ACCA Exemptions After CA Guide

Looking to enhance your international accounting credential as a Chartered Accountant? Well, ACCA is your route to international recognition! And guess what? As a qualified CA, the pathway to ACCA is shortened through exemptions of papers, saving you time and effort along with gaining a highly respectable qualification. So, let’s jump into everything you need to know about ACCA Exemption after CA!

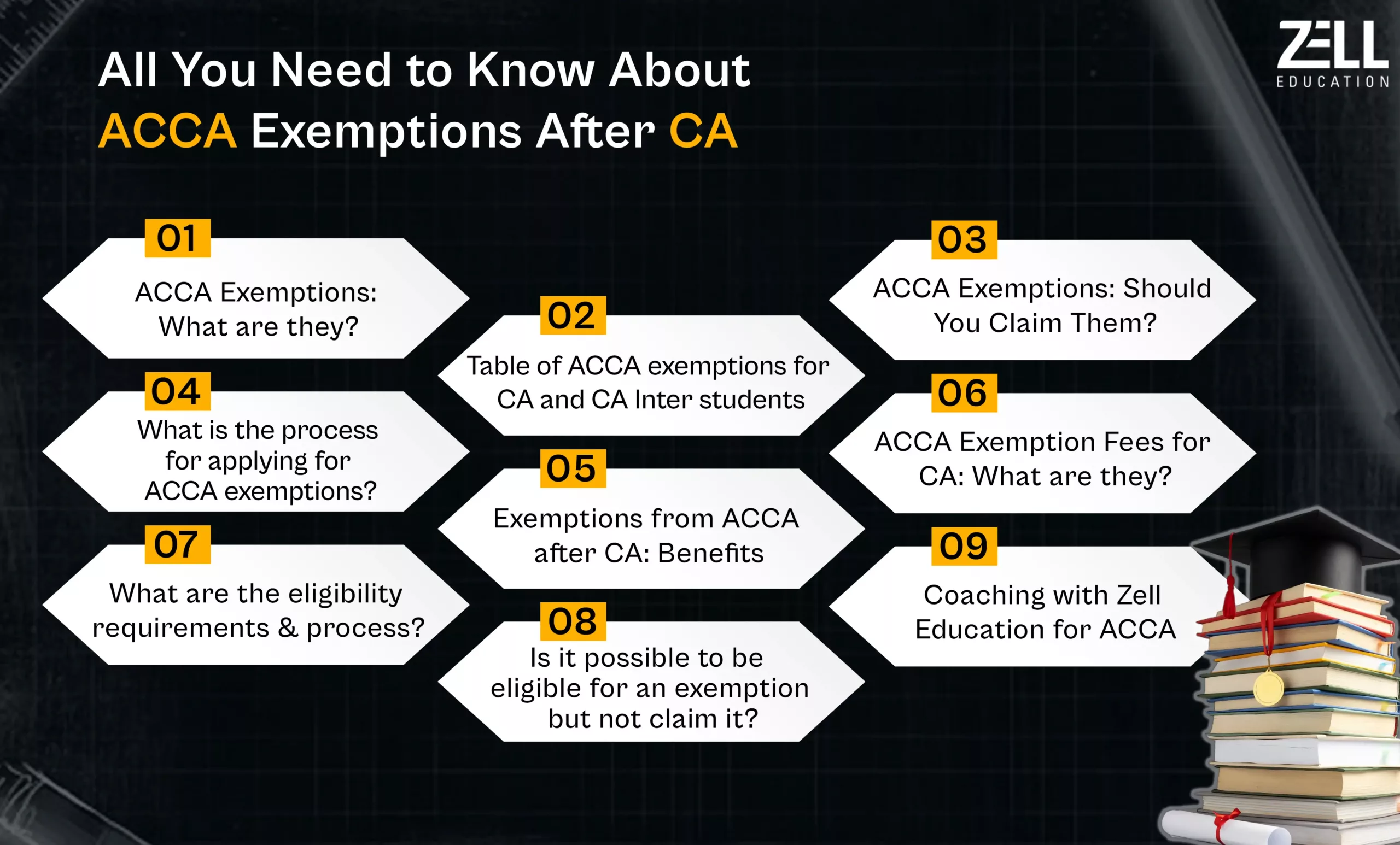

ACCA Exemptions: What Are They?

ACCA gives exemptions to the candidates to skip certain exams based on their previous studies and experience. This would make your ACCA journey easier and time-saving. Such exemptions are given to only those who already had completed studies on similar subjects, like CA, MBA, and B. Com among other recognized certifications. These exemptions vary from one qualification to another; a candidate may get up to 9 exemptions at foundational and applied levels. This enables easy processing and reduces the number of examinations one will take for the professional designation of ACCA.

Table of ACCA Exemptions for CA

| CA Levels | ACCA Exemptions for CA |

| After CA Foundation | The Certificate of completion of the CA Foundation does not lead to any exemption towards the ACCA qualification which implies that all the examinations prescribed by the ACCA syllabus must be taken by the students of this particular qualification. |

| After CA Intermediate | After CA Intermediate you can receive up to 5 paper exemptions, you will still need to give 8 papers to qualify as an ACCA professional. |

| After becoming a CA | CA can receive up to 9 exemptions from ACCA 13 papers. It provides a direct entry route for Indian CAs to the professional level with just 4 remaining papers to be qualified. |

ACCA Exemptions: Should You Claim Them?

Qualifications and Work Experience

Exemptions, if you have recently qualified as a CA or have any other relevant qualifications, or have been actively working in accounting or finance, save your time by skipping topics you are already familiar with; hence, it will let you focus on new areas and accelerate your ACCA journey.

Think about the Cost

Financially, the exemptions will save you study materials, tuition, and your time which you would use in preparations. Remember that you need to pay the fee for an exemption, which is normally almost equivalent to the exam fee that you would pay if you were taking the exam. Weigh the cost of the fees for exemption against what you stand to benefit by refreshing your knowledge in taking this exam.

Number of Gap Years

If a considerable time has elapsed since the completion of your education or any relevant work, then you should consider sitting for the exams. A longer break may result in knowledge gaps, and taking the exams will help refresh your skills and keep you updated about contemporary practices.

State of Your Preparation

Consider your present state of preparation if you are not sure whether to claim an exemption. One of the fine ways to do some revision and try past ACCA exam papers for preparation on subjects for which you may wish to claim exemptions. If after going through your answers, you feel happy with them, then you can go ahead to claim your exemptions. In case you struggle with key topics, it is wise to sit and strengthen your basics.

What is the Process for Applying for ACCA Exemptions?

Eligibility Check: Go to the official website of ACCA and use the Exemptions Calculator to check your exemptions based on your previous qualifications or work experience.

Registration to ACCA: While registering online, state your qualifications or work experience and select the exemptions that you are applying for.

Submission of Documents: Upload certified copies of academic certificates and transcripts to enable ACCA to review them.

Pay for the exemption fees: The exemption fee is usually the same as what you pay for the exam that you are asking for an exemption.

Confirmation of Approval: Once your application has been reviewed and considered by ACCA, you are informed through your web portal account of the exemptions that have been granted. You can go ahead and start preparing for your other remaining exams.

ACCA After CA Exemptions Benefits

Saves Time

ACCA exemptions after CA speed up the qualification for the CAs by exempting them from subjects they are already proficient in. This reduces the length of time required to achieve the ACCA qualification, which acts as an added advantage for career development purposes and transitioning into new roles at a greater pace.

Efficiency in Terms of Costs

Exemptions cut down on some of the costs, such as coaching fees and study material costs. These exemptions take a huge financial burden off your shoulders.

Boosting Morale

Exemptions given based on the CA qualification acknowledge the competence gained and thereby enhance one’s level of confidence and motivation. It speaks of the value of the CA qualification and adds to professional standing when CA professionals go through the ACCA qualification.

Focused Learning

With exemptions, professionals of CA will have a greater ability to concentrate on those areas that are new or challenging in the ACCA syllabus without having to go through areas that they are already conversant with. This kind of focused approach enhances efficiency in learning and makes the preparation more relevant to the career development of the candidates.

Is it Possible to be Eligible for an Exemption but Not Claim it?

Yes, a candidate can be eligible for ACCA exemption but may choose not to claim the exemptions. There can be several reasons why a candidate might choose not to take the exemptions, which may simply include a desire to refresh knowledge for some subjects or to maintain a uniform level of understanding across all subjects. Other candidates may also find that it is far better to take all the examinations as it will help them have a more comprehensive preparation for the ACCA qualification.

Coaching with Zell Education for ACCA

Zell Education provides specialized coaching to the aspirants of ACCA by helping them with expert guidance and resources necessary to pass ACCA exams. Zell Education offers support and strategic study plans. Zell prepares students for both exempted and non-exempted papers, ensuring they are well-prepared for their ACCA exams.

Conclusion

The ACCA exemptions details hold several significant benefits for Chartered Accountants in saving time and cost and boosting morale. They also enable CA professionals to invest in more advanced topics. Choosing to claim exemptions depends upon personal preferences and career choices. By opting for Zell Education’s ACCA course, you can avail their excellent resources which will help you in your preparation. Their expert guidance and support will make your ACCA journey easier.

FAQ’s on ACCA Exemptions After CA

Does getting ACCA exemptions take a long time?

No, the procedure for taking ACCA exemptions is usually simple and does not require a long time. Once the eligibility is verified, the exemptions are given without much waste of time.

After B.Com, which ACCA papers are exempt?

Candidates who complete a B. Com are typically exempted from the first 4 papers at the Fundamentals level of qualification. That would imply being able to begin at the Applied Skills level.

When do ACCA exemptions expire?

ACCA exemptions do not expire; however, they are subject to the rules of the ACCA at the time an application is submitted. It is best if one checks the latest guidelines to ensure that the exemptions remain valid throughout one’s journey in ACCA.

Can ACCA exemptions be beneficial?

Yes, ACCA exemptions can be very rewarding indeed. They save on valuable time and cost, boost morale, and facilitate focused learning by skipping over topics already learned from earlier qualifications.