If your confusion is between the two most popular finance and accounting courses like CPA vs MBA, then it’s time to break the tie between the two and find out the right course for you.

What is CPA?

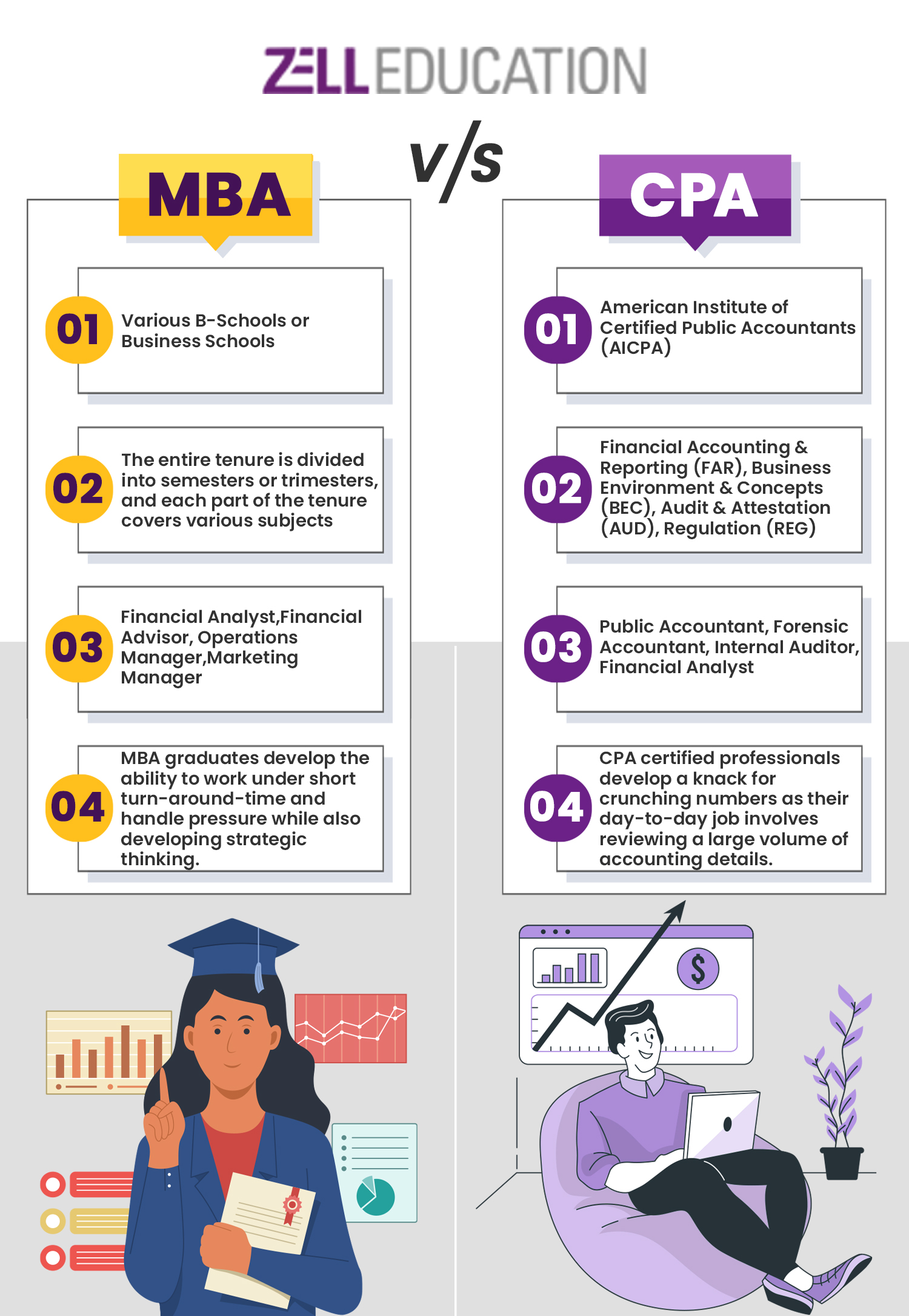

A CPA is essentially a Certified Public Accountant, which is administered by the American Institute of Certified Public Accountants. CPA is basically the American version of what we call a Chartered Accountant in India.

The CPA course has now gained tremendous popularity and has a great scope now in India as well as many other countries such as the USA, Canada, Singapore and the Gulf Countries as well.

What is MBA?

An MBA (Master of Business Administration) is a postgraduate degree for candidates who want to kickstart a career in business management. Among the many specializations offered, you can go for an MBA in Finance if you wish to apply your managerial skills to the finance sector.

An MBA specializing in finance is suitable for people with a vision for a successful career in finance. The program imparts knowledge of the management of finances and accounts for companies.

CPA vs MBA: Major Differences

| Point of Difference | US CPA | MBA |

| Organizing body | IMA (Institute of Management Accountants) awards the CPA designation to individuals who have successfully completed the course. | Private and public universities and colleges worldwide offer MBA courses to interested candidates. |

| Fees comparison | The CPA course is more affordable than an MBA course.

The standard evaluation fee for checking eligibility is around INR 22000, while the exam fee is USD $900 (may vary). |

Depending on the college, it will cost you between INR 4 to 20 LPA to complete your MBA degree.

MBA fees are much higher than FRM since autonomous authorities provide the course. |

| Course duration | The entire duration of the US CPA course could range from 12 to 18 months. | An MBA program from a reputed university will take two years to complete. |

| Syllabus | The syllabus includes

Financial Accounting and Reporting (FAR) Auditing and Attestation (AUD) (72 questions from each of these subjects are asked.) Business Environment and Concepts (BEC) Regulation (REG) |

The syllabus includes

Business Ethics. Financial and Marketing Management. Operations Research. Accounting. Business Statistics. Human Resource Management. |

| Skills | A CPA equips you with specialized skills like financial analysis, auditing, regulatory compliance, tax expertise, and forensic accounting. CPAs are expected to have strong analytical thinking, attention to detail, and ethical judgment. These skills are highly valued in audit firms, multinational companies, and government agencies. | An MBA, particularly in Finance, builds broader business management skills. These include leadership, strategic decision-making, financial planning, marketing, human resource management, and business communication. MBA graduates are trained to think critically, solve complex business problems, and manage cross-functional teams effectively. |

| Job prospect | Common job profiles after US CPA include:

Public Accounting Corporate Controller Tax Examiner Business System Analyst |

An MBA in Finance will land you one of the following job profiles:

Finance Manager Operations Manager Accountant Investment Banker |

| Leadership Opportunities | While CPA roles traditionally focus on technical expertise, leadership opportunities do exist, especially in roles like Chief Financial Officer (CFO), Financial Controller, and Partner at accounting firms. However, the leadership path usually requires additional years of experience and proven expertise in financial management. | An MBA is designed to fast-track candidates into leadership roles. MBA graduates are often placed directly into management training programs, leadership development roles, and upper management positions. Specializations like MBA in Finance, Strategy, or Consulting can lead to roles such as Finance Director, Investment Banker, or even CEO over time. |

| Salary expectations | The mean salary for a Public Accountant in India ranges between INR 3.61 LPA and INR 10 LPA. | The average base salary for a graduate in MBA Finance in India is INR 7.62 LPA. It can go up to INR 20 LPA for an Operations Manager. |

Can You Earn Both a CPA and an MBA?

Yes, absolutely! In fact, earning both a CPA and an MBA can be a game-changer for your career. Many professionals choose to pursue an MBA either before or after getting their CPA to broaden their skill set. A CPA credential establishes you as a technical expert in accounting and finance, while an MBA adds leadership, strategic thinking, and management capabilities to your portfolio.

By combining both qualifications, you position yourself for senior leadership roles like CFO, Financial Consultant, or VP of Finance, where both deep financial expertise and strong management skills are critical. It’s a powerful combo if you aspire to work in top multinational companies or even start your own business.

Curious About CPA vs MBA?

Which Course is Better, CPA vs MBA?

US CPA is the right course if you are interested in crunching numbers and handling public accounts. This course not only helps you gain Chartered Accountancy opportunities in the US but in case you wish to work for US-based companies in India, with a CPA degree you can choose to work at the big 4s. However, if you’re interested in getting into the management side of finance then an MBA degree in finance is just what you need. There’s one thing about an MBA degree that you need to consider before getting into a course. The college you get into to pursue your MBA degree should be one of the top 10 colleges in India to actually make the degree count.

We hope that with this detailed article on CPA vs MBA, you’ve received some detailed information on which course to choose and what to expect. If you wish to pursue US CPA with us or enquire about the range of professional courses that we offer then we suggest that click on the WhatsApp icon at the side of this blog and get in touch with our experts directly.

Planning to Pursue CPA Accounting Career?

To Book Your Free Counselling Session

FAQs on CPA vs MBA

Which is better, MBA or CPA?

Depending on your preference, both courses are good options. However, if you are more inclined towards crunching numbers and keeping accounts then US CPA is the course you should pursue. If you happen to have an interest in the management side of finance then MBA is what you should look out for.

Can I do US CPA after my MBA in finance?

Yes, you can do US CPA after MBA in Finance. All you need is to qualify for the US’s ‘120-hour credit rule’.

What pays more CPA vs MBA?

US CPA fresher salary starts from $66,000 per annum. With about 20 years of experience, one could expect more than a $160,000 annual salary. The salary of an MBA largely depends on the position and the college they’ve completed their studies from.

What is harder CPA vs MBA

The US CPA exams are far more difficult to crack as compared to the MBA exams considering their average passing percentage.

Should I do an MBA after CPA?

If you are looking to transition into management roles or move beyond technical finance and accounting into broader business leadership positions, pursuing an MBA after CPA is a smart move. It can significantly increase your career flexibility, salary potential, and leadership opportunities. However, if your goal is to specialize further in finance, accounting, or auditing, CPA alone can open a lot of doors without necessarily needing an MBA.