The Chartered Financial Analyst is one of the most reputed field of finance. It is offered by the CFA Institute in the USA and is recognised across the world as a professional finance qualification. This course mainly focuses on subjects relating to advanced investment analysis and consists of three main levels. After successfully completing all three levels and gaining 4 years of work experience, you will officially be known as a CFA charter holder and pursue your career as a financial analyst.

The Top 7 Benefits of Pursuing CFA

The CFA charter is more than just a prestigious title—it’s a testament to a deep understanding of financial analysis, portfolio management, and investment strategies. Earning this charter involves rigorous examinations across three levels and the completion of four years of professional work experience in the finance industry. The CFA charter is often regarded as the gold standard in the finance world, respected by employers and clients alike. It signals to the world that you possess the highest level of financial expertise and ethics, both of which are crucial in making sound financial decisions.

Enhanced Career Opportunities and Salary Growth

One of the most compelling reasons to pursue the CFA is the significant impact it can have on your career opportunities and salary potential. As a CFA charter holder, you are in high demand across a range of financial services, including investment banking, hedge funds, private equity, and asset management. The certification gives you an edge over competitors and opens doors to higher-level positions. Research shows that professionals with the CFA credential tend to earn higher salaries, with many reporting salary increases of 50% or more after obtaining the qualification. Additionally, with CFA, you become eligible for more senior roles, which typically come with better compensation packages.

For Industry Professionals

For those already working in finance, the CFA can be a game-changer. It enables professionals to deepen their knowledge and specialize in areas like portfolio management, investment research, or financial analysis. Having the CFA designation increases job security and prospects for career advancement. Even if you are already working in high-level finance roles, the CFA will demonstrate your commitment to professional growth, making you a more attractive candidate for promotions or new opportunities within your company or elsewhere.

For Non-Investment Professionals

Even if you are not directly involved in investment roles, the CFA qualification can still add immense value to your career. Professionals in fields like corporate finance, risk management, and consulting can benefit from the broad understanding of financial analysis and decision-making that the CFA provides. This qualification equips you with the tools to make more informed financial decisions and offers a better understanding of investment strategies, which is highly relevant for executives, business managers, and consultants looking to work more closely with finance teams.

For Students

If you are a student, especially one pursuing a degree in finance, economics, or business, the CFA is an excellent addition to your resume. Starting CFA during your college years, even before graduation, shows initiative and commitment to your career. It provides a competitive edge in a crowded job market and demonstrates your readiness to take on complex financial roles. Many students opt to take the Level 1 exam in their final year of college, positioning themselves for a smooth transition into the workforce with a highly regarded professional qualification.

Global Recognition and International Mobility

The Chartered Financial Analyst qualification is recognised across the world as one of the most valuable degrees in the field of finance. CFA currently has a global network of over 135,000 investment and finance professionals and is expected to grow at a rapid pace in the future. The CFA charter is awarded by the CFA Institute which is based out of the US and recognised in over 30 countries and territories. By successfully earning the CFA qualification, you can easily expand your career internationally and find opportunities in over 164 countries across Asia, Europe, and North America.

The Learning Ecosystem by The CFA institute

The Learning Ecosystem is an interactive study tool that is made available to registered candidates. It features helpful tools such as a study planner, progress tracker, mock exams, flashcards as well as learning games to help you stay productive and consistent with your preparation. You have access to the platform as long as you are a registered candidate of CFA.

Extensive Networking and Professional Development

The CFA Institute is not just a certification body but also a community of professionals dedicated to advancing the finance profession. As a CFA candidate or charter holder, you gain access to a vast network of professionals, including opportunities for mentoring, knowledge-sharing, and professional development. The CFA Institute organizes events, webinars, and conferences that connect you with like-minded individuals and industry experts, which can be incredibly valuable for career advancement. The networking opportunities provided by the CFA Institute can lead to job referrals, collaborations, and even potential business partnerships.

Flexibility: Balancing CFA with an MBA or a Job

The CFA program is designed with flexibility in mind, allowing you to balance your studies with a full-time job or even an MBA program. You can start the CFA exam registration process while working full-time, giving you the ability to gain practical experience while you study. Many professionals choose to pursue the CFA in parallel with an MBA to enhance their skill set and marketability. While both qualifications are prestigious in their own right, having both the CFA and an MBA gives you a comprehensive understanding of both financial and strategic business management.

CFA is considered a Gold Standard in Finance and Investment

Among all the qualifications offered specifically for finance professionals, CFA is by far one of the most respectable and coveted courses you can pursue. A CFA charter holder is considered to be an expert in all aspects when it comes to the field of finance and is often indicative of the quality of work of a finance professional. After successfully completing CFA, the number of opportunities being made available to you will be endless.

It gets you started in the field of Investment Banking

As a student planning to work in lucrative roles like investment banking or hedge fund management, the two most valuable courses to pursue after graduation are CFA and MBA in Finance. However, you will only be able to gain the maximum advantages of an MBA when done from one of the 10 colleges of the country, which can be quite a difficult process. The exam pattern is such that you can even appear for the Level 1 exam in your final year of graduation. As far as a career in finance is concerned, you can get started with either MBA or CFA.

Exemption from Graduate Level Entrance Exams

Another big advantage of pursuing a globally recognised qualification is that you can claim exemptions! If you are a CFA, you are eligible to be eligible for waivers on coursework for professional certification courses such as Chartered Alternative Investment Analyst (CAIA), Chartered Market Technicians (CMT) charter, Investment Management Certification (IMC) exams, Professional Risk Manager (PRM) designation. The official website of the CFA Institute has listed all the exemptions and waivers that can be claimed after completing each stage of CFA.

The Return on Investment is Quite High

Excluding the training fees, the overall cost of pursuing CFA can be anywhere between INR 1.5 to 1.7 lakhs or USD 2100 to USD 2400. With training, the overall cost of completing CFA in India usually does not cross the INR 3 or 3.5 lakh mark for a period of 3 years. After successfully clearing all 3 levels of CFA, you can easily expect a starting salary of INR 7 to 8 LPA. So the amount you spend initially will be recovered by you within a year of working!

Improve your job prospects

Even if you are already working as a finance professional, the CFA charter will only improve your future career prospects. After completion of each level of CFA, your level of compensation is expected to increase significantly. You also have a better chance of climbing the corporate ladder, especially if you already have some relevant experience in the field.

Curious About Benefits of Pursuing CFA?

Additional Benefits: Starting Your Own Service & Licensing Waivers

For some professionals, the CFA can lead to entrepreneurial opportunities. With the knowledge gained from the CFA program, you might decide to start your own financial services firm or consultancy. The credibility and trust that come with the CFA designation can make it easier to attract clients and establish your business. Additionally, the CFA charter provides access to various licensing waivers, reducing the barriers to entry for other financial certifications such as CAIA (Chartered Alternative Investment Analyst) or CMT (Chartered Market Technician), further enhancing your professional credentials and scope of services.

Work Requirements

To earn the CFA charter, you must meet the work experience requirement, which entails at least four years of professional work in an investment decision-making process. This experience can be gained in various roles, including asset management, financial analysis, corporate finance, or risk management. The work must be directly related to investment decision-making and should demonstrate your ability to apply the knowledge and skills learned throughout the CFA program. This requirement ensures that CFA charter holders have both the theoretical knowledge and the practical experience needed to succeed in the finance industry.

Job Profiles after CFA

If you have completed one or more levels of CFA or have completed all three levels and are officially a CFA charter holder, there are numerous job profiles that you can start working in. Moreover, you may also get the opportunity to work as a finance professional outside India if your skills and resume are strong enough!

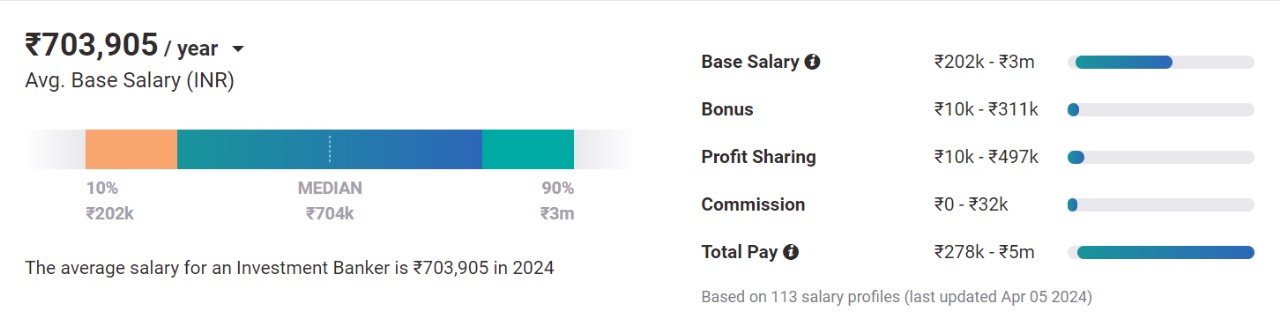

1. Investment Banker

For many students, the main reason behind pursuing CFA is to get into the field of investment banking. The primary job role of an Investment Banker is to manage the investments of a company and raise money for them. They look after the investment portfolio of their organisation and, based on their valuation results, offer recommendations for private equity transactions, mergers and acquisitions, and product offerings.

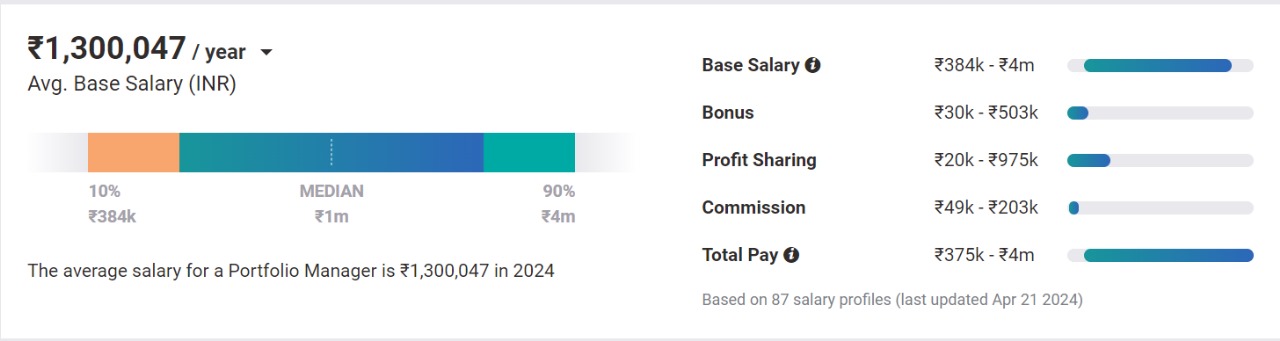

2. Portfolio Manager

A Portfolio Manager is someone who manages the existing assets and investment strategies of a company. Such professionals are required to manage their client’s portfolio based on how much risk their client is able and willing to take and how much they can invest for the short term or long term.

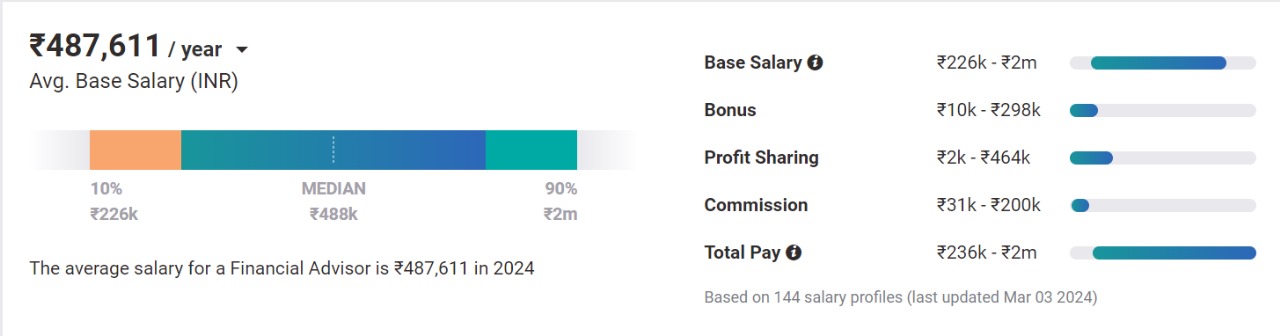

3. Financial Advisory

Working as a Financial Advisor mainly involves gathering data from the financial statements of an organisation and analysing this data to help them make better financial decisions in the future. They offer forecasts and suggestions regarding the next steps that an organisation should take when it comes to managing its finances.

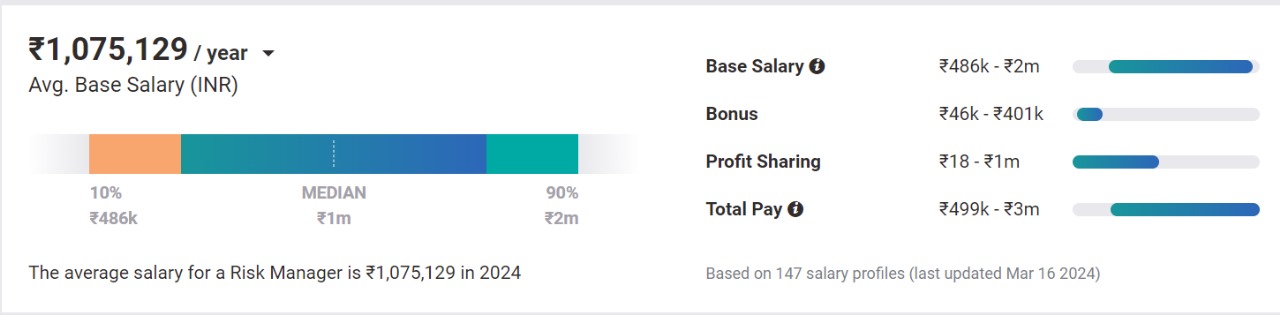

4. Risk Manager

A risk manager is a professional who analyses the amount of risk faced by an organisation and suggests ways to reduce that risk. They also help determine the potential loss that may be incurred by the organisation as a result of that risk. A risk manager also manages the liability programs and directly operates the risk management program of a company. You can also pursue risk management after completing FRM, but the salary to be expected will increase drastically after CFA.

5. Hedge Funds Manager

Hedge funds are investment partnerships where funds pooled funds are managed using aggressive investment strategies in order to earn higher returns. A professional who manages these funds is known as a Hedge Fund Manager. Such professionals make investment decisions on behalf of High-Net-Worth Individuals (HNWI) and attempt to improve the performance of their existing investments.

The Chartered Financial Analyst is a globally recognised qualification in the field of finance and investment. If you are looking to step into a career in finance, pursuing CFA will definitely help you along the way. If you have recently completed your graduation or are appearing for your final semester, you may be eligible to become a CFA. Interested? We highly recommend checking out our Chartered Financial Analyst (CFA) Program.

Planning to Pursue CFA Accounting Career?

To Book Your Free Counselling Session

FAQs on Is CFA Course Worth it

Can I pursue CFA after FRM?

Yes, you can. Since the eligibility for FRM is 12th grade, most students usually start pursuing FRM early in their careers. A combination of FRM and CFA will only strengthen your resume as qualified finance professional.

When should I start studying for CFA level 1?

If you have made a concrete decision to pursue CFA after completing your 12th grade, ideally you should start preparing for your Level 1 exam at least by your second year of college. This not only keeps you in a consistent routine of studying but also helps you prepare better for the exam.

Can I pursue CFA after graduating with a Science background?

Yes, you can! A lesser-known fact about CFA is that a graduate from any of the three fields i.e. Commerce, Science, or Arts, can pursue CFA.