US CPA or Certified Public Accountant is a US-based accounting that enables you to become a Chartered Accountant of the US. While the duration of this course is much shorter compared to the Indian Chartered Accountancy course, the examinations are equally competitive and equip you with a gamut of accounting concepts. Different countries have their own CPA course, however, with the US CPA qualification you can choose to work in Europe, North America and Asian countries. Since there are several US-based MNCs situated in several parts of India, the scope for US CPA professionals is also on the rise.

Let’s take a look at the top jobs in India for US CPAs.

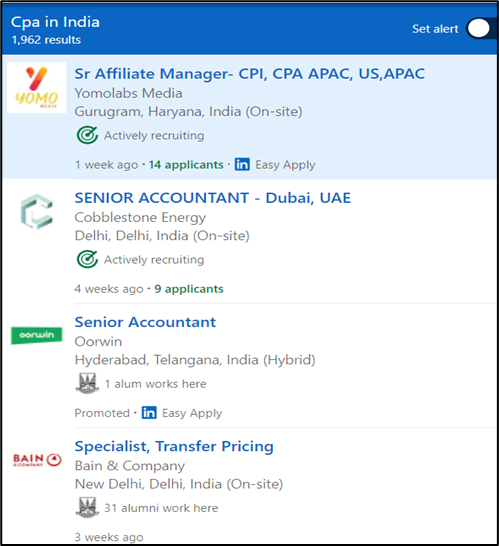

Latest Opportunities for US CPA in India

If you were under the impression that the opportunities for US CPA are quite low in India, here’s a deal-breaker that will help you get an understanding of the opportunities for US CMA professionals in India.

Top job opportunities for US CPA professionals in India

Certified Public Accountants (CPA), after the successful completion of their course, find themselves choosing related professions that are more in line with their interests and skill set. Here’s a list of the top professions one can pursue after US CPA in India and their respective average salaries.

- Corporate Finance: These professionals manage the overall budget and sources of funding. They take charge of the financial decisions made by the company, which includes advising on investments, cash flows and expenditures. A Corporate Finance Analyst analyses all revenue streams and create reports on the return on investment.

The average salary of a Corporate Finance professional

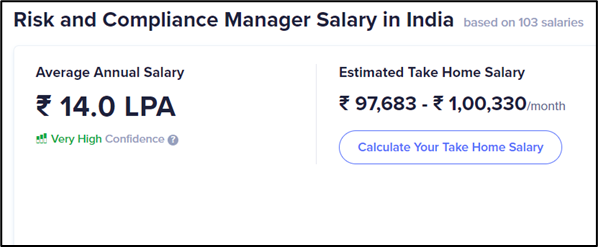

- Risk and Compliance Expert: A Risk and Compliance Manager is someone who ensures that the company’s business practices are in line with the standard laws and regulations. They ensure that the organisation is protected from unforeseen risks. These experts work closely with the employees and management to implement internal controls.

The average salary of a Risk and Compliance Manager

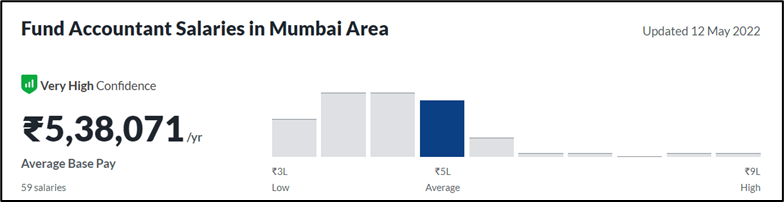

- Fund Accounting: Fund Accounting is an accounting system wherein the professionals record the resources where the usage of these resources is limited by an individual, company, governing agency, grant authority or the law. These professionals are usually hired by non-profit organisations or government bodies.

The average salary of a Fund Accounting professional

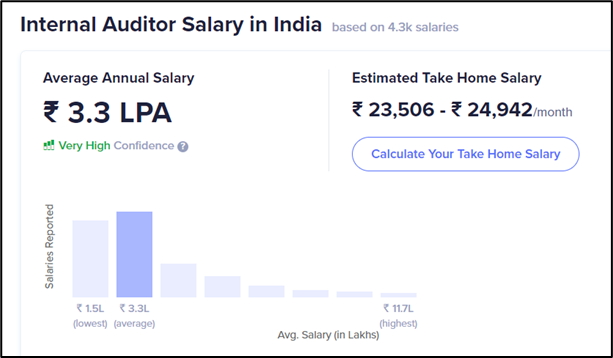

- Internal Audit: Every company today has an internal audit team. An Internal Auditor evaluates a company’s financial performance and detects financial flaws before the external audit team conducts the audit. An Internal Auditor is in charge of the compliance audit, financial audit, information and technology audit, and operational audit.

The average salary of an Internal Auditor

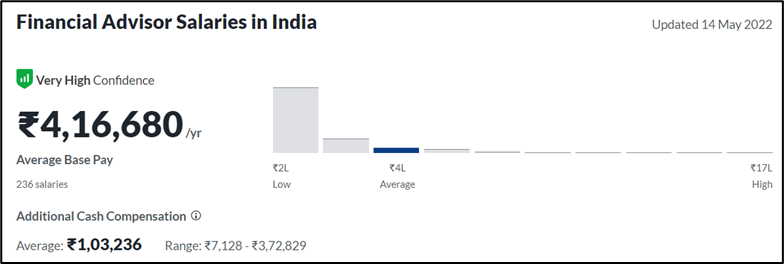

- Accounts Advisory: An Accounts Advisory is responsible for guiding individuals and organisations in varied financial matters. They enable people to make better financial decisions in terms of personal financial matters and investments. These professionals can either choose to work as independent advisors or can be hired by large firms.

Several US-based companies like Amazon, Apple, Dell, Citi Bank and Coca-Cola require Certified Public Accountants in their Indian finance team. Wondering why? Here’s breaking it down for you.

Since these companies are operating from India, they prepare their statements as per Indian Accounting Standards. But when their American head office prepares consolidated financial statements for various other countries including India, they have to make sure that the financial statements prepared according to Indian Accounting standards are converted to U.S GAAP. That’s where the role of a US CPA comes into the picture. A US CPA helps MNCs convert financial statements from Indian Accounting Standards to the U.S GAAP.

Top US-based Companies that hire US CPAs

- KPMG

- Deloitte

- Coca-Cola

- Amazon India

- PriceWaterhouseCoopers (PwC)

- Ernst and Young (EY)

If you wish to pursue US CPA in India brace yourself to work with some of these top companies that not only provide a satisfactory compensation but also various other benefits and growth opportunities. With Zell Education, your journey toward this prestigious position can be simplified within no time. All you need to do is reach out to our experts and we’ll take care of your learning journey, from application to placements.

The US CPA qualification is recognised worldwide and can open doors to opportunities in Europe, Asia and North America. If you are an accounting professional looking to boost your career or just curious to learn about the course, we suggest you check out our Certified Public Accountant (CPA) course to learn more.

FAQs

1. What are my career opportunities after CPA?

Opportunities exist in all areas of the business world including accounting, auditing, corporate finance, financial advisory, investment banking, corporate governance, tax, IT, etc.

2. Can I do CPA if I’m in my first year?

Unfortunately, being a graduate is the minimum requirement for pursuing the CPA course.

3. How are the exams held?

The exams are held all year long (except the weekends) in Prometric centres. The exams are currently held in New Delhi, Bangalore, Calcutta, Mumbai, Ahmedabad, Hyderabad, Chennai and Trivandrum.