Why IFRS is Important For Performance Management

In the world of business, performance management is critical to ensure that companies can achieve their goals and objectives effectively. A significant aspect of performance management is financial reporting, which is essential for decision-making and measuring the success of a business. To ensure that financial reporting is standardized and reliable, many companies adopt the International Financial Reporting Standards (IFRS). In this blog post, we will explore why IFRS is important for performance management.

IFRS is a set of globally recognized accounting standards that dictate how companies should prepare and present their financial statements. These standards ensure that financial statements are transparent, reliable, and consistent across different companies and countries. The use of IFRS for financial reporting has become increasingly popular among companies because it promotes transparency, consistency, and comparability of financial information.

To stay compliant with IFRS, it is important to avoid common pitfalls.

One such pitfall is cost accounting, which is a crucial aspect of performance management. While cost accounting provides quantitative data to the management for optimizing business practices, it often fails to capture the necessary qualitative data for controlling current operations and planning for the future.

Decision-making is another crucial aspect of management accounting. It helps in controlling risks and uncertainty in businesses, but many organizations struggle to incorporate circular thinking due to a lack of knowledge and skills.

Budgeting is essential for planning and optimizing business performance. However, using inappropriate techniques and methods can lead to financial problems. Not taking corrective action when things go wrong can also result in budgeting failures.

Performance measurement and control are crucial for assessing and improving organizational performance from both financial and non-financial perspectives. However, the process of collecting, analyzing, and reporting information, as well as the appropriateness of measures and methods of performance, are often overlooked. Effective and efficient systems are needed for top-level management accountants in large organizations.

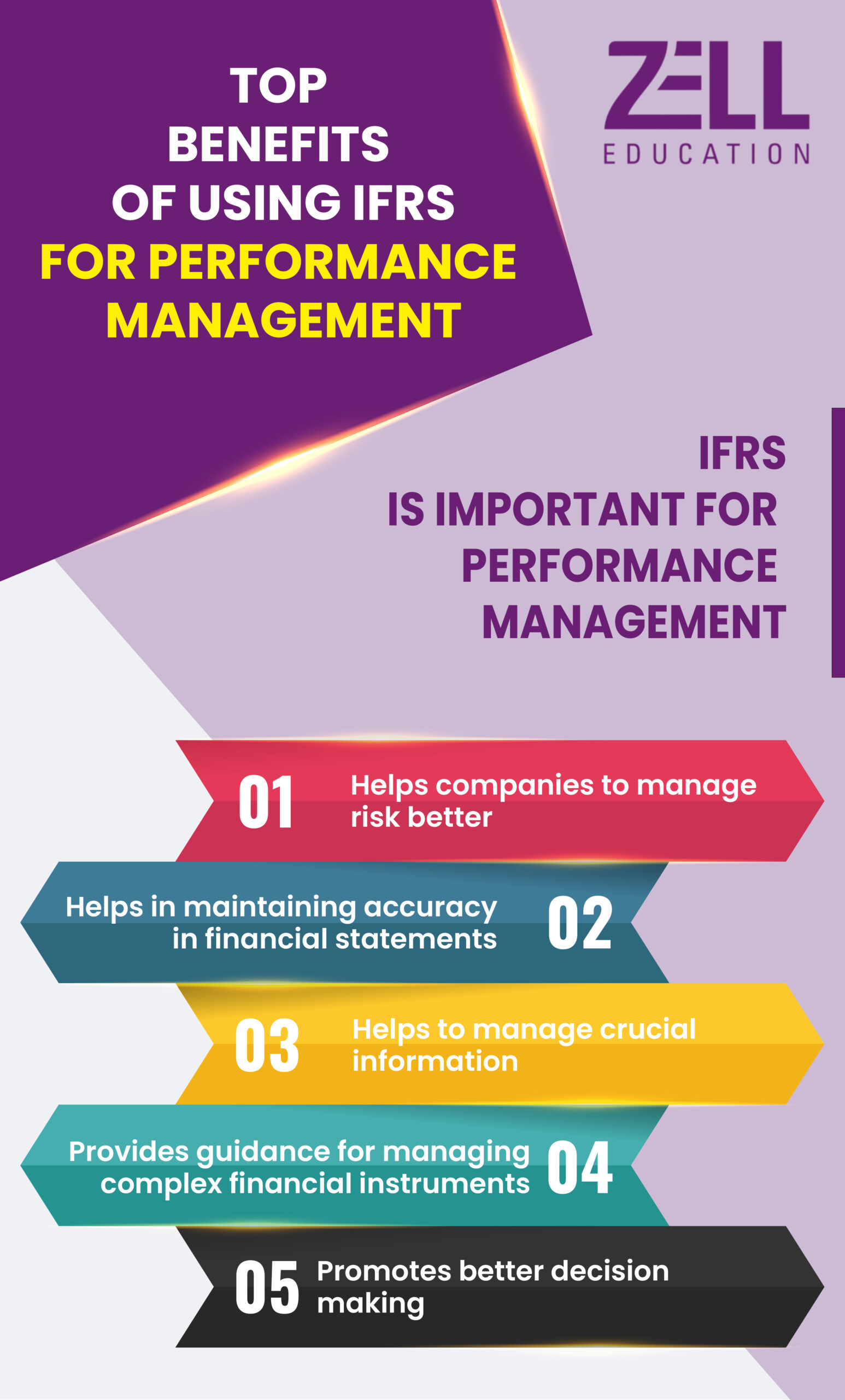

Benefits of using IFRS for performance management

For individuals seeking to enhance their performance management skills, taking an IFRS course can be highly beneficial. IFRS courses cover the key principles and concepts of IFRS, including the requirements for preparing financial statements, the accounting treatment for complex financial transactions, and the disclosure requirements. These courses can help individuals to gain a deeper understanding of financial reporting and performance management, which can be useful in a wide range of roles and industries.

- One of the main benefits of using IFRS for performance management is that it helps companies to better manage risk.

- By adopting IFRS, companies can ensure that their financial statements accurately reflect their financial position, performance, and cash flows.

- Helps manage crucial information for identifying and managing financial risks, such as liquidity risk, credit risk, and market risk.

- IFRS provides guidance on how to account for complex financial instruments, such as derivatives, which can be challenging to account for using traditional accounting standards.

- Using IFRS for performance management is that it promotes better decision-making.

- By using a standardized set of accounting principles, companies can compare their financial performance with that of other companies in the same industry or sector.

- This enables them to make more informed decisions about investments, mergers and acquisitions, and other strategic initiatives.

- Additionally, IFRS requires companies to disclose more information about their financial position, which can provide investors with greater insight into a company’s operations and financial health.

To know more about the benefits of IFRS, read our article Benefits of IFRS Course: Career Scope and Reasons.

In conclusion, IFRS plays a crucial role in performance management by providing a standardized and transparent framework for financial reporting. This framework allows organizations to accurately measure and report their financial performance, which in turn helps in making informed decisions and optimizing business practices. By following IFRS guidelines, organizations can ensure compliance with regulatory requirements, enhance credibility with stakeholders, and ultimately drive long-term success. Therefore, it is imperative for organizations to prioritize IFRS compliance as a key aspect of their performance management strategy.

To keep up with the pace of the changing accounting standards, it’s important to upskill with professional courses. If you’re confused if IFRS is the right course, reach out to us at Zell Education, and we’d be happy to counsel you. You can also fill in the form on the right-hand side and someone from our team will contact you.