams and practical experience. You have up to 10 years. The US CPA can be completed faster, often within 1.5-2 years, but you must pass all four exams within an 18-month window once you pass the first part.

What are the eligibility criteria for ACCA and CPA?

For ACCA, 10+2 with good marks, or a relevant degree, often gets you in with exemptions. For CPA, you need 150 semester hours of college education, typically a master’s or equivalent, plus specific accounting credits and experience.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

10-Year Zell Discount: Secure Your Offer Now!