Certified Financial Planners (CFPs) are experts whose primary job is to help clients manage their finances related to investments, taxes, insurance, and even retirement planning. A professional certification in financial planning is mandatory to become a Certified Financial Planner. While CFP is a top-rated course for finance enthusiasts in foreign countries, the certification has grown in popularity over the last few years in India. A Certified Financial Planner’s salary in India can start from Rs. 2 LPA and average salary is

The demand for Certified Financial Planner’s is high in India, both in the government and private sectors. In fact, the CFP professional growth rate in India is among the top three globally, making it an attractive career option for finance enthusiasts.

If you’re interested in pursuing financial planning as a career, read on to learn about who a CFP is, the various CFP job roles and the salary of a CFP across these roles.

Who is a Certified Financial Planner?

Certified Financial Planner is a formal designation awarded by the Financial Planning Standards Board (FPSB). CFP is a globally acknowledged credential in finance. The course consists of five exams of six modules.

Listed below are some of the roles and responsibilities of a CFP:

- CFPs identify clients’ risk appetites and guide them in creating their investment portfolios accordingly.

- A CFP must know the client’s sources of income, the flow of money, debts, and asset details, among other information.

- A Certified Finance Planner prepares individual investment roadmaps for their clients after analysing the latter’s critical financial details and identifying the problem areas.

- CFPs help clients pave the path toward financial freedom by offering systematic goal-based planning for clients.

- A CFP tracks their client’s portfolio from time to time and advises them accordingly.

What Does a Certified Financial Planner Do?

A Certified Financial Planner (CFP) helps individuals make informed financial decisions. Their responsibilities include creating personalized investment strategies, tax planning, managing retirement savings, and advising on insurance and estate planning. They act as long-term partners in a client’s financial journey, adjusting strategies as life and markets evolve. Ultimately, a CFP helps clients work toward financial freedom by aligning their goals with the right financial tools and decisions.

What is the CFP Certification?

The CFP certification is a globally recognized designation offered by the Financial Planning Standards Board (FPSB). It validates an individual’s expertise in financial planning across areas like investment, insurance, tax, and estate management. In India, CFP certification consists of five exams covering six modules. To earn this designation, candidates must meet the educational requirements, clear the exams, and adhere to ethical and professional standards.

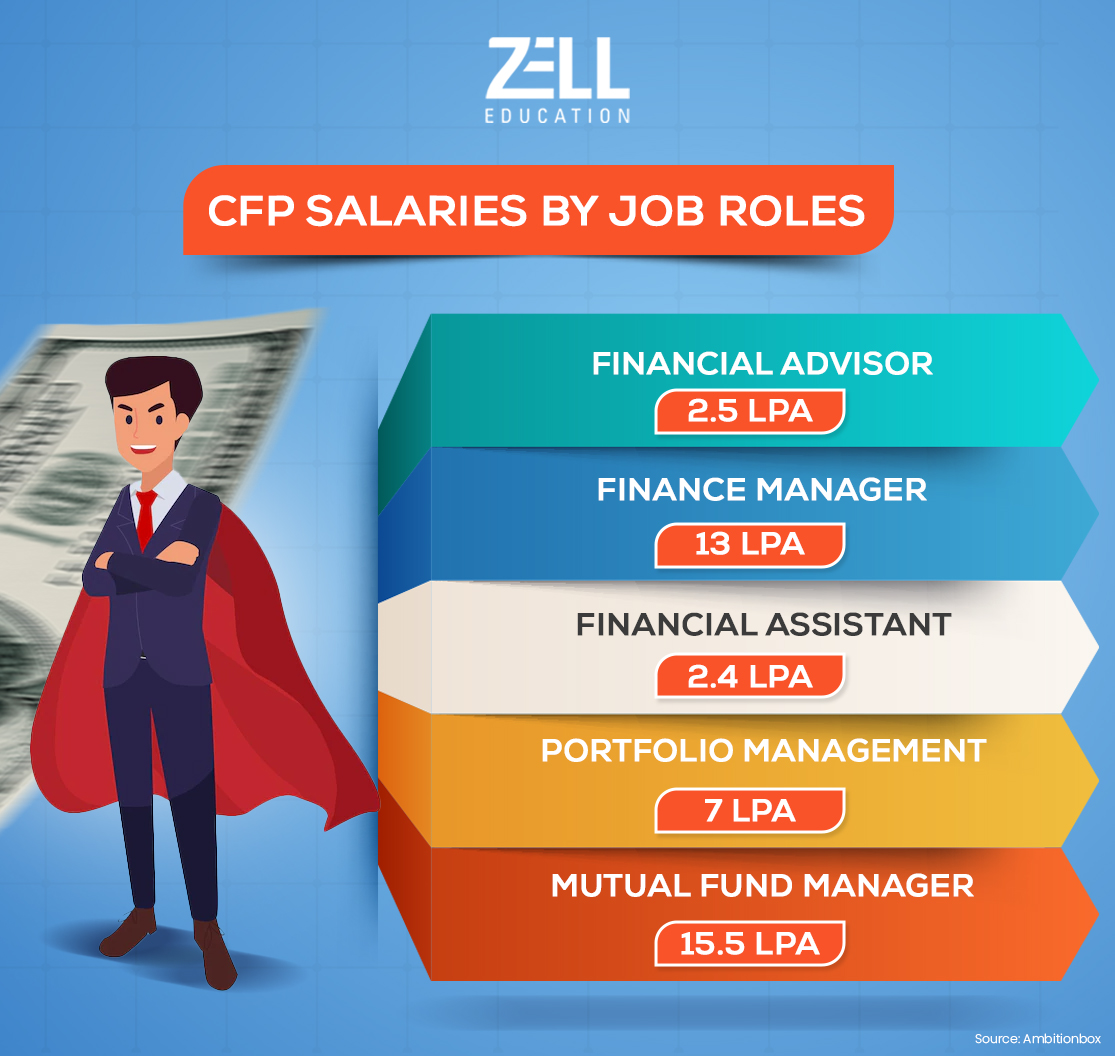

CFP Salaries by Job Roles

Financial planning is a thriving field. As a result, the demand for CFPs is high across various sectors with diverse job opportunities. After completing the CFP course, you are eligible for different job roles such as Investment Banker, Portfolio Manager, Wealth Manager, Mutual Fund Manager, Client Service Associate, and many more.

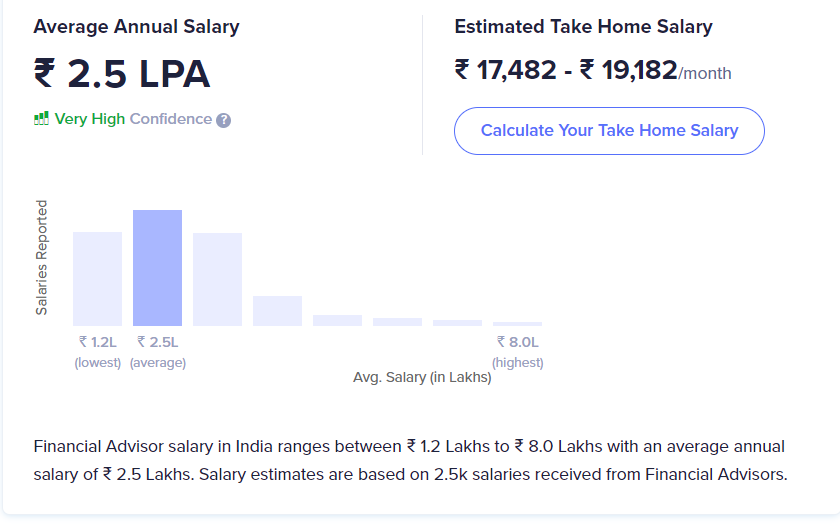

1. Financial Advisor

Financial Advisors guide clients on where, when and how to invest money. This job role has gained massive popularity, and professionals are hired for senior and junior-level posts based on their education, skills and competence.

- Salary: Rs. 2.5 LPA, which can go up to 7.8 LPA

- Hiring Companies: Deloitte, Raymond James, UBS, Bank of America, ICICI

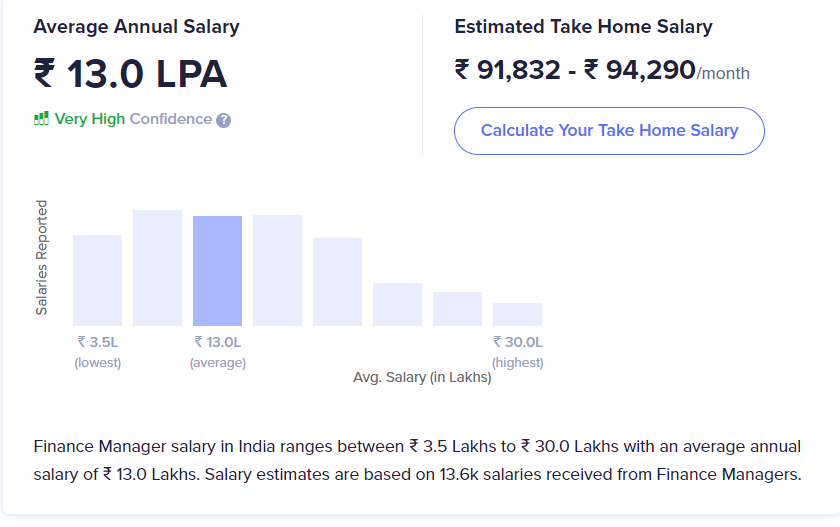

2. Finance Manager

Finance Managers plan the budget for a company, offer financial insights to drive the best business decisions, and oversee a company’s financial health.

- Salary: Rs. 13 LPA, which can go up to 30 LPA

- Hiring Companies: HSBC, Genpact, ITC, ICICI Prudential, Atos

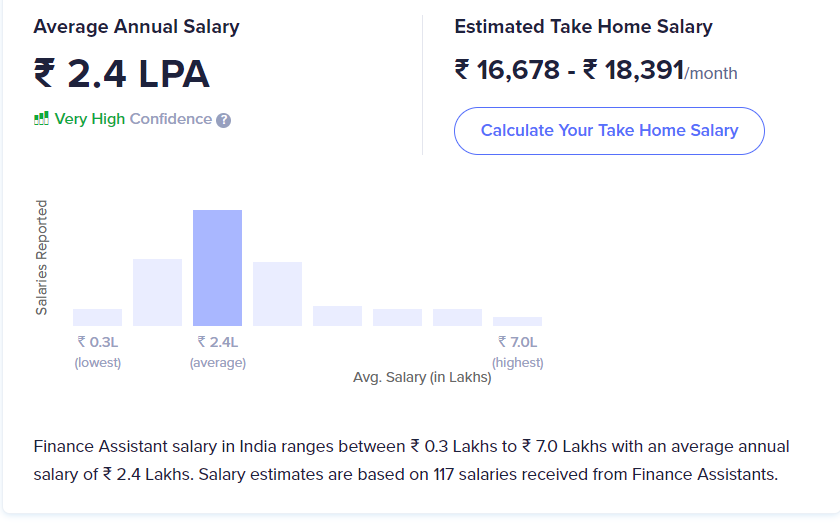

3. Financial Assistant

A Financial Assistant’s primary responsibilities include preparing balance sheets, updating financial reports, and generating invoices. You can become a Financial Assistant with a CFP certification.

- Salary: Rs. 2.4 LPA, which can go up to 7.0 LPA

- Hiring Companies: Deloitte, Accenture, HBD, Bajaj Finance, Manappuram Finance

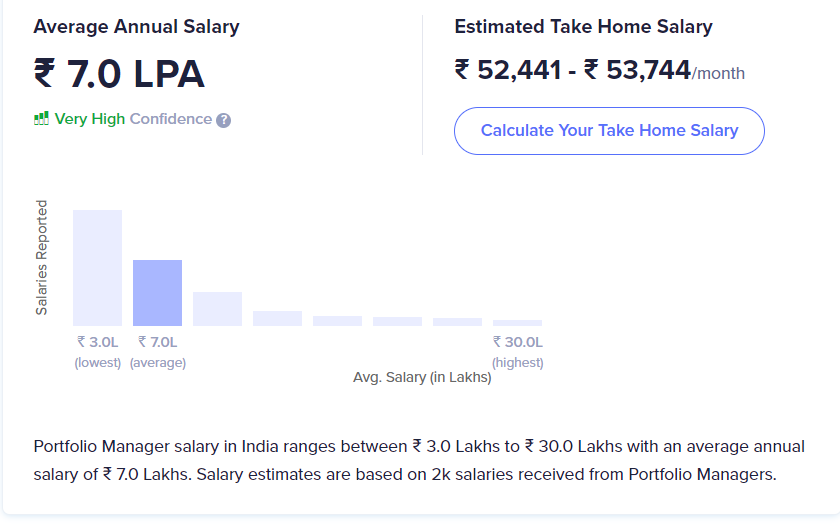

4. Portfolio Management

A Portfolio Manager advises clients on investment policies and asset allocation while informing them about investment risks. Implementing investment strategies and creating and managing client portfolios fall within the job description of a Portfolio Manager.

- Salary: Rs. 7 LPA, which can go up to 30 LPA

- Hiring Companies: Capgemini, Mahindra & Mahindra Financial Services, Investors Clinic

5. Mutual Fund Manager

Being a Mutual Fund Manager is a wise career option for those who wish to explore their management skills. Mutual Fund Managers handle clients’ funds, assist them in making profitable investments and help plan financial goals depending on their objectives.

The primary role of a Mutual Fund Manager is to complete all financial paperwork related to Mutual Funds and oversee the legal requirements of any investment.

- Salary: Rs. 17 LPA, which can go up to 93.7 LPA

- Hiring Companies: Kotak Mahindra Bank, Wipro, HDFC Bank

6. Wealth Manager

Wealth Managers provide holistic financial planning services to high-net-worth individuals (HNWIs). They manage a client’s complete financial portfolio, including investments, real estate, tax strategies, and estate planning. A CFP-certified professional in this role brings structured planning and trust to long-term wealth building.

- Salary: ₹8–25 LPA

- Hiring Companies: Private banks, wealth management firms, family offices

7. Investment Advisor

Investment Advisors help clients choose the best investment vehicles based on their financial goals, risk appetite, and market conditions. CFPs in this role use their in-depth knowledge to provide tailored guidance on equities, mutual funds, fixed income, and alternative investments.

- Salary: ₹5–10 LPA

- Hiring Companies: ICICI Securities, Motilal Oswal, HDFC Securities

8. Retirement Planner

Retirement Planners specialize in helping clients plan for a financially secure post-retirement life. From pension planning to asset allocation and withdrawal strategies, they ensure that clients maintain their desired lifestyle after retirement.

- Salary: ₹4–12 LPA

- Hiring Companies: Professionals working with middle-aged or pre-retirement clients

9. Insurance Advisor

Insurance Advisors assess the insurance needs of clients and recommend appropriate life, health, or property insurance products. With a CFP certification, they’re equipped to consider insurance as part of a broader financial plan rather than a standalone product.

- Salary: ₹3–9 LPA

- Hiring Companies: LIC, ICICI Prudential, Max Life Insurance

10. Estate Planner

Estate Planners help individuals manage and transfer their wealth efficiently through wills, trusts, and other legal instruments. They ensure clients’ assets are distributed as per their wishes while minimizing tax liabilities and legal complications.

- Salary: ₹6–15 LPA

- Skills Required: Knowledge of succession laws, estate tax, and trust formation

Other Popular Financial Planning Qualifications in India (With Base Salary)

In addition to CFP, several other financial planning certifications are recognized in India:

- Chartered Financial Analyst (CFA) – Avg. Salary: ₹6.8 LPA

- Chartered Accountant (CA) – Avg. Salary: ₹8–12 LPA

- Certified Management Accountant (CMA) – Avg. Salary: ₹6–10 LPA

- NISM Certifications – Avg. Salary: ₹3–6 LPA (entry-level roles in financial advisory)

- NCFM (NSE) – Avg. Salary: ₹2.5–5 LPA

Each has a different focus area and ideal career path, depending on your interests and career goals.

CFP vs. CFA: A Comparison

| Feature | CFP | CFA |

| Focus | Personal finance & planning | Investment analysis & portfolio management |

| Duration | 1–1.5 years | 2–4 years (3 levels) |

| Average Salary | ₹3.9 LPA | ₹6.8 LPA |

| Global Recognition | High | Very High |

| Ideal For | Financial planners, advisors | Portfolio managers, analysts |

CFA is more rigorous and investment-focused, while CFP is client-centric and ideal for holistic planning roles.

CFP vs. PFS: A Comparison

| Feature | CFP (India) | PFS (U.S.-based) |

| Full Form | Certified Financial Planner | Personal Financial Specialist |

| Offered By | FPSB | AICPA (U.S.) |

| Focus | Financial planning | Tax and personal finance (CPA-focused) |

| Recognition in India | Very High | Limited |

| Prerequisite | None (open to finance graduates) | CPA License (mandatory) |

CFP is more suitable for Indian finance professionals, while PFS caters to U.S. CPAs with a specialization in personal finance.

Key Factors to Consider When Choosing a Certification

Choosing the right certification depends on your career goals, background, and area of interest. Here are a few key factors to help you decide:

- Career Path – Do you want to work in investment banking, wealth management, or personal financial planning?

- Time Commitment – CFA takes 2–4 years, CFP can be completed in 12–18 months.

- Cost – Consider exam fees, study material, and training costs.

- Global Recognition – If you plan to work abroad, check if the certification is internationally accepted.

- Job Opportunities – Research which certifications are in demand in your desired role or location.

Make an informed choice that aligns with your long-term vision and the kind of financial professional you want to become.

Curious About Certified Financial Planner Salary in India?

Conclusion

There are ample career opportunities for skilled Certified Financial Planners. As per the U.S. Bureau of Labor Statistics, the demand for personal financial advisors will rise at a rate of 7% through 2028. Needless to say, a competent Certified Financial Planner’s salary in India can be huge. So, if you are an aspiring finance professional, you can check certification courses like the CFA (Chartered Financial Analyst) course. Not only are these certifications globally recognised, but they teach you the essential skill sets you need to thrive in the finance profession. We at Zell Education are here to guide you through the admission procedure. Contact us to learn more.

FAQs on Certified Financial Planner Salary in India

How much does a Certified Financial Planner (CFP) make in India?

On average, the CFP salary in India for freshers is 3.6 LPA, which can go up to 17 LPA in specific job roles. With experience and enhanced skill sets, you can earn more in a company or work independently.

Is CFP a good career in India?

CFP is a promising career option for finance enthusiasts in India. The number of CFP professionals in India increased by 17.6% in 2021. There is a huge demand for good financial planners in India, with diverse job opportunities across various sectors.

Is CFP demand in India?

There is a good demand for CFP professionals in the Indian job market. According to the CEO of the Financial Planning Standards Board (FPSB), the growth rate of CFP professionals in India is among the top three globally.

Which is better, CFP or CFA?

CFA is comparatively more challenging than CFP since CFA requires you to clear three levels of examinations. On the other hand, CFP has only one exam. Even the average CFA’s salary is around Rs 6.8 LPA vs the average CFP salary, which is around Rs 3.9 LPA.

What is the starting salary for a Certified Financial Planner (CFP) in India?

The starting Certified Financial Planner’s (CFP) salary in India is 3.0 LPA.

Why Zell?

- • Largest Provider for Global F&A Courses

- • 4.6 Google Review Rating

- • 1000+ Global Placement Partners

- • Placement Opportunities at the Big 4

- • 100+ Global & Indian Rank Holders

- • 100+ Faculty Network

- • 10,000+ Students Placed

Speak to A Career Counselor

Speak To A Course Expert To Know More