Why Pursue the CFP Certification?

What is CFP? Chartered Financial Planner is an emerging professional course that’s often chosen by finance enthusiasts who are interested in planning and managing organisational finances. This course is a globally recognised certification that offers several job opportunities in over 26 countries worldwide.

With over 170,000 Chartered Financial Planner credentials in the world, and the profession continuing to grow, the opportunities and potential income continue to grow as well. Given that the wealth and financial planning industry is growing at around 20% every year, there will always be a haven of jobs available.

This competitive programme, offered through the Financial Planning Standards Board (FPSB), will provide you with the skills and knowledge to manage the growing complexity of navigating the financial world for your clients in a safe and effective manner.

If you wish to enter the career of wealth management and financial planning, taking this course would be the right direction to take, as it equips you with concepts like risk analysis, financial planning, insurance planning, tax planning, etc. When pursuing this course with a Chartered Financial Analyst degree, your opportunities are sure to double up.

Got More Questions About CFA Program?

Click Here for a Free Counselling Session

Curious About What is CFP?

Chartered Financial Planning Course Details

CFP is a professional certification course that can be pursued right after completing your 12th. If you’re planning on becoming a qualified CFA, then this course could be of great help in preparing you for the world of financial markets and investments. Let’s take a look at some of the course details of CFP.

| Chartered Financial Planning | Course Details |

| Board | Financial Planning Standards Board (FPSB) |

| CFP Course Duration | 6 months to 2 years |

| Student Registration Fees with FPSB India | Rs 16,385 (valid for one year) |

| Coaching Fee | INR 15,000 to INR 60,000 |

| Eligibility Criteria | For the Regular Pathway, here’s what you’ll need:

Complete your 10+2 NCFM number from the NSE website Fill the registration form to become a member Pay the registration fees For the Challenge Pathway, here’s what you’ll need: Complete your 10+2 Fill out the Challenge Pathway registration form Share scanned copies of your work experience documents to [email protected] Become a member to begin your learning journey |

| Exam Paper Format | 3 hours, 85 multiple-choice questions, computer-based test for each track exam |

| Test Windows | Jul. 12-19, Feb. 23, Jun. 7, Nov. 2-9, Jul. 15, Oct. 4 |

| CFP Job Scope | Portfolio Manager, Tax Planner, Insurance Advisor, Risk Analyst, Debt Management Specialist, Financial Advisor, Retirement Planning Advisor, and Mutual Fund Advisor |

| Chartered Financial Planning Fresher Salary | INR 3.5 lpa |

CFP Course Details & Eligibility Criteria

CFP Pathways & Eligibility

The Financial Planning Standards Board (FPSB) offers two pathways to pursue CFP certification:

- Regular Pathway: For candidates without relevant work experience.

- Challenge Pathway: For candidates with prior work experience in finance or related fields.

Eligibility for Different Candidates

For Freshers

- Completion of 10+2

- NCFM number from the NSE website

- Registration form submission to become a member

- Payment of registration fees

For Experienced Candidates

- Completion of 10+2

- Challenge Pathway registration form submission

- Submission of scanned copies of work experience documents to [email protected]

- Becoming a member to begin learning

For Self-Employed Candidates

- 2 years of full-time post-graduation degree or professional qualifications as mentioned by FPSB India

- 3 years of work experience in financial services or 5 years of work experience in other related industries

CFP Course Curriculum & Examination Structure

CFP Syllabus Overview

Module 1: Introduction to Financial Planning

What you’ll learn:

- Financial Planning Process that includes client interactions, time value of money applications, etc.

- Education planning and other general principles.

Module 2: Insurance Planning and Risk Analysis

What you’ll learn:

- Introduction to the strategies and applications of Risk Analysis.

- Insurance Concepts, Insurance Policies, Environment of an Insurance Advisor.

Module 3: Retirement Planning and Employee Benefits

What you’ll learn:

- Introduction to Retirement Planning, Retirement Benefits, Retirement Planning, and Strategies, etc.

- Reform proposals, Pension Sector Planning, and other related sectors.

Module 4: Components of Investment Planning

What you’ll learn:

- A fundamental concept to Investment Planning, Regulation of the process, Investment vehicles, Client Application, and other related sections.

Module 5: Tax Planning & Estate Planning

What you’ll learn:

- Tax Planning Considerations, Tax Computations, etc.

- Planning of Estates.

Module 6: Introduction to Advanced Financial Planning

What you’ll learn:

- Determining and gathering client data along with their goals and expectations and other related sections.

Exam Paper Format & Test Windows

- Format: 3 hours, 85 multiple-choice questions, computer-based test for each track exam.

- Test Windows: July 12-19, Feb. 23, Jun. 7, Nov. 2-9, July 15, Oct. 4.

CFP Course Fees & Registration Process

Fees Breakdown

- Student Registration Fees with FPSB India: Rs 16,385 (valid for one year)

- Coaching Fee: INR 15,000 to INR 60,000

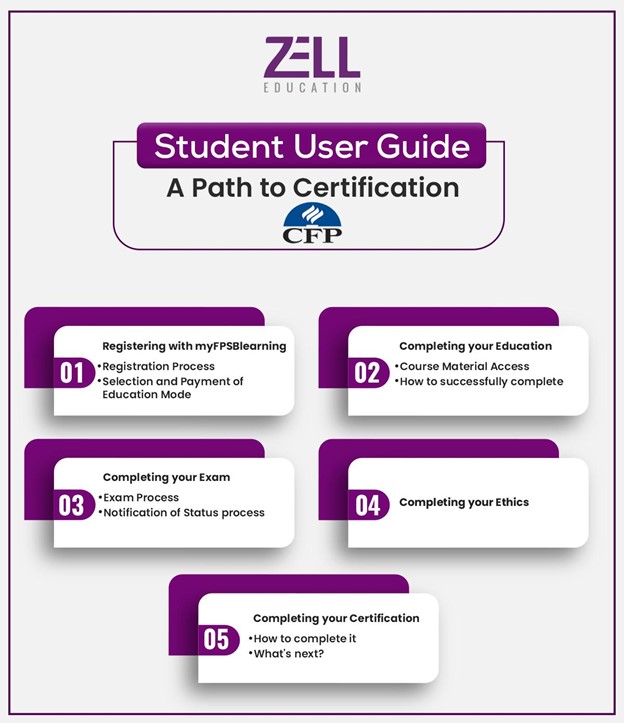

Registration & Scheduling Process

- Register with FPSB Ltd.

- Submit documentation in the FPSB online portal to request an education exemption.

- FPSB will notify within 14 days if the documentation is accepted as valid.

- If approved, proceed to take the online prequalification exam in the FPSB online portal.

Job Roles & Responsibilities of a CFP

Job Roles

- Portfolio Manager

- Tax Planner

- Insurance Advisor

- Risk Analyst

- Debt Management Specialist

- Financial Advisor

- Retirement Planning Advisor

- Mutual Fund Advisor

Responsibilities of a CFP

- Assess client financial goals

- Create tailored financial plans

- Advise on investments and risk management

- Offer tax planning solutions

Scope of CFP in India and Abroad

India had around 261 HNIs in 2020, which grew to 308 in 2021. Collectively, the total HNI wealth of these Indians grew by 11.6 per cent. To cater to these growing HNIs and their companies, a Chartered Financial Planner is essential.

Potential Employers and Hiring Sectors

Sectors Hiring CFP Professionals

- Banks

- Investment Firms

- Insurance Companies

- Wealth Management Firms

Top Employers Hiring CFPs

India

- HDFC Bank

- ICICI Securities

- Axis Bank

- SBI Wealth Management

Global

- JP Morgan Chase

- Morgan Stanley

- Merrill Lynch

- UBS Wealth Management

CFP Salary Prospects

Salary Based on Specialisation & Experience

India

- Chartered Financial Planning Fresher Salary: INR 3.5 LPA

Global Salary

- Salaries vary based on location and experience but typically range higher than in India.

Setting Up Your Own Firm After CFP – Pros & Cons

Critical Requirements

- Strong financial knowledge

- Client management skills

- Investment expertise

Pros of Setting Up Your Own Practice as a CFP

- Independence in decision-making

- Higher earning potential

- Flexibility in work schedule

Cons of Setting Up Your Own Practice as a CFP

- Requires significant effort to build credibility

- Initial capital investment

- Uncertain income in early years

Conclusion

With this detailed article on the CFP course, you have received an in-depth understanding of what the profession looks like and what to expect. If you are interested in getting into this exciting and equally dynamic field, then pursuing a Chartered Financial Analyst course with Zell Education is the direction to take.

Got More Questions Related To CFP Course?

Book Your Free Counselling Session Today!

FAQs on CFP Credential:

What does the CFP credential stand for, exactly?

CFP stands for Certified Financial Planner, and it’s a globally recognised certification for financial planning professionals.

What are the eligibility criteria to get the CFP certification?

You need to have a bachelor’s degree and a minimum of three years of professional experience to be eligible.

How long does it typically take to complete the CFP certification?

On average, it takes about one to two years to complete all the coursework and pass the required exams.

What is the estimated cost of the CFP course in India?

The total cost varies, but it typically ranges from ₹40,000 to ₹70,000, which includes registration, exam, and certification fees.

What is the average salary of a CFP professional in India?

An entry-level CFP in India can earn around ₹3 to 7 lakhs annually, with significant growth potential as they gain experience.

How many exams are included in the CFP certification process?

There are a total of four exams to pass: three specialist exams and one final integrated financial planning exam.

Is the CFP qualification better than CFA?

Both are highly valued. CFP is for comprehensive financial planning for individuals, while CFA is more focused on investment management and analysis.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

10-Year Zell Discount: Secure Your Offer Now!