Do Banks Hire CFA’s?

A Chartered Financial Analyst course prepares you for the field of investment with the knowledge of financial markets, stocks, trading, fund management, etc. This course also equips you with techniques to analyse finance and find out the company’s risk appetite. The CFA course is an approximately 2 to a 3-year long learning program that gives you in-depth knowledge of financial concepts, making you a complete financial professional that’s ready to take crucial decisions for the company and plan its finances. There are several professions that one can consider after completing CFA exams and becoming a Charterholder. Careers like Financial Analysis, Financial Planning, Investment Banking, Hedge Fund Management, etc are all high-paying jobs that can be taken up after CFA. However, if your career goal is to work in a good position in a bank, here’s how a Chartered Financial Analyst degree can help you get there.

What Is The Scope Of CFA

The scope of CFA is vast and includes a broad range of financial careers. CFA stands for Chartered Financial Analyst, and the designation is highly respected in the finance industry. The CFA program covers a wide range of financial topics, including investment analysis, portfolio management, economics, aznd ethics. As a result, individuals who earn the CFA designation can pursue careers in various sectors, such as investment banking, asset management, equity research, and risk management. The scope of CFA also extends to countries worldwide, with employers recognizing the designation’s value in different regions. Moreover, the CFA charter is considered a gold standard for investment professionals, providing holders with a competitive edge in the job market. With the scope of CFA, individuals can explore a wide range of career opportunities and develop a deep understanding of the financial industry, making the designation a valuable asset to any finance professional.

Banking Professions You Can Consider After CFA

The two most glamorous banking professions one can consider getting into, after completing CFA are

- Hedge Fund Management: Hedge funds or similar private investment partnerships are actively managed liquid investments made by high-net-worth individuals. Such investments offer bigger returns but also often have a higher risk. A Hedge Fund Manager is usually hired by high-net-worth individuals or global banks to monitor the financial markets and make the maximum amount of profit from their existing investments. A Hedge Fund’s job profile is quite similar to that of an Investment Banker, the key difference being the extent of rewards and risks to be expected from the investments. Hedge fund management is one of the most lucrative careers to work in since the average base salary of a Hedge Fund Manager is INR 15 LPA.

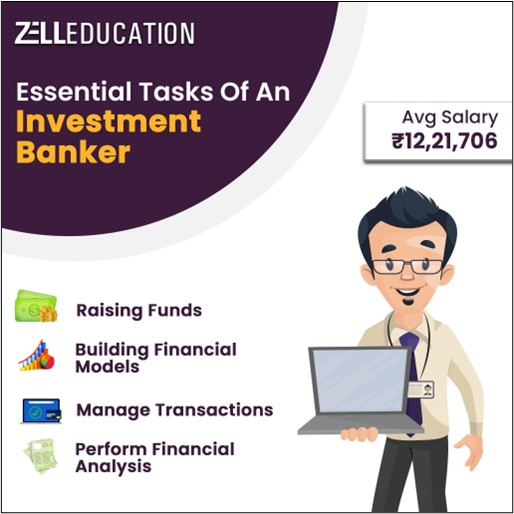

- Investment Banking: An Investment Banker is a finance professional who undertakes many responsibilities for a client. One of the main tasks includes raising capital for clients or firms by issuing or selling securities and issuing public bonds. They use their knowledge of the financial models to help clients with estimating the best price of these financial instruments. Taking into account the client’s risk appetite, they make the decisions regarding the financial instruments. They are involved in the Initial Public Offering (IPO) and ensure compliance with the financial decisions as directed by financial regulatory institutions of the country they are working in. To sum up, we can say that Investment Bankers help large companies or governments to make financially informed and sound decisions.

Global Banks that hire CFAs

Several banks hire CFAs, not just for the above-mentioned professions but also for the various sub-professions falling under them. If you’re interested in working for a reputed bank after becoming a Chartered Financial Analyst, then you’d be elated to know that there are a range of well-known banks that are on the list. Here’s a glimpse of a few of them.

- JPMorgan Chase

- Morgan Stanley Wealth Management

- Royal Bank of Canada

- BofA Securities

- UBS Group

- HSBC Holdings

- TD Bank Financial Group

CFA’s Relevance To Banking Jobs

The CFA course prepares you for multiple financial challenges, be it at an individual level or an organisational level. This means you could choose to work as a Financial Analyst for HNI or a global bank, as everyone today needs a Financial Advisor who can guide them with data-backed decisions. To track the exact relevance of CFA for banking jobs, here are some of the banking subjects that are covered in CFA.

- Financial Reporting and Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivative Investments

- Alternative Investments

If you wish to work for a global bank with the right skills, the best pathway is through completing your professional degree in CFA. To pursue your Chartered Financial Analyst degree from a prestigious learning provider click on the WhatsApp Icon on this blog and get in touch with our experts directly.

FAQs

1. Can CFA work in a bank?

Since CFA equips you with multiple financial, analytical and investment-related concepts, it is easier for CFAs to find prestigious jobs in large banks.

2. Does CFA help get into investment banking?

Yes, since the CFA course is based on financial markets, investments and efficient financial planning, a CFA degree helps to get into investment banking.

3. Do Indian banks hire CFA?

International banks based in India like JPMorgan Chase, Morgan Stanley Wealth Management, Royal Bank of Canada, BofA Securities, UBS Group, HSBC Holdings, and TD Bank Financial Group do hire CFAs on a large scale.