The IT and banking and finance sectors in India contributed to 93% of the net increase in jobs in FY22. Without these sectors, the employment growth would have been only about 1.8% as opposed to the 10.2% including these sectors.

Moreover, the BFSI sector is recruiting employees not only from Tier 1 cities but also from Tier 2 and Tier 3 cities. Jaipur tops the list for the cities with the largest year-on-year growth, followed by Pune and Mumbai. These stats evidently point at promising career prospects in the banking and financial services sector.

Read on to learn more about the job roles and career options in this field.

Top 10 Career Options in Financial Services and Capital Markets

Financial services and capital markets offer a broad range of career opportunities, each with unique roles and responsibilities. Popular career paths include investment banking, where professionals help companies raise funds and navigate mergers and acquisitions. Equity research analysts focus on evaluating securities and providing insights to investors. Portfolio managers oversee investment funds and ensure optimal asset allocation. Risk analysts work to identify and mitigate potential financial threats. Financial planners and wealth managers assist individuals in managing their finances and achieving long-term goals. Compliance officers ensure organizations adhere to regulations, while corporate finance analysts handle budgeting, forecasting, and financial analysis. Quantitative analysts use advanced math to support trading strategies, and traders actively buy and sell securities in global markets.

Curious About Career Options in Financial Services and Capital Markets

Overview of Financial Services

The financial services industry covers a wide spectrum including banking, investment management, insurance, and advisory services. It serves as the backbone of the global economy, facilitating transactions, managing assets, and providing capital to businesses and individuals. Capital markets, a key component of this sector, deal specifically with equity and debt instruments used by companies to raise long-term funds.

Benefits of Working in Financial Services and Capital Markets

Working in this field provides exposure to fast-paced environments and offers lucrative compensation packages. Professionals benefit from access to international markets, networking with top-tier clients, and involvement in high-impact financial transactions. The dynamic nature of the industry encourages continuous learning and skill development.

Global Job Opportunities

There is no shortage of international roles in financial services and capital markets. With financial hubs located in cities like London, New York, Hong Kong, and Dubai, professionals can pursue careers across borders. Many firms have global footprints, and mobility is encouraged through cross-country assignments and client engagements.

The Never-Ending Challenges

The financial world is constantly changing due to market volatility, shifting regulations, and technological advancements. This creates a challenging yet stimulating environment where professionals must adapt quickly, make informed decisions, and continuously upgrade their knowledge and tools to stay relevant.

Ease in Shifting Careers

The skills acquired in this domain—such as data analysis, client management, and strategic thinking—are highly transferable. Professionals can transition into related fields like fintech, consulting, entrepreneurship, or even regulatory bodies. The versatility of finance roles offers flexibility in career planning.

Stable Career Choices

Certain areas within the industry remain consistently in demand. Careers in risk management, compliance, and financial planning provide long-term career stability. Even during economic downturns, these functions are essential to protect organizations and guide them through uncertainty.

Required Education and Skills

A strong foundation in finance, accounting, economics, or business is essential for entering this industry. Analytical thinking, quantitative aptitude, and technological proficiency are key. Familiarity with financial modeling tools and platforms such as Excel, Bloomberg, and ERP systems adds significant value.

Higher Education

Many professionals choose to pursue postgraduate degrees such as an MBA or a Master’s in Finance to accelerate career growth. These programs not only provide advanced technical knowledge but also offer valuable networking opportunities and access to global recruiters.

Professional Certification

The CPA, FRM, CIMA and CFA certifications enhance credibility and career prospects. These globally recognized qualifications validate expertise in specialized areas and often serve as a requirement for senior roles in investment management, risk analysis, and corporate finance.

Fluency in Current Events

Keeping up with economic trends, geopolitical developments, and market movements is crucial. Employers look for candidates who can interpret news and understand its impact on investment decisions, company valuations, and risk scenarios.

Soft Skills

Success in financial services and capital markets also depends on interpersonal skills. Professionals need to communicate complex ideas clearly, build strong client relationships, work effectively in teams, and demonstrate resilience in high-pressure situations. Soft skills often distinguish top performers in a highly competitive industry.

Top Career Options to Consider in the Capital Markets

Here are some of the most challenging yet rewarding career options to consider in financial services and capital markets:

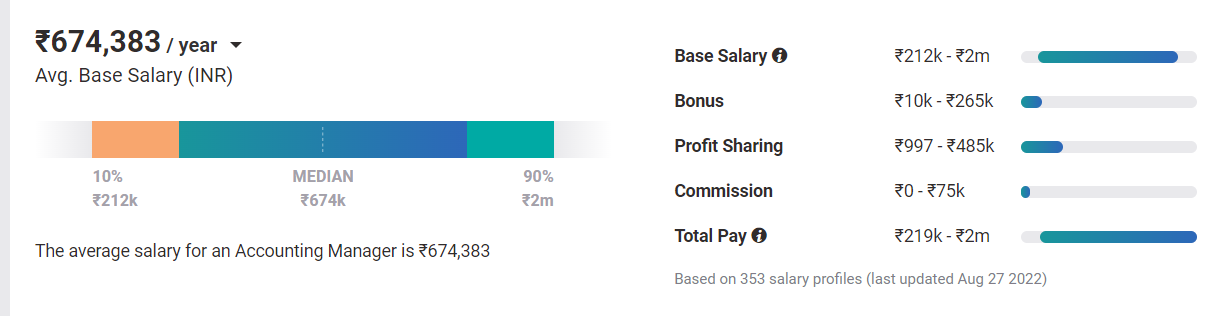

1. Accounting Manager

An Accounting Manager is responsible for an organization’s accounts. They are in charge of keeping the general ledger system up to date. Accounting Managers also create monthly financial statements and deliver them to management along with regulatory reporting.

The average salary of an Accounting Manager is INR 6,74,383.

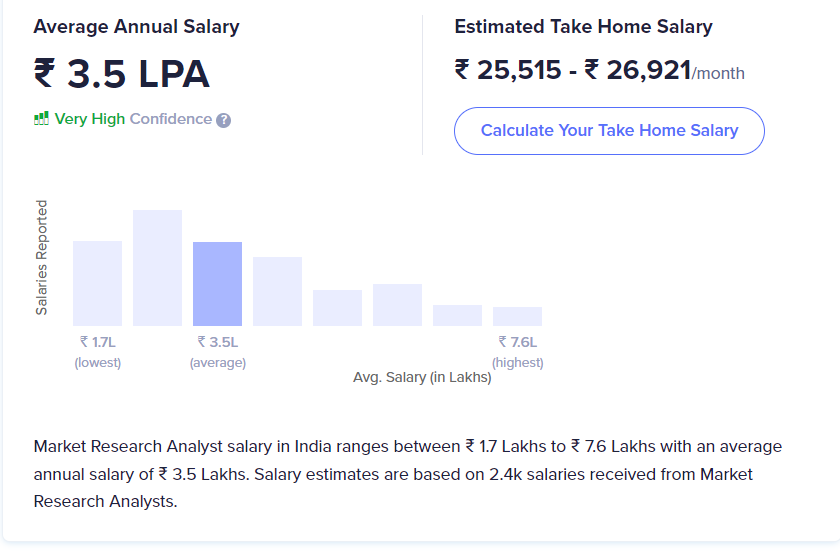

2. Market Research Analyst

Businesses employ Market Research Analysts to gather and compile data related to competitors and consumers. They must know market trends, third-party research, and best practices. A Market Research Analyst assists clients in making investment decisions in the stock market by looking at the performance history of a company or its shares.

The average salary of a Market Research Analyst is 3.5 LPA.

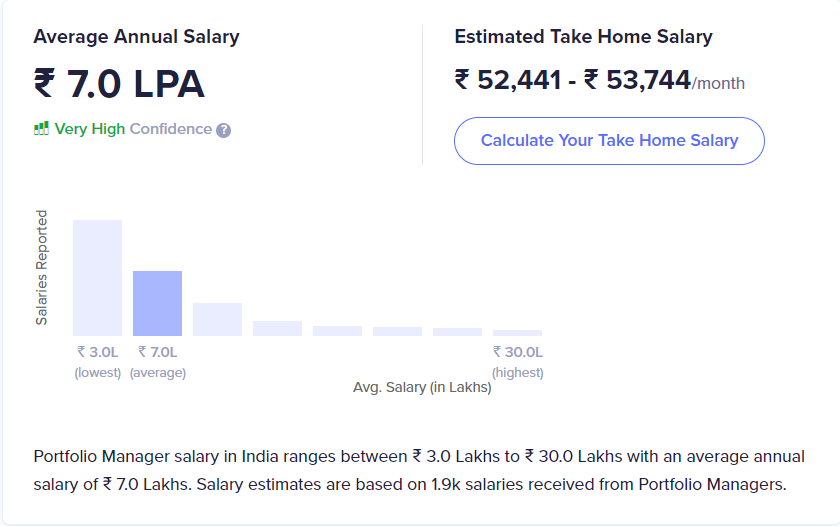

3. Portfolio Manager

A Portfolio Manager creates and implements investment plans for private individuals or companies. Portfolio Managers usually work independently or in investment banks, insurance companies, or mutual fund companies. Their aim is to minimize risks and maximize profits for clients.

The average salary for Portfolio Managers in India is 7.0 LPA, which can go up to 30 LPA with experience.

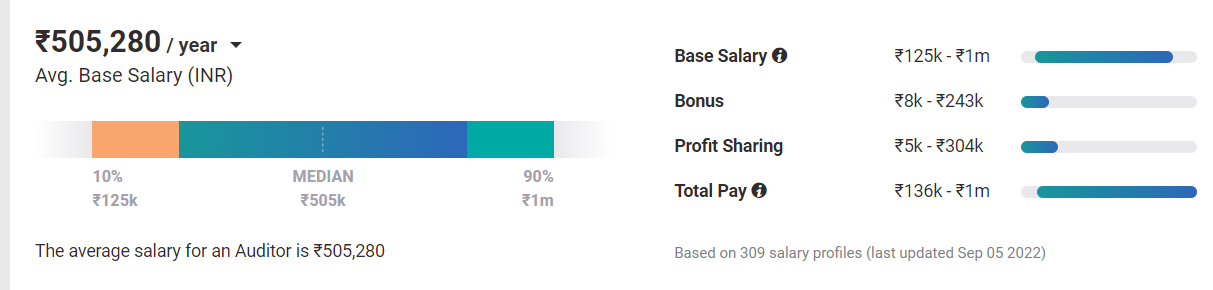

4. Auditor

An Auditor is a key individual involved in reviewing and verifying financial statements and records. They take care of the financial operations of a company and ensure the efficient running of an organization. Auditors are also responsible for detecting discrepancies in the operations of the company.

The average base salary for Auditors in India is INR 504,582

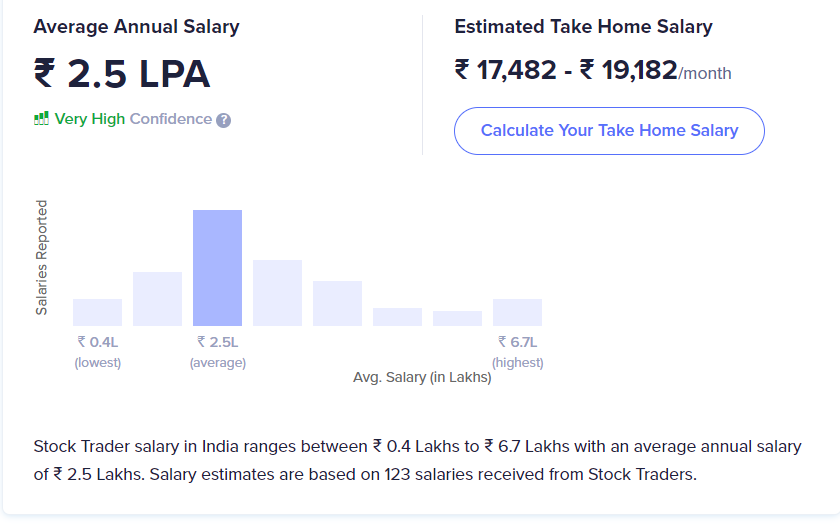

5. Stock Trader

When talking about career options in the capital market, we cannot miss out on talking about a Stock Trader. Stock Traders are professionals who speculate on the success or failure of securities and buy and sell stocks for themselves or on behalf of an individual or a company. They do this by analyzing economic data and trends.

The average salary of a Stock Trader is 2.5 LPA.

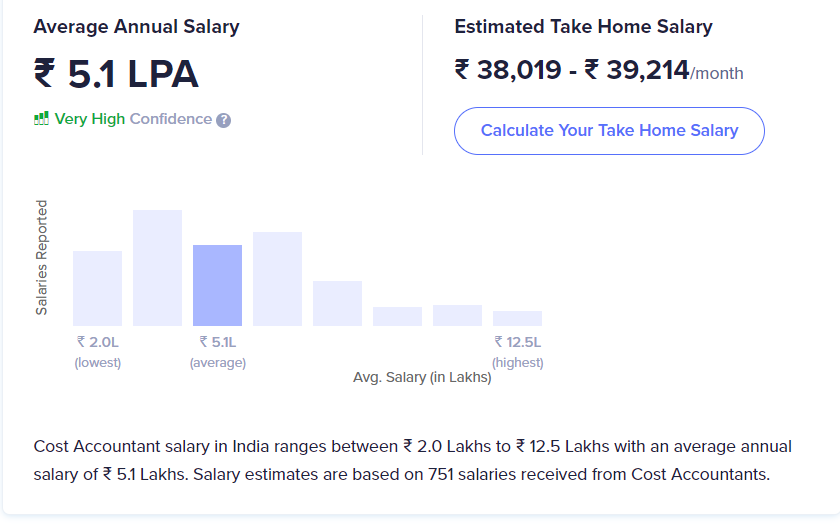

6. Cost Accountant

Cost Accountants are responsible for creating, implementing, and maintaining internal control systems. They make and maintain costing sheets, cost accounts, performance records and other financial data. They also generate monthly profit and loss statements and record all costs incurred during the firm’s operation.

The average salary of Cost Accountants is 5.1 LPA.

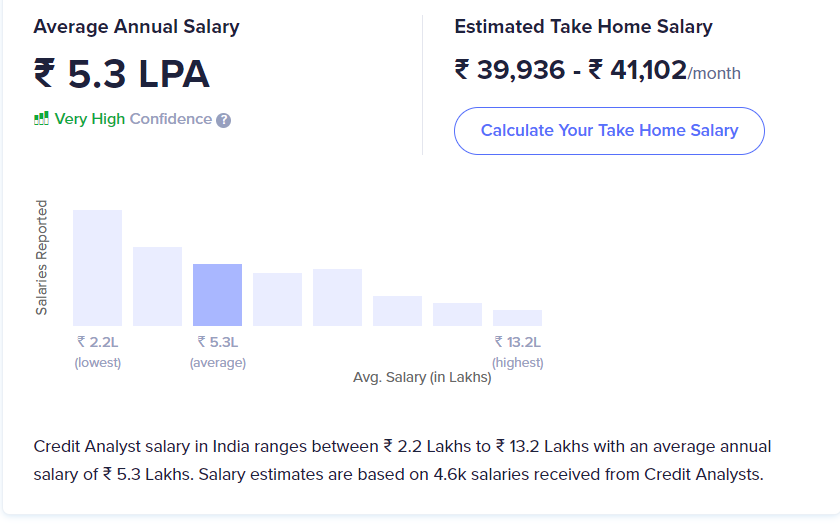

7. Credit Analyst

A Credit Analyst’s role is to assess the creditworthiness of a person or a firm and assess if the party will adhere to their financial obligations. They are usually a part of commercial or investment banks. They also perform due diligence and undertake risk assessments.

The average salary of Credit Risk Analysts is 5.3 LPA.

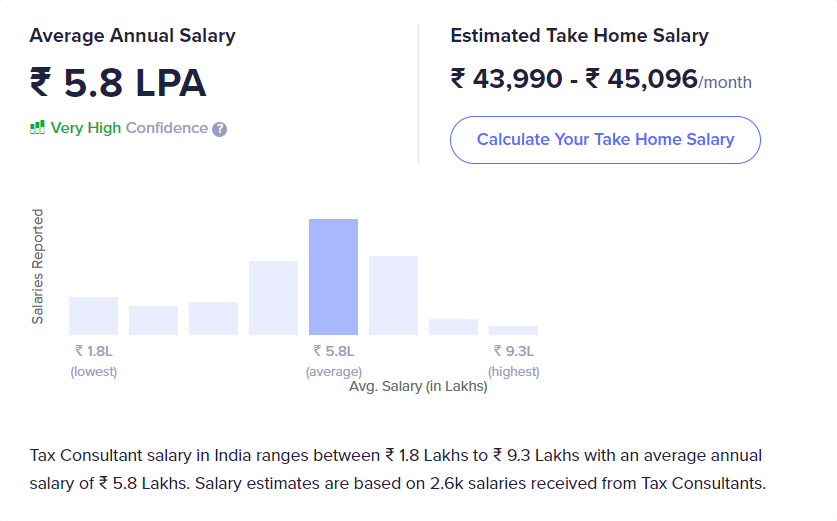

8. Tax Consultant

Tax Consultants are involved in providing tax-related advice to companies or individuals. A Tax Consultant works with clients to reduce the latter’s tax liabilities and boost savings. Tax Consultants develop tax-efficient business plans for clients with domestic and international operations in various commercial circumstances, such as takeovers, mergers, and company restructuring.

The average salary of a Tax Consultant is 5.8 LPA.

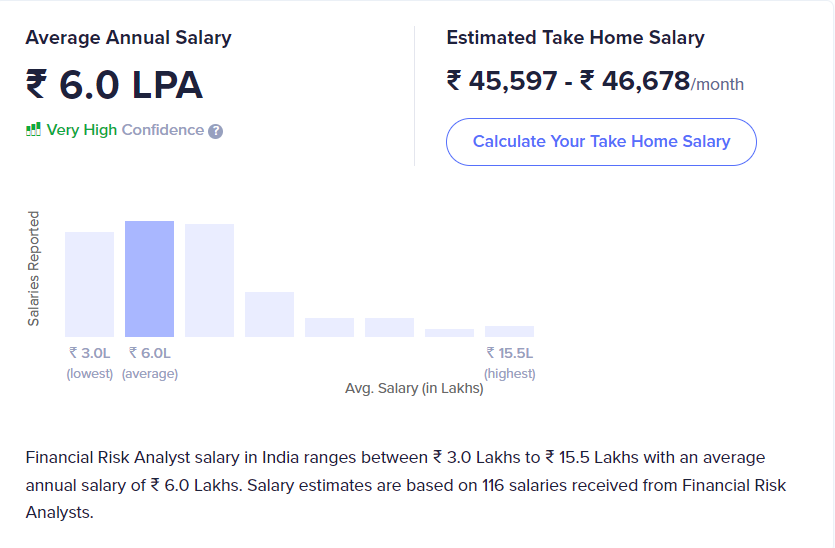

9. Financial Risk Analyst

Risk Analyst is one of the most in-demand career opportunities in financial markets. Financial Risk Analysts assist clients in estimating the financial risks related to critical business decisions. A Financial Risk Analyst must carefully analyze data to comprehend potential risks and business outcomes. They need to have strong analytical skills to arrive at such crucial decisions.

The average salary of Financial Risk Analysts is 6 LPA.

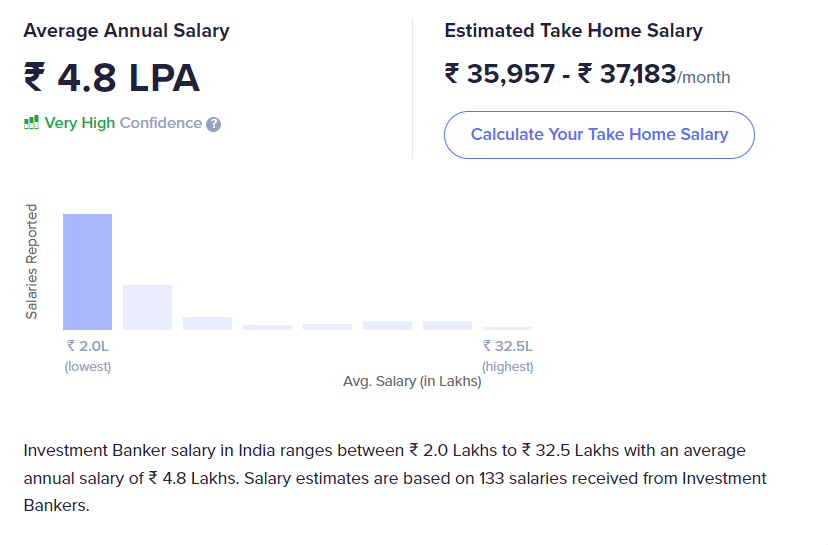

10. Investment Banker

Investment Bankers work for financial institutions, and their job is primarily concerned with generating revenue for businesses, governments, or other bodies. Investment Bankers assist in structuring acquisitions, mergers, or sales for their customers as part of large, complex financial transactions. An Investment Banker also helps identify potential hazards before a company moves forward with a business deal.

The average salary of Investment Bankers in India is 4.4 LPA but can go up to 33 LPA.

Conclusion

Pursuing a career in financial services and capital markets comes with its own set of challenges. Getting a CFA certification is the best way to advance your career in this field. A CFA course can give you lucrative work opportunities in India and abroad.

Check out Zell Education if you want to enroll in an Association of Certified Chartered Accountants or CFA course. Zell strives to ensure holistic skill upgradation with personalized study plans, interactive online classes, and guidance from eminent faculty. Key highlights of our program? 80% passing rate, 1:1 mentorship, and 100% placement assistance!

Planning to Pursue Accounting and Finance Career?

To Book Your Free Counselling Session

FAQs on Career Options In Financial Services and Capital Markets:

What are the four career Pathways in finance?

Cost Accounting, Auditing, Underwriting, and Investment Banking are four popular career pathways in finance.

What is the highest-paid career in finance?

A career in Investment Banking is one of the highest-paid careers in Finance. Investment Bankers in India can make up to 33 LPA with experience and the right skills.

What is the scope of the capital market?

The scope of the capital market is likely to increase in future. Reports suggest that the Global equities market value rose 16.6% year on year to $124.4 trillion in 2021.

How do I start a career in financial markets?

To pursue a career in financial markets, you must have a Bachelor’s degree followed by professional certifications like ACCA or CFA.